2016 Cableco Survey: 5 Data Points

In 2006, cable providers together held less than $2 billion worth of the overall business telecom market. Fast forward to 2016.

July 26, 2016

Already have an account?

2016 Cableco Survey: 5 Data Points

2016 marks the sixth year Channel Partners has run the Cablecos & The Channel: State of the Market survey, and boy, have things changed.

When we first launched the study, cable operators in the United States had been including voice, video and data services in their product lineups for about 10 years. Yet, in 2006,� cable providers together held less than $2 billion worth of the overall business telecom market, according to New Paradigm Resources Group.

Fast forward to 2016. In the first quarter alone, Comcast by itself reported business services revenue of $1.3 billion. We predict that, by next year, the number of partner respondents who expect cable-supplied products to generate up to 30 percent of their total sales will double from 2013.

Clearly, there’s momentum. What’s driving it is that channel partners increasingly see cablecos as viable primary networks or carriers of last resort providers. We can cite a few more factors: SIP trunks displacing PRIs in an overall shift to IP and Ethernet, the consumerization of IT, the growth of cloud, expanding coverage areas and capacity, and simply getting the message out. Cablecos are going toe to toe with incumbents in pitching their networks to enterprises.

And finally, there’s the all-mighty value-added service. Respondents generally don’t realize that cablecos provide such customer necessities as web hosting, managed security and storage, even customized television stations. That’s pure greenfield opportunity.

Click through for some hidden data jewels from the 2016 Cablecos & The Channel: State of the Market survey, which includes overviews of channel programs from Bright House Networks, Comcast Business, Cox Business, Mediacom, Optimum, Shaw Business, Spectrum Business and Time Warner Cable Business Class.

Follow editor-in-chief Lorna Garey on Twitter.

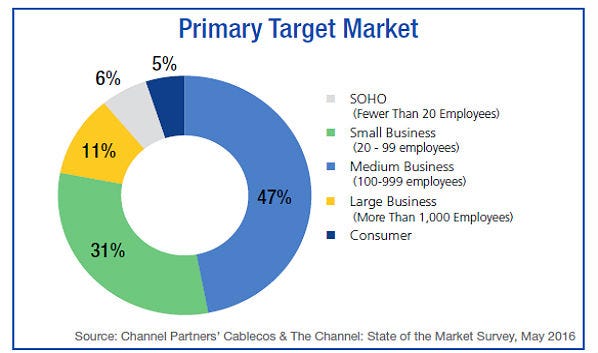

2016 Cableco Survey: Primary Target Market

In 2011, 48 percent of respondents said they targeted cableco business services primarily at customers with more than 100 employees. Now, 58 percent are gunning for those midsize and large companies. Just 31 percent primarily target small shops.

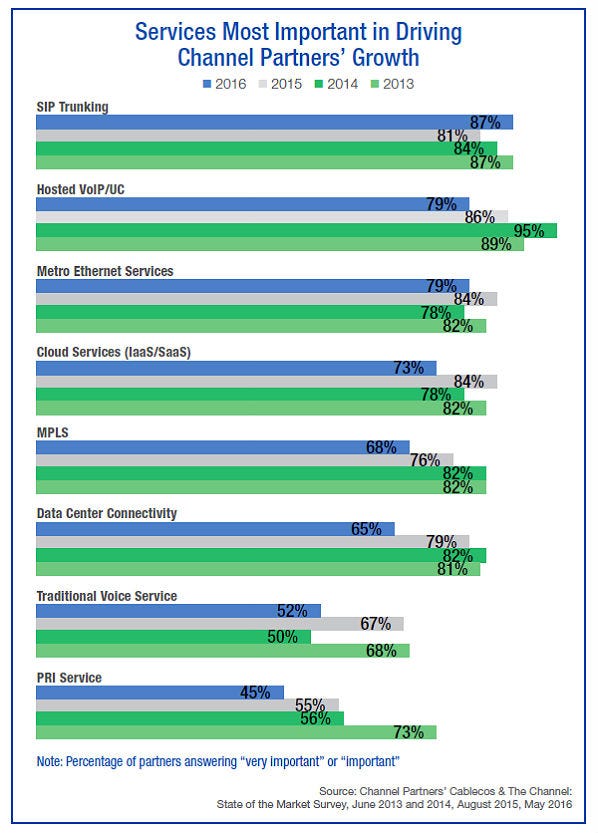

2016 Cableco Survey: Important Services for Growth

Channel Partners respondents credit SIP trunking with driving growth — about as much as they did in 2013. The popularity of Metro Ethernet has held relatively steady as well. But what’s up with the drops in hosted VoIP/UC and data center connectivity? We’re encouraged that some cablecos are jumping on SD-WAN this year.

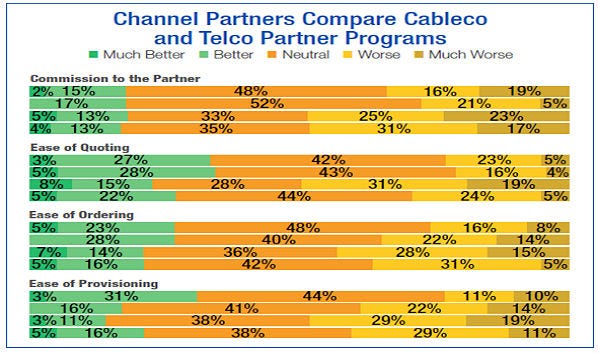

2016 Cableco Survey: Comparisons With Telcos

There’s no doubt that partners care about commissions, and telcos have the edge when it comes to payouts. They’re also way ahead when it comes to helping with lead generation (see full report). But more and more, partners seem to realize that time is money. Easier quoting, ordering and provisioning may offset that margin gap. Don’t believe us?

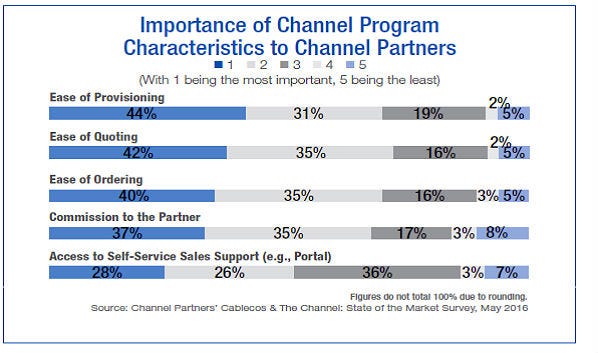

2016 Cableco Survey: Channel Program Characteristics

Here are the top five most important channel program characteristics to respondents. The customer’s business success is tied to the partner’s business success, meaning that getting services up and running fast is Job 1. Everything else is (somewhat) negotiable.

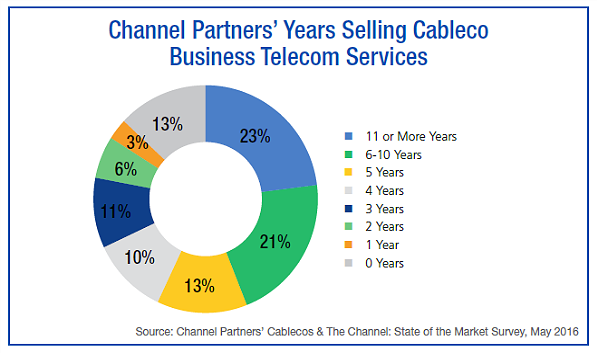

2016 Cableco Survey: Years Selling Services

The upward curve of both respondent satisfaction and cableco profits are helped by deep familiarity with providers. But this leaves us with a question: Why such low awareness of services like managed security and VoIP/UC? Time for some outreach to long-term partners?

2016 Cableco Survey: 5 Data Points

Please click here for more Channel Partners galleries.

Read more about:

AgentsAbout the Author

You May Also Like