AI, Blockchain Adoption Stats Map to Partner OpportunityAI, Blockchain Adoption Stats Map to Partner Opportunity

Research into AI and blockchain adoption gives partners insight into emerging markets to make growth investments.

September 25, 2019

As an emerging technology, artificial intelligence (AI) has been in the top tier as one that offers real near-term opportunity for channel partners.

Results from a recent survey – Small & Midmarket Business Artificial Intelligence Adoption Trends – from Techaisle, provides insight into the current state of AI adoption, deployment status, application areas, and where AI is being used or planned to be used. All of that plus information on how partners can figure out where AI fits into their business growth strategies.

Techaisle has been collecting data about small and midmarket artificial intelligence (AI) adoption for several years. Channel Futures asked Techaisle CEO and analyst Anurag Agrawal to point out what he thinks are a few surprises in the most recent survey results, which are based on a panel of more than 1.6 million B2B companies. The results cover the U.S., Europe and Asia Pacific.

Beginning with the current state of AI adoption, Agrawal was surprised at how close AI adoption levels are in the U.S., Europe and Asia Pacific among small businesses. While all the percentage figures are in the single digits – 5% U.S., 3% Europe, and 3% Asia Pacific – they were pretty evenly distributed across the three geographies. Looking at small businesses planning to adopt AI: U.S. (22%), Europe (25%), and Asia Pacific (22%).

Techaisle’s Anurag Agrawal

The current state of AI adoption among midmarket business looks a bit different with the highest rate of adoption in the U.S. (26%), followed by Europe (24%) and Asia Pacific (17%). Agrawal expects Asia Pacific to quickly catch up to the other two geos. Midmarket businesses planning to adopt AI is as follows: U.S. (28%), Europe (30%) and Asia Pacific (27%).

“The most important thing for me was the deployment status of those business currently adopting AI who have it in production – not implementing AI or conducting trials – Asia Pacific is ahead of the U.S.,” said Agrawal.

So, for example, while 5% of small U.S. businesses are adopting AI, 1% have it deployed in production. Compare that to small businesses in Asia Pacific, where 3% are adopting AI but 4% are have it in production. Similarly, with midmarket organizations: 26% of U.S. midmarket businesses are adopting AI and 6% have deployed AI in production, while 17% of Asia Pacific midmarket companies have adopted it and 10% have it in production.

Agrawal says Asia Pacific AI adoption is being driven by Singapore and China, India and Australia, and in some cases, Japan, leading the way ahead of the U.S.

Another surprise in the data is where companies were using AI or planned to be using it more – for core or non-core applications or for automating IT. What rose to the top was using AI to automate IT — 45% for small businesses and 46% for midmarket.

“That’s very interesting because they’re looking at AI to automate IT — to automate support, automate the deployment of applications and devices, [and] automate customer support. The reason for that is very simple: It’s one of the ways to reduce costs and it also allows IT staff, which has already been very lean and mean – we know that SMBs has one-twentieth the number of IT staff compared to …

… enterprises – it makes sense for them to free up IT staff to do other things,” said Agrawal.

Courtesy: Techaisle

According to Techaisle, the size of an average IT staff at enterprises averages about 241, midmarket companies about 15, and small companies about two. And, among small companies, only 6% have full-time IT staff.

Agrawal sees this as a big opportunity for partners.

“The opportunity for partners is that they have to look beyond their break-fix or remote monitoring operations, and say, “How can I embrace the tools that are offered through my vendor partners or through other suppliers where I can create more efficiency in my SMB customers?” he said.

Techaisle also conducts similar partner studies. For example, one study found that find 20% of system integrations (SIs) are focused on building a significant AI and machine learning (ML) practice. Only 10% of VARs are currently doing so but 45% report having plans to build such practices. Another 17% of channel partners are dabbling or experimenting with AI in their business.

Looking at the top application areas for AI, the survey highlights the different priorities for small businesses compared to midmarket companies. Small businesses cite their top two AI application areas as marketing and customer experience, while midmarket companies cite process automation and analytics. Both market segments rank cybersecurity as their third top AI application area.

Looking deeper into the two distinct responses from small and midmarket companies: small business look at AI tools for lead management, lead scoring, and how to attract and retain customers, all of which mesh well with their business challenges. Midmarket companies, on the other hand, look at AI for any type of business process that’s mission-critical to their organization, whether in manufacturing, customer retention or agile development, to name just a few.

“For midmarket companies, analytics has helped their business for the past several years, but now analytics needs to deliver the decisions that these companies need. AI combined with analytics is becoming extremely important,” said Agrawal.

As for the interest of seeing AI in cybersecurity applications, both small and midmarket are on the same page. Think of security vendors that are looking at building AI into their security products — Webroot, McAfee, Trend Micro, and Dell, for example.

“This is not an extra investment that small and midmarket companies are making; they’re saying that they’re transferring the onus to the supplier to have AI capabilities within their cybersecurity operations,” said Agrawal.

Again, what does this mean for partners?

“What it means for partners is very clear. Partners need to understand their level of expertise and do a segmentation of their customer base — small business versus midsize business. Then they need to ask, ‘Do I have skill sets in AI that help our customers implement AI-driven process automation? If not, then can I collaborate with another partner to facilitate that?’” said Agrawal. “Taking a customized approach means that partners need to …

… invest in human resources that today are hard to find. Or, they can partner with vendors that are doing a tremendous amount of co-selling and co-marketing programs these days.”

Courtesy: Techaisle

Agrawal contends that the approach for partners who work with small businesses versus midsize ones will be different. Small business will use simpler rules-based systems that involve analyzing the process, analyzing what the customer is doing and build AI rules around it. In midmarket companies, there’s more structured and unstructured data coming into the organization – which requires machine learning – and also deep learning on neural networks, which is coming into picture. Most MSPs and VARs won’t have this type of expertise, while SIs are more likely to have it.

“It’s an SI’s game at the beginning, but MSPs and VARs can participate as they build their internal resources,” said Agrawal.

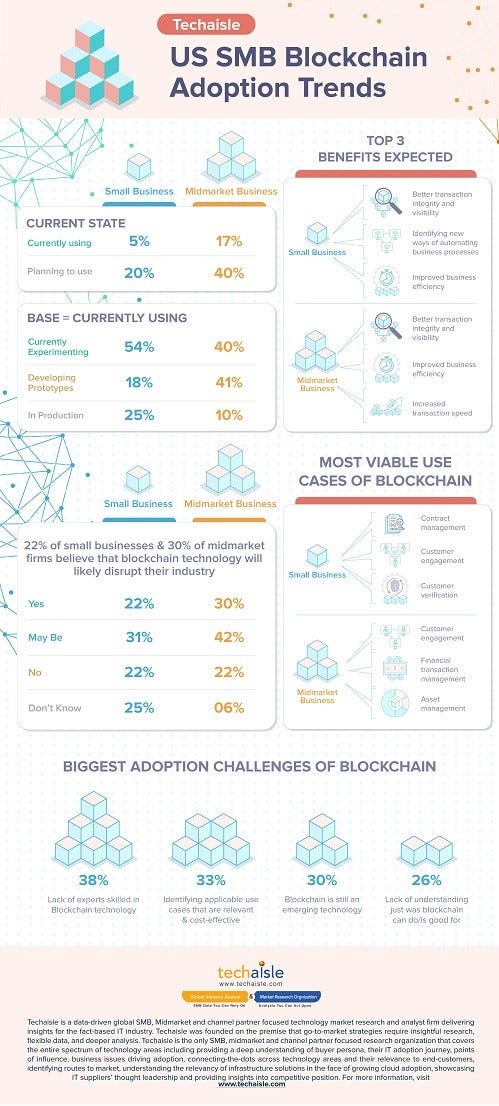

Techaisle also recently looked at U.S. blockchain adoption trends and published an infographic (see left). A few interesting points, 5% of small businesses are using blockchain, but out of those 5%, one in four is using it in production, and more than one-half are experimenting with blockchain.

“It’s one of those important things where it’s easier for small businesses to adopt it because their footprint is smaller, processes are simpler making it easier to adopt,” said Agrawal.

Looking at midmarket companies, 17% are using blockchain, but only 10% have it in production. Forty percent are experimenting with it.

According to Techaisle, small businesses are using blockchain in different areas. For example, they are working with local cities or governments enabling smart city rollouts. They’re working in smart appliances, asset management, or in identity management or transaction management.

“There are many different places where blockchain is currently being used by small business or those small businesses in retail or manufacturing and have suppliers in different regions, working with them using blockchain for contract management,” said Agrawal.

There isn’t one dominant place, vertical or application where blockchain is being used, according to the study.

“Everyone is experimenting,” he said.

With that, Agrawal noted that about 9% of partners are working on blockchain, but 17% of them think that blockchain will be one of the three big opportunities in the next two years. A big constraint for partners today is having the right skill set.

According to Techaisle research, 7% of VARs think that blockchain is a technology worth investing their time and resources. That figure goes up to 16% for IT consultants and 22% for SIs.

“Behold the fact that 23% of MSPs see blockchain as a huge opportunity that allows them to diversify in blockchain security products,” said Agrawal.

About the Author

You May Also Like