Channel Business Strategy Trends and Predictions

Accelerating M&A, the rise of new competitors to the traditional channel and do-or-die transformation all impacted channel business strategy in 2016.

December 28, 2016

Already have an account?

Channel Business Strategy Trends and Predictions

Accelerating M&A, the rise of new competitors to the traditional channel and do-or-die transformation all impacted channel business strategy this year.

Steven Ostrowski, CompTIA’s director of corporate communications; Carlos Roman, 8×8’s head of global partner marketing; and Jeff Newton, TBI’s vice president of enterprise sales and IT; witnessed all of the changes in strategy and shared with Channel Partners their insights on current trends and 2017 predictions.

Ostrowski said 2016 has been “a year of continuation of many of the changes we’ve seen for the last five years or so.”

Scroll through our gallery to get the buzz on channel business strategy.

Follow contributing editor @EdwardGately on Twitter.

Business Strategy Trends and Predictions: Constant, Surprising M&A

CenturyLink buying Level 3 Communications, Windstream buying EarthLink, and Dell buying EMC were some of the biggest deals among the flurry of M&A this year.

The consolidations, mergers and acquisitions reflect the “aging of the channel as some business owners sought to cash out or to keep their company viable and competitive in a fast-changing market,” Ostrowski said.

“I think the acquisitions are going to be a hot topic, especially … the bigger ones, like CenturyLink and Level 3, and what the impact to the channel will be,” Newton said. “Level 3 and CenturyLink are two of the bigger names out there … those two companies have large billing bases throughout the channel, so it will be very interesting to see how well they do on the integration and just how that’s going to affect channel sales and channel perception of acquisitions going forward.”

Business Strategy Trends and Predictions: Slow, But Sure Transformation

Many companies in the channel are in the midst of transforming from legacy hardware to services and a recurring-revenue model.

“While we all talk a big game about transforming business, it’s not easy to do,” Ostrowski said. “In fact, it can be very difficult, especially for a small business. That’s why most channel companies will remain a hybrid, continuing to sell products and do some of the legacy work that they’ve always done while adding new services and venturing into new areas, as well.”

Business Strategy Trends and Predictions: Continuing Rise of SD-WAN

Carriers increasingly are going to focus on SD-WAN because it “blurs the line to all types of products and services in IT that can be offered,” Newton said.

“If you’re talking SD-WAN, you’re talking network, you’re talking about applications that the customer is running, you’re talking about cloud strategy, voice; you really get into the very strategic types of conversations that the carriers want,” he said.

Newton also said consolidation is likely among the growing number of SD-WAN providers.

“I do think that Cisco IWAN will still be prevalent and whether that means Cisco is going to buy some of the smaller SD-WAN providers for their customer base, for their technology, for their engineering know-how, or it’s just going to be a continued push against Cisco IWAN by the other providers and carriers, it will be interesting,” he said.

Business Strategy Trends and Predictions: UCaaS, CCaaS Go Mainstream

In 2017, channel partners will start accelerating the shift from selling legacy on-premises UC and contact-center offerings to providing cloud-based UCaaS and contact center as a service (CCaaS) offerings, Roman said.

“While most partners are still primarily leading with on-premises offerings, most partners will evaluate and add UCaaS and CCaaS to their portfolio,” he said. “The percentage of partners selling these cloud-based offerings will shift from early adopters to enter the early majority phase.”

Business Strategy Trends and Predictions: Cloud Communications Moves Upmarket

The UCaaS and CCaaS markets now are seeing broader adoption, from being primarily SMB-focused to midmarket and enterprise businesses now adopting, faster than anyone predicted, Roman said.

“With the shift up-market, large enterprises are turning to their trusted advisers whom they have been working with for many years — their channel partners to help them make this transition to the cloud,” he said. “This creates new opportunities for traditionally on-premises-focused partners to build a new recurring revenue-based business model.”

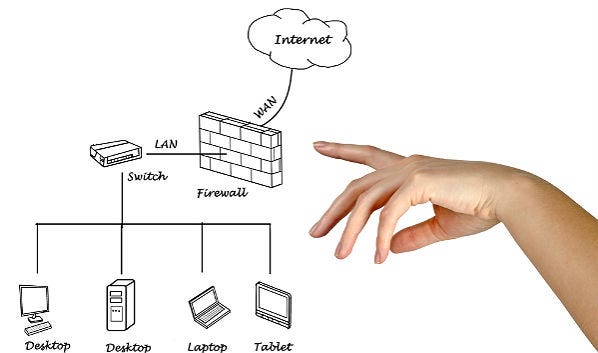

Business Strategy Trends and Predictions: Challenges to Traditional Channels

“There has been a rise in the number of new competitors to the traditional channel and that will only continue as we head into 2017,” Ostrowski said. “We’re seeing a whole new type of ‘channel’ company. You’re seeing a surge in SaaS companies. Digital agencies, marketing firms, accountants and other nontraditional partners are selling or recommending IT solutions today, a development that has upended the traditional competitive landscape.”

Business Strategy Trends and Predictions: Shifting Focus

“The channel is shifting to a services focus and specializing across vertical industries and/or solutions niche,” Ostrowski said. “In the year ahead, more channel firms will be developing their own intellectual property too, whether that is a piece of custom code or a business process they replicate across end customers.”

“Companies that have the ability to meet a customer’s needs on several fronts … those are the types of companies that I think are really going to make a lot of headway and being able to be that turnkey solution provider,” Newton said “So companies that can be more sophisticated and not have to pawn off a certain element of a customer’s needs to another company, that’s where the push is.”

Business Strategy Trends and Predictions: Changing Growth Areas

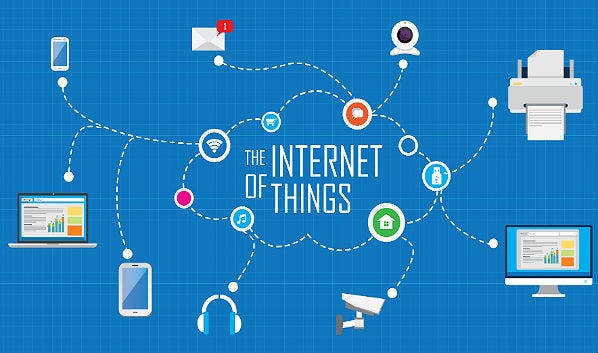

Security, cloud, mobile devices and services, and the Internet of Things are projected growth areas in the channel, Ostrowski said.

“While these categories have mostly moved passed the emerging technology phase, there are a number of new elements and nuances to their place in the market in the year ahead,” he said.

Business Strategy Trends and Predictions: Smarter Conversations

“As the channel community gets deeper and wider with [its] customer base in the enterprise space, and then those traditional customers they brought in through the channel, like with IoT, they’re becoming much more sophisticated and having much deeper and complex conversations about solutions,” Newton said. “So it’s no longer just a traditional network or traditional backup services, or disaster recovery as a service (DRaaS). The conversation is becoming much wider, so things are on the table, whether it’s a complete hybrid cloud solution for customers, the product set in the channel is growing at a staggering rate. So we’re not having to go to niche companies to provide a very specific cloud solution here, and a different company to provide a network solution over there.”

Business Strategy Trends and Predictions: Bringing Together Disparate Technologies

“Complementing the top-ranked growth categories are the integration and digital services to bring disparate technology components together through platforms, APIs and business-process automation,” Ostrowski said. “While certain facets of technology are becoming easier to manage, the overall complexity of managing technology ecosystems often exceeds the capabilities of many customers, especially small businesses. For this reason, managed services also ranks as a likely growth category in 2017.”

Channel Business Strategy Trends and Predictions

Please click here for more Channel Partners galleries.

Read more about:

AgentsAbout the Author

You May Also Like