Cloud Computing Boomed Over Last Decade, Microsoft Leads the Pack Among Enterprises

Three new reports contain implicit guidance that can help channel partners build their businesses.

There’s a lot happening in the world of cloud statistics and the results underscore just how much the technology has secured a permanent place within the enterprise and the channel.

Three new research reports confirm that assertion, and all contain implicit guidance that can help resellers, managed service providers and other indirect channel experts set their visions for 2020.

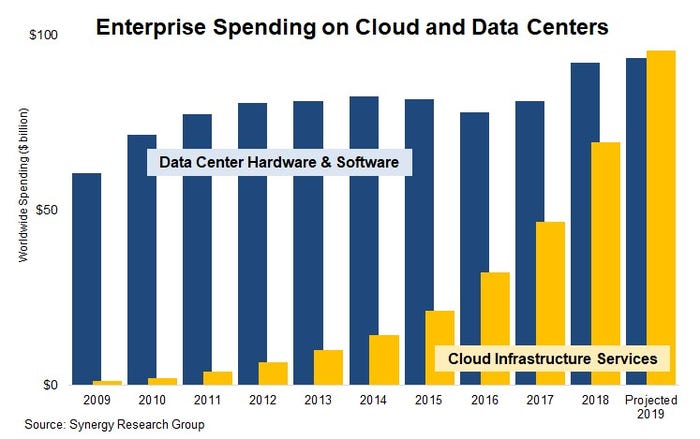

First up, Synergy Research Group’s detailed rundown of enterprise IT spending over the last decade — the firm says annual spending on cloud infrastructure services grew from “virtually zero” to almost $100 billion. That’s according to analysis released on Jan. 6, titled “The Decade’s Megatrends in Numbers – Part 1: Cloud Goes from 0 to 100 in Ten Years while Enterprise Data Center Spending Stagnates.”

First up, Synergy Research Group’s detailed rundown of enterprise IT spending over the last decade — the firm says annual spending on cloud infrastructure services grew from “virtually zero” to almost $100 billion. That’s according to analysis released on Jan. 6, titled “The Decade’s Megatrends in Numbers – Part 1: Cloud Goes from 0 to 100 in Ten Years while Enterprise Data Center Spending Stagnates.”

At the same time, enterprise spending on data center hardware and software stagnated over much of the last 10 years. That should come as no surprise, given the growth and popularity of cloud options. Indeed, cloud saw almost 40% growth in 2019 alone, Synergy Research found. Last year further marked the first time enterprises spent more on cloud services, including IaaS, PaaS and hosted private cloud, than they did on data center equipment, analysts wrote.

From 2009-2019, average annual spending growth for data center amounted to 4%, mostly within the first three years, while cloud services garnered 56%, according to Synergy Research. The firm further predicts that 2019’s worldwide spending on cloud infrastructure services will reach $97 billion.

“The decade has seen a dramatic increase in computer capabilities, increasingly sophisticated enterprise applications and an explosion in the amount of data being generated and processed, pointing to an ever-growing need for data center capacity,” said John Dinsdale, chief analyst at Synergy Research Group. “However, over half of the servers now being sold are going into cloud providers’ data centers and not those of enterprises.”

Vendors Leading the Pack

Breaking out the last few years of cloud spending, and looking at who’s driving what, will help channel experts gauge their business models.

Breaking out the last few years of cloud spending, and looking at who’s driving what, will help channel experts gauge their business models.

The biggest takeaway is that, at Synergy Research Group and other research houses, everything’s coming up roses for Microsoft.

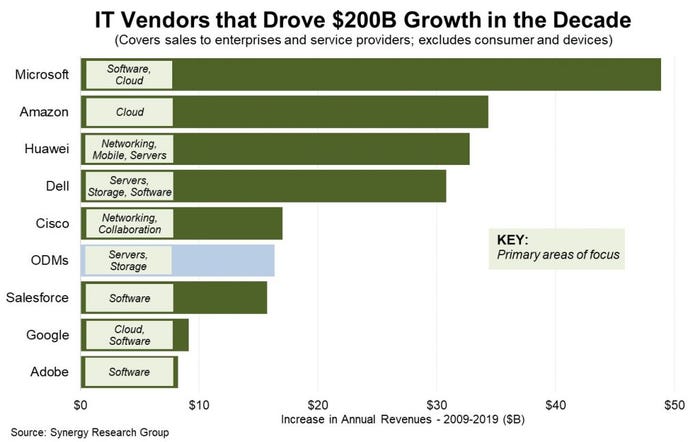

The Redmond, Washington-based tech behemoth saw almost $50 billion in growth over the last 10 years thanks in large part to the Azure cloud platform, Synergy Research says in its Jan. 10 report, “The Decade’s Megatrends in Numbers – Part 5: IT Vendors that Grew Their Enterprise Sector Revenues by over $10 Billion in the Decade.”

“In 2009 Microsoft was already one of the biggest sellers of enterprise technology, but over 10 years it has grown those revenues by almost 150% to become by far the biggest player in the sector,” Dinsdale said.

Amazon, with Amazon Web Services, and Google Cloud Platform, followed in the cloud category.

Microsoft Is Killing It

Synergy Research isn’t the only firm tracking Microsoft’s meteoric rise and predicting continued growth. The biannual IT Spending Survey from Goldman Sachs also is making waves: The investment bank’s analyst arm discovered that the majority of 100 technology executives at Global 2000 companies are choosing Azure’s public cloud services over AWS.

Microsoft’s lead has been increasing since December 2017, CNBC quoted analysts as saying, particularly in IaaS and PaaS. On top of that, more respondents said they expect their organizations to use Azure more than any other cloud brand over the next three years.

“Microsoft remains the clear leader, with 22% of the votes today and in three years respectively,” the analysts wrote, according to CNBC.

AWS still wins when it comes to cloud revenue.

On the whole, approximately 23% of IT workloads now live on public clouds, according to Goldman analysts, with that figure expected to reach 43% in three years. Goldman forecasts the cloud services market overall to attain a valuation of up to $1 trillion, Forbes reported.

Channel partners can use these findings – which likely are not a shock – as barometers for their businesses over the next one to three years.

About the Author

You May Also Like