Hot Data: What's Driving the U.S. PC MarketHot Data: What's Driving the U.S. PC Market

It's a reversal of fortunes as Dell takes a tumble.

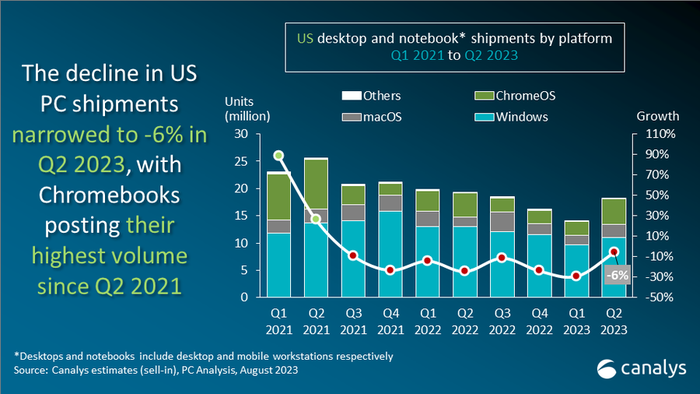

The U.S. PC market showed some signs of promise in the second quarter as the rate of decline in shipments of desktops, notebooks and workstations slowed. That was thanks to a boost from sales to schools and educational institutions, along with demand in the B2B sector.

The quarter featured a stunning reversal of fortunes, with HP topping Dell for the No. 1 spot in shipments.

Canalys’ Ishan Dutt

“Despite undergoing another year-on-year decline, the U.S. PC market showed promising signs of improvement in the second quarter,” said Ishan Dutt, principal analyst with market research firm Canalys.

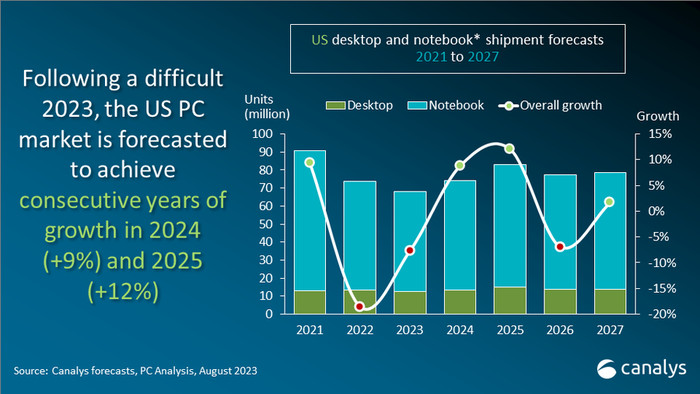

Dutt expects the market to stabilize with healthier channel inventories. Also look for a boost from upcoming AI enhancements in software and hardware. Canalys is forecasting robust growth (9%) for 2024, and even higher in 2025.

Based on data provided by Canalys, U.S. PC shipments in the second quarter posted a 6% decline compared to the same quarter last year. In the quarter ended June 30, U.S. PC shipments totaled 18.2 million units vs. 19.3 million in the same quarter last year, which Canalys analysts said showed “significant improvement” over declines posted earlier this year.

The North American PC market experienced what Canalys said was a “relatively mild decline” in the quarter, aided by a boost in education demand that was backed by public sector financing. Small form-factor desktops gained traction through commercial demand, while clamshell notebook shipments were flat due to stronger Chromebook performance.

Managed service providers and other channel partners track PC shipment rates carefully because of the opportunities around attachment rates of their services. Many MSPs influence the sale of hardware and, in some cases, sell notebooks and other devices either directly or through partners.

PC Market: Education Is King

Notebook (including mobile workstations) shipments were down 4%, to 15.2 million units, bolstered by the return of Chromebook demand in the education sector. Desktops (including desktop workstations) suffered a steeper decline, with shipments falling 12%, to 3 million units. The U.S. tablet market faced a similarly modest decline, with shipments down 5%, to 10.3 million units.

“With the buildup of channel inventories now largely cleared, pockets of demand strength are now being reflected in vendors’ sell-in shipment performance. A key area that helped drive volumes was the return of demand from education institutions, backed by the latest wave of federal funding, ahead of a licensing cost increase for ChromeOS,” Dutt said.

This helped propel Chromebook shipments to 4.7 million units, the highest level since peak deployments during the first half of 2021.

PC shipments to the commercial sector were down just 4%, while the consumer sector posted a larger drop of 10%.

“Consumers are still deprioritizing spending on PCs compared to other goods and services amid economic challenges,” Dutt said. “Recovery in this segment is likely to only emerge in the fourth quarter, with strong discounting expected during an extended period of holiday season promotions. Businesses, however, are displaying a more resilient demand for PCs. Dell, the leading commercial vendor in the U.S., has highlighted its home market as a particular area of strength.”

HP edged out Dell in the second quarter with the two going head-to-head in the U.S. desktop and notebook market. HP shipped some 4.83 million units, resulting in 26.5% market share, while Dell recorded …

… 4.81 million units (26.4% share). Call it a dead heat in the quarter but a reversal from the second quarter in 2022 when Dell shipped some 5.5 million units to HP’s 4.5 million. It is a stunning reversal from the year-ago quarter, based on Canalys data. Dell’s annual growth sagged 13%, while HP posted a 6% gain in the quarter.

Lenovo, which is pushing hard into the MSP space, was in third place in the second quarter, shipping some 3.02 million units, with 16.6% market share. Lenovo’s shipments were down 9.2%. Apple had an amazing quarter, up nearly 33%, to 2.3 million — nearly 13% of the market.

Although businesses and consumers are likely to exhibit some caution in spending on PCs in the short term, the industry can now look forward to further improvement in the U.S. Canalys expects an even smaller shipment decline of 4% in in the third quarter before the market bounces back to 12% growth in the fourth quarter. Beyond that, Canalys forecasts 9% growth in 2024 and 12 percent in 2025.

“The long-term outlook for PCs in the U.S. remains positive,” noted Dutt in a statement accompanying the data. “As macroeconomic pressures subside, the strong fundamentals around post-pandemic PC usage behavior and the larger installed base across all segments will be a boon to the industry. From an innovation perspective, the expected demand boost from the transition away from Windows 10 is now set to be bolstered by the emergence of AI-capable PCs. While this new device category may not significantly increase shipment volumes, it will create strong revenue opportunities for both vendors and the channel as adoption becomes more widespread, particularly within businesses.”

Shipments of tablets in the second quarter declined 5%, to 10.24 million, with Apple, Amazon and Samsung dominating the market. Apple’s tablet shipments surged 20%, to 5.35 million, generating 52% market share in the quarter, trouncing second-place Amazon, whose tablet shipments plunged 32.5%. Third-place Samsung held nearly 15% of the market, with shipments declining 17%, to 1.8 million.

Canalys and Channel Futures are owned and operated by the technology division of Informa plc, a publicly held company that is a market leader in live and digital events, market research, media and academic knowledge.

Vendors, channel partners and distributors will gather in Palm Springs, California, at Canalys’ first North America Forum, Nov. 13-15, to discuss the PC market and more.

About the Author

You May Also Like