T-Mobile Ka’ena Acquisition Brings in Ryan Reynolds' Mint Mobile, 2 Other Wireless Subsidiaries

TelePacific founder David Glickman had been running the three subsidiaries T-Mobile bought.

T-Mobile is acquiring Ka’ena Corp. and its three wireless subsidiaries, which have functioned as exclusive T-Mobile partners.

The self-styled “un-carrier” on Tuesday announced the acquisition of Ka’ena for 39% cash and 61% stock. That adds up to a maximum of $1.35 billion. The deal brings over online direct-to-consumer wireless provider Mint Mobile, mobile virtual network operator (MVNO) Ultra Mobile and wholesaler Plum.

T-Mobile described Mint and Ultra as “complementary” to its prepaid services. The latter include Metro by T-Mobile and Connect by T-Mobile.

“Mint has built an incredibly successful digital direct-to-consumer business that continues to deliver for customers on the un-carrier’s leading 5G network and now we are excited to use our scale and owners’ economics to help supercharge it – and Ultra Mobile – into the future,” said Mike Sievert, CEO of T-Mobile. “Over the long term, we’ll also benefit from applying the marketing formula Mint has become famous for across more parts of T-Mobile. We think customers are really going to win with a more competitive and expansive Mint and Ultra.”

T-Mobile’s Mike Sievert

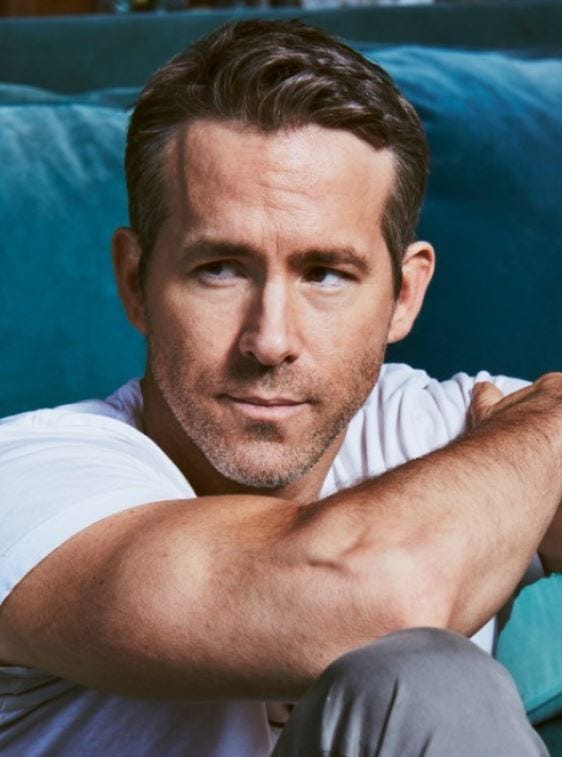

Mint Mobile’s Ryan Reynolds

Channel Futures’ sister site, Light Reading, quotes Wells Fargo analysts, who said T-Mobile paid a premium. They compared it to T-Mobile’s 2020 purchase of TracFone for approximately $7 billion. Wells Fargo estimated that price as around $300 per customer. The same formula puts Mint’s price at about $450 per customer.

The deal will close later in 2023, according to T-Mobile, pending closing conditions.

Ryan Reynolds

Initial media attention has focused on Mint Mobile, of which actor Ryan Reynolds owned approximately 25%. Reynolds has functioned as spokesperson for Mint Mobile since buying his minority stake in 2019. He and T-Mobile CEO Mike Sievert filmed a video announcement featuring Reynolds’ patented dry wit, in which he expressed his excitement to have Sievert as a new father figure.

“Mint Mobile is the best deal in wireless and today’s news only enhances our ability to deliver for our customers. We are so happy T-Mobile beat out an aggressive last-minute bid from my mom Tammy Reynolds as we believe the excellence of their 5G network will provide a better strategic fit than my mom’s slightly-above-average mahjong skills. I am so proud of the entire Mint team and so excited for what’s to come,” said Reynolds.

Despite T-Mobile’s focus on Reynolds in its announcement, it’s worth noting that David Glickman owned the majority of Mint as well as other Ka’ena other subsidiaries, which are also joining T-Mobile.

David Glickman

Glickman founded Mint Mobile, Ultra Mobile and Plum. The channel will know Glickman from co-founding TelePacific (now TPx) Communications in 1998.

“Our brands have thrived on the T-Mobile network, and we are thrilled that this agreement will take them even further, bringing the many benefits of 5G to even more Americans,” Glickman said. “This transaction validates our meteoric success and will unite two proven industry innovators committed to doing things differently in the wireless industry.”

Exclusive Partners

The acquired Ka’ena subsidiaries used the T-Mobile mobile network exclusively.

Last summer Plum announced that the mobile virtual network aggregator (MVNA) was expanding its exclusive T-Mobile partnership. That partnership now includes participation in T-Mobile’s Affordable Connectivity Programs (ACP). Plum also was providing fixed wireless, white-label wireless, data failover and SD-WAN as a result of the partnership.

Plum had been doing business as UVNV Inc. In the meantime, Bloomberg writes that UVNV Inc. was doing business as Ultra Mobile. That essentially makes Plum Ultra Mobile’s wholesale division.

Mint Mobile spun off from Ultra Mobile in 2019

Ka’ena is a Hawaiian word for “the heat.”

Background

T-Mobile’s acquisition of Sprint went through in 2020 after years of regulatory gridlock, bringing together the third and fourth largest U.S. wireless carriers.

JS Group CEO Janet Schijns, whose channel consultancy has worked with T-Mobile, said the company announced last year the elimination of all blocked accounts, leaving all accounts open to partners. She also said the appointment of George Fischer as business sales leader has given the channel a higher priority.

Schijns, Janet_JS Group

“They get that the partner is king in many segments and geographies. Now with this most recent acquisition, [as] they demonstrate their ability to wrap different distribution models across all segments including consumer, it’s likely we will see a play here around expanding the Mint Mobile prepaid strategy through their indirect B2C agents, and perhaps some changes in their wholesale strategy with the Plum asset. The bottom line is, T-Mobile is playing to win in all channels of distribution and all segments,” Schijns told Channel Futures.

Want to contact the author directly about this story? Have ideas for a follow-up article? Email James Anderson or connect with him on LinkedIn. |

About the Author

You May Also Like