COVID-19 and Cloud: Avalanche of Research Shows Partner Opportunity

Recent findings from Synergy Research, Technavio, Nutanix and Faction give the channel some ‘profitable’ insights.

It’s no secret that COVID-19 has pushed cloud technology into the mainstream and into the spotlight. The different cloud variants — public, private, hybrid — each are seeing unprecedented growth as the pandemic hangs on worldwide. Exactly what numbers does that all mean? And what are the opportunities for channel partners? We’ve compiled a series of recent research reports that highlight the technologies organizations are demanding, struggling with and looking to adopt. Each of these areas points to gaps the channel can fill. And that will translate into revenue — in some cases, record revenue.

Seeing Record Demand for Hosted, Cloud Platforms? You’re Not Alone

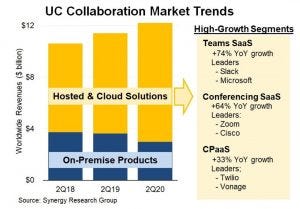

Hosted and cloud platforms now account for more than three-quarters of the unified communications and collaboration market.

That’s according to second-quarter data from Synergy Research Group.

And, no surprise, the growth stems from the COVID-19 pandemic and organizations’ subsequent work-from-home mandates in 2020. Because of that shift from in-office to remote work, spending on UC&C tools topped $12 billion, 7% higher than the same period a year ago, Synergy Research found.

And, no surprise, the growth stems from the COVID-19 pandemic and organizations’ subsequent work-from-home mandates in 2020. Because of that shift from in-office to remote work, spending on UC&C tools topped $12 billion, 7% higher than the same period a year ago, Synergy Research found.

Outlay on hosted and cloud solutions rose 18%. That exactly zeroed out spending on on-premises products; expenditures there dropped 18%.

Synergy Research tracked especially strong growth in teams software-as-a-service — again, not a shock given that organizations have had to support employee communications despite geographic disparity. Zoom, Vonage, Twilio and Slack take up a large portion of the top 10 collaboration vendors, Synergy Research analysts said.

Synergy Research’s Jeremy Duke

“We were already seeing a steady migration in the collaboration market away from on-premises products and toward cloud solutions,” said Jeremy Duke, founder and chief analyst at Synergy Research. “COVID-19 and the sudden radical change in working practices has resulted in an acceleration of that transition. CIOs need to find ways of maintaining communications and productivity in a world where remote working is the new norm and offices are sparsely populated. This is a world for which hosted and cloud solutions are perfectly suited.”

Private Cloud Poised to Make Bank

Channel partners offering private cloud services appear to be in a hot sector.

Research firm Technavio said this week the market will soar by almost $71 billion between now and 2024.

That represents a compound annual growth rate of more than 25%. Small and medium-sized enterprises are fueling the uptick. This comprises a key demographic for many a channel partner.

The major vendors seeing the biggest adoption include BMC Software, Cisco, Citrix, Dell, HPE, IBM, Microsoft, Oracle, SAP and VMware, Technavio said. By extension, then, channel partners actively working with these companies stand to benefit.

Channel Partners to the Rescue: Your Customers Need Your Hybrid Cloud Expertise

Organizations relying on hybrid cloud need help.

Nearly all respondents (96%) to a recent Nutanix survey said they are having trouble managing applications and data across on-premises and public clouds. The top three challenges within those realms are:

Ensuring data security across both environments (54%);

Hiring and retaining IT staff (53%); and

Grappling with the cost of application migration (49%).

Consider, too, that more than two-thirds of respondents (69%) told Nutanix they are not moving more applications into the public cloud because of staff’s cloud skills shortages. In addition, 44% said their IT teams don’t have the ability to manage both the cloud and on-premises environments.

These findings highlight just how much enterprises need managed service providers and other services-oriented partners. That’s particularly true as hybrid cloud proves its mettle as an ideal IT configuration. Hybrid’s interoperability lets organizations choose the right platform for each workload and features more security protections than public cloud on its own.

Nutanix commissioned independent market research firm Vanson Bourne earlier this year to interview IT decision makers worldwide. The result is the company’s recently released report, “Hybrid Cloud Is Here to Stay: Now What?”.

Speaking of Hybrid Cloud…

Faction, which develops cloud data management technology, has a new report showing that more organizations plan to adopt VMware Cloud on AWS because of COVID-19.

To that point, the pandemic is…

…pushing more than half (51%) of respondents either to accelerate their cloud adoption timelines or move forward as planned, Faction said. The figure goes up to 59% among respondents considering VMware Cloud on AWS.

Among those organizations where COVID-19 has paused or canceled cloud adoption, top factors are budget pressures (75%) and staffing shortages and macro-economic uncertainty (each cited by 41% of respondents).

Organizations need cloud to scale, propel strategic IT initiatives and save money, particularly amid pandemic-created pressures, Faction found. They want to extend their data centers, ensure disaster recovery capabilities, and have the means to conduct testing and development. As a result, they’re likely to turn to VMware Cloud on AWS, specifically, for its hybrid cloud advantages and ease of modernizing legacy applications.

Faction conducted its 2020 VMware Cloud on AWS Market Survey throughout June of this year. The company questioned 1,054 IT professionals across a range of industries.

Read more about:

MSPsAbout the Author

You May Also Like