Finalized Cox Acquisition of Segra 'a Win' for PartnersFinalized Cox Acquisition of Segra 'a Win' for Partners

Comcast also announced a significant network expansion.

Cox Communications has officially wrapped its purchase of Segra‘s commercial services and carrier segment in a move that spells opportunity for the channel.

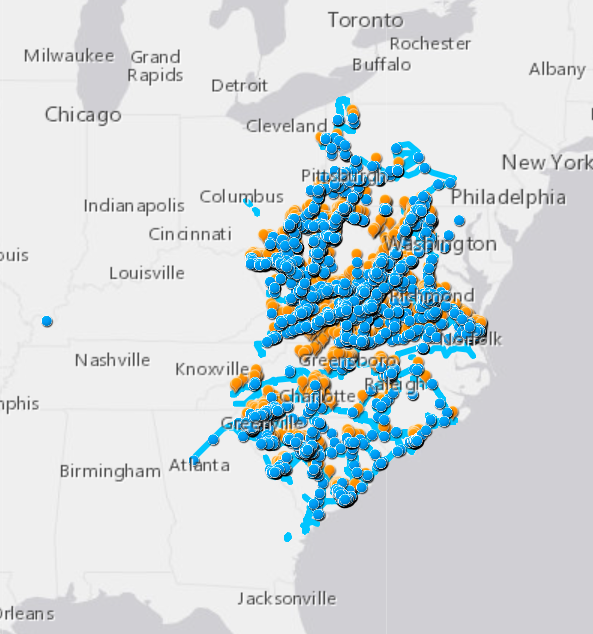

Atlanta-based Cox first announced the asset purchase in April. Charlotte, North Carolina-based Segra provides fiber services in nine Mid-Atlantic and Southeastern states.

Source: Segra.com

Cox, on the other hand, maintains a presence in a few eastern states that overlap with Segra’s services (see the image below). However, Cox’s network also includes states in the central and western U.S. Acquiring Segra helps Cox solidify its footprint on the East Coast. South Carolina is one such gap that Segra helps fill.

Keep up with the latest channel-impacting mergers and acquisitions in our M&A roundup. |

Segra will operate as a standalone business under the Cox umbrella, according to a news release.

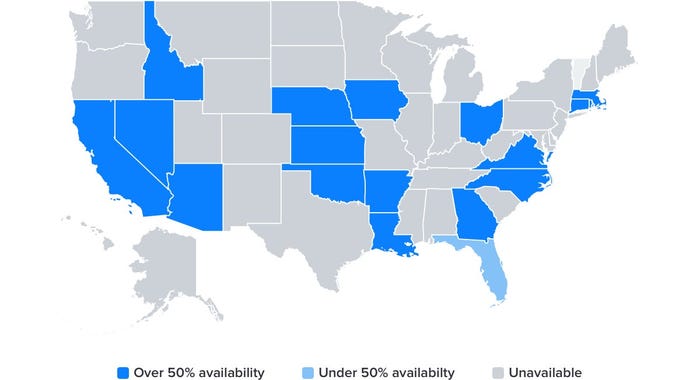

Source: https://www.allconnect.com/

Cox executives said the company has spent more than $15 billion in infrastructure upgrades over the last 10 years.

“An expanded geographical presence, greater network capacity, and more services will be an immediate benefit for customers of both companies and will better enable us to meet the massive demand for our solutions,” said John Muscarella, executive director of indirect channel sales for Cox Business.

Partner Opportunity

Cox Business’ John Muscarella

Muscarella said Cox Business has started work on making the new assets monetizable for channel partners. He said he will share more information at the Channel Partners Conference & Expo in November.

“We are just beginning the integration activities and look forward to offering Segra’s portfolio through our technology services distributors within a short time,” Muscarella told Channel Futures. Cox Business has made significant investments in growing our indirect channels for connectivity services as well as cloud solutions from RapidScale. We anticipate that connectivity integrators will be utilizing Segra’s services to address their customers’ requirements in the near future.”

Telarus’ Adam Edwards

Telarus CEO Adam Edwards said the acquisition creates selling opportunities for agents.

“From a partner perspective, the Cox acquisition of Segra is a win,” Edwards told Channel Futures. “More enterprise endpoints to sell under the Cox brand means more opportunities for partners to give the best options to their customers.”

Cable Investments

2021 has seen multiple cablecos buy and sell assets, particularly in the area of fiber. Astound Broadband in the summer announced plans to buy WOW’s assets in Chicago; Evansville, Indiana; and Ann Arundel, Maryland. Most recently, Comcast announced a $28 million investment in its network in five Beltway states. Channel Futures argued in its recent report, more MSOs are foregoing their traditional geographical siloes to compete for larger, even multinational, customers.

Business broadband has seen a positive rebound in recent quarters, after COVID-19 companies caused companies to temporarily (or permanently) shutter their offices.

Want to contact the author directly about this story? Have ideas for a follow-up article? Email James Anderson or connect with him on LinkedIn. |

Read more about:

AgentsAbout the Author

You May Also Like