Channel Partner 2024 Optimism: Unwarranted or Underestimated?Channel Partner 2024 Optimism: Unwarranted or Underestimated?

Our Omdia research team breaks down results of a recent channel partner survey asking about optimism in 2024, AI and more.

April 2, 2024

During our 2024 Channel Partners Conference & Expo and MSP Summit, speakers and panelists shared their thoughts about their outlook for 2024. The Channel Futures team recently queried channel partners to share their sentiments about 2024 revenue and profit growth expectations, and other major topics like artificial intelligence (AI), go-to-market (GTM) resource needs, and the frequency of technology services distributor (TSD) support.

The various types of channel partners from whom we received feedback from included:

Managed service providers (MSPs): MSPs, managed security service providers (MSSPs), value-added resellers (VARs)/solutions providers, cloud service providers (CSPs), telecom service providers, systems integrators (SIs), independent software vendors (ISVs), and consultants (with managed services).

Technology agents/advisors: Technology agents, technology advisors (TAs), and consultants (without managed services).

Below are key insights we received from prominent channel partners which can be useful for both vendors and partners that want to better understand the current state of the channel.

Key Managed Service Provider (MSP) Findings

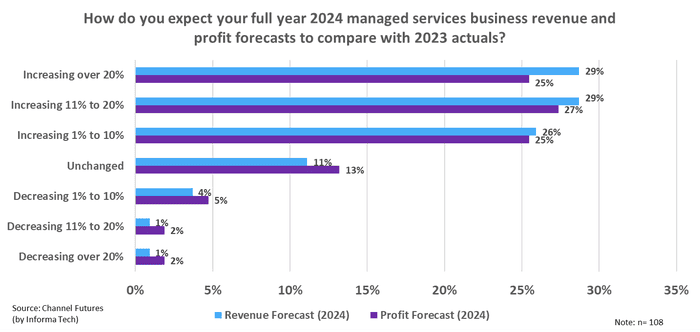

MSPs are high on their 2024 full-year managed services revenue prospects. Eighty-three percent forecast 2024 revenue increases compared to 2023 actuals. Most MSPs (29% each) expect revenue increases in the 11–20% and more than 20% ranges.

MSPs are also bullish about their 2024 full-year managed services profit projections. Seventy-eight percent forecast 2024 profit increases compared to 2023 actuals. Most MSPs (27%) expect profit increases in the 11–20%.

Lead generation remains a top priority for go-to-market (GTM): Success in the channel requires optimization of both internal and external resources. Lead generation (55%) continues to lead the pack as the top resource MSPs need from vendors to make go-to-market enhancements. Enhanced training (36%) and post-sales support (36%) were tied for the second most important resources needed.

Key Technology Agent/Advisor (TA) Findings

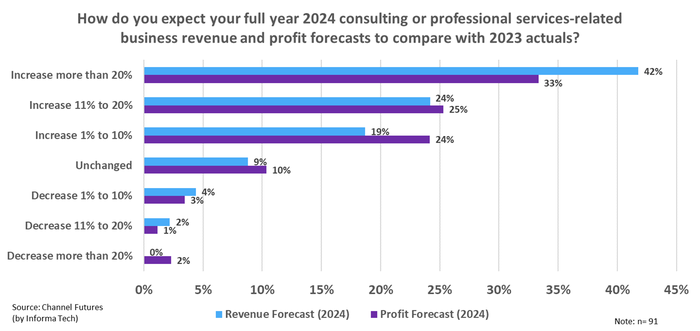

TAs are very optimistic about their 2024 full-year consulting and professional services-related revenue. Eighty-five percent of TAs forecast 2024 revenue increases compared to 2023 actuals. Most TAs (42%) expect revenue increases in the more than 20% range.

TAs are similarly optimistic about their 2024 full-year consulting and professional services-related profits. Eighty-three percent forecast 2024 profit increases compared to 2023 actuals. Most TAs (33%) expect profit increases in the more than 20% range.

Note: The revenue and profits referenced from TAs are primarily related to the consulting and professional services-related fees they charge, as opposed to technology sales.

Frequent TSD support is pivotal: TAs perform a variety of services, and most do so with limited resources; over the last six months the top five activities that require daily or weekly attention by TAs and support from TSDs were quoting/pricing (55%), vendor vetting (26%), sales engagement (24%), back-office/ commissions delivery (23%), and education/ training (17%).

Key AI-Related Findings

AI is the talk of the town in every IT sector, so seeing how channel partner deployments and use cases are growing in response is vital to better understanding the use cases to prioritize.

MSPs: Sixty-two percent of MSPs increased their deployment of, or consultation for, AI solutions in the fourth quarter of 2023, compared to 4Q22. Most of the increases were in the 1–10% range (28% of MSPs), followed by the 21–50% range (15% of MSPs), 11-20% range (11% of MSPs), and more than 50% range (9% of MSPs).

TAs: The type of generative AI use cases that TAs use within their businesses may vary. The top use cases they highlighted were sales and marketing (48%), followed by social media posts (38%), then education/research and email (32%), which tied for third.

Conclusion

There are two major takeaways from partners’ recent channel market sentiments.

MSPs and TAs are highly optimistic about the growth opportunities for 2024, with over 75% projecting both revenue and profit increases. Some view this optimism as unwarranted, others view it as underestimated. Time will tell which proves to be true.

AI continues to proliferate in the channel via increased internal use cases to improve business efficiency and external deployments to enhance customer solutions. As AI offerings escalate, seeing which solutions and use cases rise to the top will be important in determining how to exploit them.

The high aspirations for 2024 growth should motivate vendors to engage with partners to understand where the greatest demands are so they can respond accordingly. These sentiments from partners need to be used to directly influence vendors’ product road-map priorities so they don’t miss the opportunity to capitalize on a flourishing market.

Resources

Omdia Quarterly Market Outlook Research Report: For more in-depth insights and analysis of the Channel Futures Quarterly Market Outlook Survey and to obtain a unique perspective on the key trends impacting the channel from the lens of prominent MSPs and TAs, check out the recently published Omdia Quarterly Market Outlook Survey Insights – 4Q23 report.

MSP 501 Application: Become a 2024 MSP 501/NextGen 101 honoree! The application is open until April 30. The Channel Futures MSP 501 is the IT channel’s most prestigious and comprehensive global survey and ranking of managed service providers, technology providers and channel partners.

If you’re a channel partner, elevate your company’s brand and give it the recognition it deserves by applying to the 2024 MSP 501.

If you’re a vendor, help your partners highlight their successes by recommending they apply to the 2024 MSP 501.

MSP 501/ NextGen 101 winners enjoy abundant benefits including, but not limited to, recognition at the Channel Futures Leadership Summit Awards Gala, Sept. 16-19, 2024, in Atlanta; free marketing materials to amplify your company’s brand; significant credibility in the channel partner community, and much more. The free, online application closes on April 30, so apply now.

About the Author

You May Also Like