Cisco, HPE, Dell EMC Tops in Enterprise IT Infrastructure RanksCisco, HPE, Dell EMC Tops in Enterprise IT Infrastructure Ranks

There's still life in the enterprise data center, according to new spending figures.

January 10, 2019

The gloom and doom predictions for the survival of the enterprise data center are getting a counter-punch from Synergy Research Group.

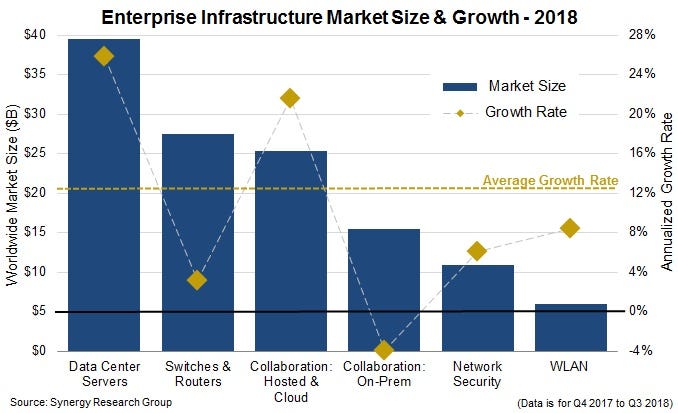

End-of-year research showed that overall annual enterprise-infrastructure spending grew by 13 percent, or $125 billion, compared to the previous year. Synergy looked at six key enterprise infrastructure segments — data center servers, switches and routers, hosted and cloud collaboration, on-premises collaboration, network security and WLAN.

Synergy’s Jeremy Duke

“After some pretty anemic growth in the previous years, we saw enterprise spending on IT infrastructure pick up at the end of 2017 and continue to grow strongly throughout 2018,” said Jeremy Duke, founder and chief analyst at Synergy Research Group.

Data-center servers showed the highest growth, while also making up the largest segment of the market, up almost 26 percent year on year, reaching almost $40 billion. Synergy attributes this growth to more highly featured configurations and higher selling prices.

The next largest segment of the market is switches and routers, with 3 percent growth, crossing the $25 billion mark. Then comes hosted and cloud collaboration.

“We saw the ongoing swing in emphasis away from on-premises collaboration products and toward hosted and cloud collaboration solutions,” Duke noted.

Hosted and cloud collaboration is the third largest segment, but the second fastest growing — up 22 percent. At the same time, spend for on-premises collaboration products saw a decrease in spending.

Spending on both network security and WLAN increased moderately from the previous year – about 6 percent and 8 percent, respectively – according to Synergy.

Spending on both network security and WLAN increased moderately from the previous year – about 6 percent and 8 percent, respectively – according to Synergy.

Cisco continued to dominate the in the data center as the top enterprise vendor in almost all segments, despite a market share drop of 2 percentage points for the previous four quarters, to claim 23 percent market share.

Synergy attributes Cisco’s positioning to substantial growth in servers, where Cisco lags as the fifth-ranked vendor. At the same time, it’s worth noting that across the other market segments, Cisco’s market share remained relatively constant.

In December, Synergy reported that Cisco’s share of the total worldwide switch and router market was 53 percent, the highest it’s been since 2016. Breaking that down at bit, Cisco’s market share ranged from 63 percent for enterprise routers to 40 percent for service provider routers.

Claiming an overall IT infrastructure market share of 11 percent, HPE was second in line behind Cisco. By segment, HPE leads the data-center server category, is No. 2 in WLAN, and ranks third in switchers and routers.

After Cisco and HPE, other vendors who lead or are ranked second in the segments are Dell EMC for enterprise data-center servers, Huawei for switches and routers, Microsoft for collaboration, and Check Point for network security.

Synergy says other major vendors that achieved particularly high growth rates in 2018 include Lenovo, Inspur, Twilio, RingCentral, Ubiquiti, and Palo Alto Networks.

About the Author

You May Also Like