Q3 Agent Survey: Direct Sales, Technology Evolution Pose Challenges to AdvisorsQ3 Agent Survey: Direct Sales, Technology Evolution Pose Challenges to Advisors

And are more agents going direct with vendors?

Conflict from direct sales reps represented the big source of competition to the technology advisor (agent) channel. That’s according to a new survey.

Channel Futures for the first time ever is publicizing results from its agent quarterly survey. The questionnaire functions as part of Channel Futures’ quarterly Partner Industry Outlook survey, asking specific questions geared toward the commissions-based agent channel. The results paint a picture of agent growth, portfolio evolution and shifting TSD alliances. Channel Futures’ first quarterly agent outlook survey took answers from 32 respondents who identified their firms as agents or subagents. While not a large sample size, the answers nevertheless shed light into the challenges facing partners.

Silver Linings

Respondents expressed moderate optimism about the economy compared to the macroeconomic concerns about recessions and layoffs. For example, 39% of agents said their confidence in the U.S. economy is good, and 7% called it excellent; another 36% called it average. On the other hand, 14% called it poor, and another 4% called it terrible. Moreover, agents feel better about the state of the channel than they feel about the larger economy. The majority of partners (57%) rated the health of the industry as good; another 18% considered it excellent. On the flip side, 18% of respondents described the health of the industry as average. Seven percent called it poor, and no one rated it as terrible.

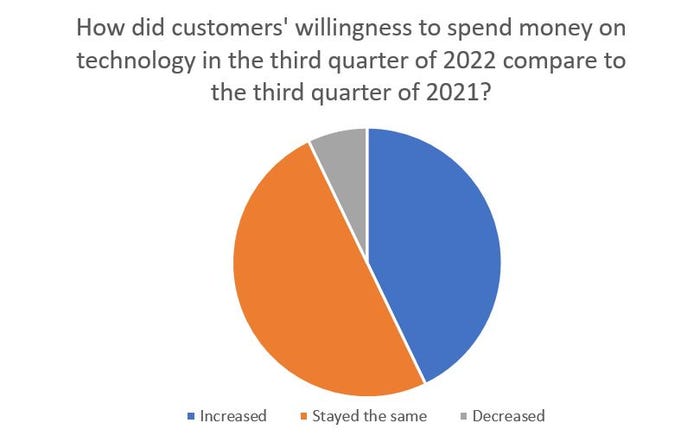

Perhaps most importantly, respondents said customers remain as willing as ever, if not more willing, to purchase technology.

Source: Channel Futures Quarterly Partner Outlook. Question 13.

Forty-three percent said customer appetite increased, while 50% said it stayed the same.

The Changing Shape of Agencies

The results of the study indicate that partners are growing in terms of personnel.

Twenty-nine percent of respondents said they grew their full-time headcount in the third quarter compared to a year prior. The majority (71%) stayed the same, while no respondents reported a decrease in headcount. That’s an excellent sign of partners’ confidence in their business model, considering the stampede of vendors to cut people.

Agents appear to be targeting a diverse set of customers. The survey asked respondents to list the market segments they pursue, and an even balance emerged. Fascinatingly, respondents selected SMB the most (45%), followed by midmarket (42%).

Small business (25 employees or fewer) | 35% |

SMB (26-100 employees) | 45% |

Midmarket (101-999 employees) | 42% |

Enterprise (1,000 employees or more) | 39% |

We don’t have a target customer size. | 6% |

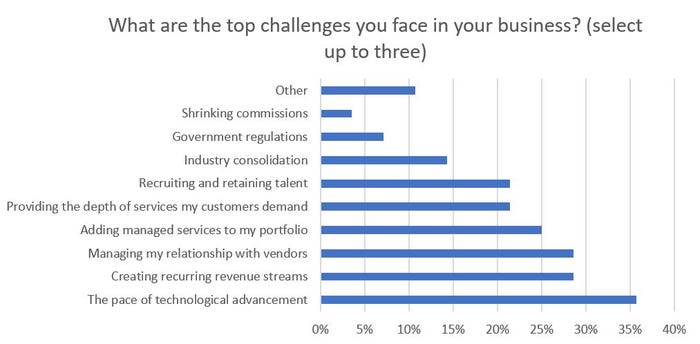

Biggest Challenges

Respondents noted the biggest obstacles they face. Keeping up with advances in technology proved the most common challenge, with 35% of agents selecting it. That was trailed by vendor relationship management and creating recurring revenue streams (29%). On a similar note to creating recurring revenue streams, 25% of partners said are challenged by adding managed services to their portfolio. Those observations fit well with the trend of more agents offering professional services, including deployment and life cycle management.

It’s worth noting that 61% of agents said they …

… charge for their consulting services.

Source: Channel Futures Quarterly Partner Outlook. Question 10.

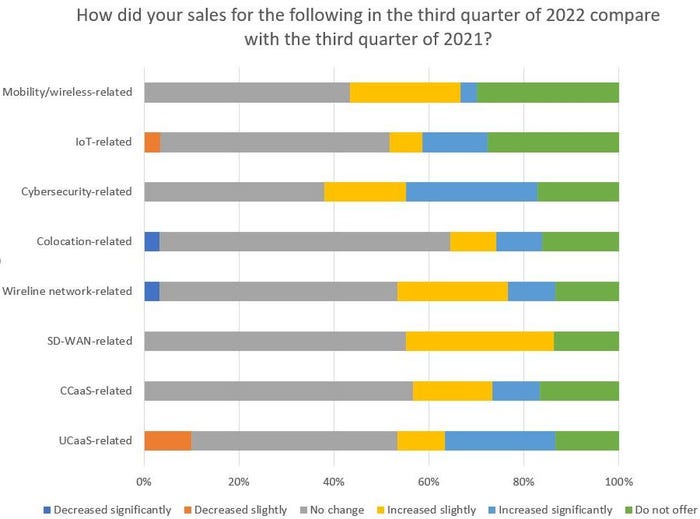

When it comes to technological advancement, cybersecurity looms large as an area of growth partners are trying to access. Forty-five percent of respondents said they increased their sales of cybersecurity slightly or significantly in the third quarter compared to last year’s third quarter. Seventeen percent said they do not offer cybersecurity, which actually resembled other technologies (17% do not offer CCaaS, 16% do not sell colocation, and 14% do not sell SD-WAN).

Source: Channel Futures Quarterly Partner Outlook. Question 4.

The results pointed to the well-known gaps in IoT and mobility portfolios. Twenty-eight percent of partners said they do not sell IoT-related solutions, and 30% of partners said they do not sell mobility-related solutions.

Tech Service Distributors

The study also shone a light on the relationship between agents and their tech services distributor (TSD) partners. For the majority of partners (61%), their overall reliance on TSDs has not changed compared to the third quarter of 2021. However, 32% of respondents said they increased their reliance on TSDs. Only 6% said their reliance diminished.

In addition, the survey showed that partners are adding new TSD partners, potentially due to M&A. Thirty-six percent of technology advisers said they increased the amount of business they conducted with Telarus compared to a year ago, while 12% decreased and 52% remained the same. For Intelisys, 39% of agents increased business, while 9% decreased and 52% remained the same. For Avant, 44% increased business, while 0% decreased and 56% remained the same. Nineteen percent of respondents said they increased business with AppSmart, with 10% decreasing and 71% staying put.

The chart below lists out the full answers to the question of how business with different TSDs has changed compared to Q3 2021. Please note partners who “remained the same” were not necessarily working with the TSD to begin with.

Company | Decreased | Increased | Remained the Same | Respondent count |

Telarus | 12% | 36% | 52% | 25 |

Intelisys | 9% | 39% | 52% | 23 |

Avant | 0% | 44% | 56% | 25 |

Sandler Partners | 10% | 10% | 80% | 20 |

TBI | 14% | 5% | 82% | 22 |

AppSmart | 10% | 19% | 71% | 21 |

Jenne | 10% | 0% | 90% | 20 |

TD Synnex | 10% | 5% | 85% | 20 |

Pax8 | 5% | 20% | 75% | 20 |

Ingram Micro | 10% | 10% | 81% | 21 |

ScanSource | 5% | 5% | 89% | 19 |

Other | 10% | 0% | 90% | 10 |

Going It Alone?

Thirty-two percent of respondents said their number of direct contracts with suppliers increased year-over-year, while only 4% said their direct agreements decreased. Those driving more direct contracts pointed to consolidation among the vendors and distributors.

“A year ago we would not entertain direct contracts; we wanted all business protected by a TSD agreement,” one respondent wrote. “The M&A fallout has been so rocky that we are evaluating pivoting away from the traditional ‘big brand’ vendors and TSD relationships and routing more business through smaller MSP partners and other vendors we can have a more personal partnership with. Despite all the fanfare and adulations, the consolidation has hampered the pace of sales and growth for our business.”

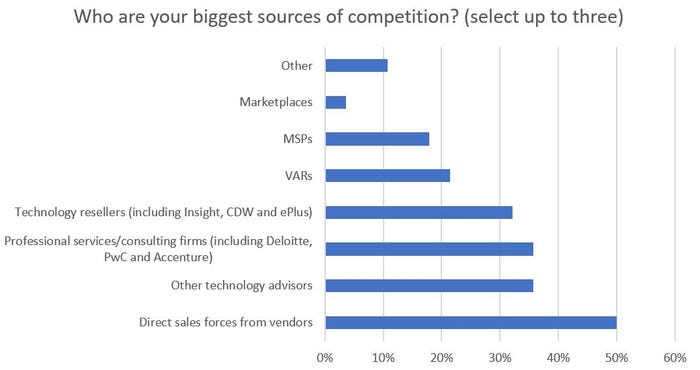

Competition

The study also touched on agents’ biggest competition. Much conversation in the channel has revolved around the idea of technology advisors competing with the big consultancies for enterprise customers. That sentiment is reflected in the survey, with 36% of respondents saying professional services and consulting firms represent their biggest competition. Other agents (36%) scored the same.

Source: Channel Futures Quarterly Partner Outlook. Question 16.

However, direct sales proved to be the most common source of competition for agents, cited by 50% of respondents. Interestingly, marketplaces scored at the bottom of the threat list, selected by only 4% of agents. For competition in the “others” category, respondents pointed to customers choosing to procure and manage technology on their own.

Want to contact the author directly about this story? Have ideas for a follow-up article? Email James Anderson or connect with him on LinkedIn. |

About the Author

You May Also Like