The Biggest M&A of Sept.-Oct. 2016The Biggest M&A of Sept.-Oct. 2016

This gallery breaks down big mergers and acquisitions from Sept.-Oct.: CenturyLink-Level 3, Berkshire Partners-Masergy, TelePacific-DSCI, Dell-EMC, Verizon-Sensity Systems, Tech Data-Avnet, AT&T-Time Warner, HP-Samsung Print, Extreme Networks-Zebra and RCC-VARCentric.

November 10, 2016

Already have an account?

The Biggest M&A of Sept.-Oct. 2016

In just the past week, we’ve seen three giant M&A moves that will have significant channel impacts.

Windstream pulled the trigger on a $1.1 billion purchase of EarthLink, the Internet pioneer that has since moved more heavily into business services; Broadcom announced plans to buy Brocade for nearly $6 billion, enhancing its position as a top provider of enterprise storage connectivity solutions; and CenturyLink agreed to sell its data centers for more than $2 billion — just days after announcing it would buy Level 3 Communications for $34 billion.

All of that followed what was already perhaps the biggest two-month period in the history of telecom and IT M&A.

We’ve broken down a baker’s dozen of those huge deals in the gallery that follows, offering up takeaways for the channel from the wheeling and dealing in September and October that is nothing short of mind-boggling.

Follow executive editor Craig Galbraith on Twitter.

Biggest M&A of Sept.-Oct.: CenturyLink-Level 3

Let’s start with the biggest.

On Halloween, CenturyLink “scared up” a $34 billion purchase of Level 3 Communications. Green-lighted by both companies’ boards of directors, the merger – pending regulatory approval – will create the second-largest domestic communications provider serving global enterprise customers.

John DeLozier, vice president of CenturyLink Channel Alliance, told Channel Partners many details must still be ironed out, but business is usual until closing, with both companies continuing to operate independently.

Most agents we talked to were optimistic, but one, who wished to remain anonymous, expressed worry.

“While we are seeing evidence of operational improvement with Level 3, they have a long way to go,” the agent said. “I fear this [will] table that progress. Also, Level 3 is far more friendly to the channel from a terms perspective. It was nice to have a big network player that was channel-friendly. Consolidating them with CenturyLink would take a viable competitive option away in the large deal space.”

Get the full scoop on this mega-buy here.

Biggest M&A of Sept.-Oct.: Berkshire Partners-Masergy

Masergy, which offers hybrid networking, managed security and cloud communications services to medium and large enterprise customers, sold to private-equity firm Berkshire Partners for an undisclosed sum.

Berkshire has made more than 115 investments since its founding in 1986. It claims industry experience in several areas, including consumer and retail, business services, industrials, communications and transportation.

Chris MacFarland, Masergy’s CEO, told Channel Partners the acquisition will “only have a positive effect on our partnerships and ability to deliver outstanding service to our mutual clients.”

This is where to read more about his acquisition.

Biggest M&A of Sept.-Oct.: TelePacific-DSCI

The completion of its acquisition of DSCI allows TelePacific Communications’ to reach a nationwide audience.

DSCI’s UCx unified communications offering and ITx managed IT services are expected to drive faster sales for the managed services that comprise more than half of TelePacific’s business. When joined with TelePacific’s SD-WAN technology that can deliver those services anywhere that there’s a broadband connection, this combination “sets the bar for success in the integrated MSP space,” TelePacific said.

DSCI will operate under its own name as a TelePacific company and will remain under the leadership of its senior management team with headquarters in Waltham, Massachusetts.

Read more about the acquisition.

Biggest M&A of Sept.-Oct.: Intelisys on ‘Partner Angst’

If Intelisys partners arrived at Channel Connect 2016 with angst and concern about the ScanSource acquisiton, “it’s gone, it doesn’t exist.”

That’s what Intelisys President Jay Bradley said during an interview with Channel Partners as the conference drew to a close. Buck Baker, ScanSource’s president of worldwide communications and services, also participated in the interview. Just over a month prior, ScanSource completed its acquisition of the master agent. The deal is being heralded as the first of its kind for the industry. Bradley said there have been expectations in the industry that this “convergence or consolidation between the hardware and the services side will happen.”

Read more about what Jay Bradley said.

Biggest M&A of Sept.-Oct.: Dell-EMC

Bucking the trend to streamline operations like most of its competitors, Dell Technologies became the world’s largest privately controlled technology company — reaching the finish line in its $60 billion merger with EMC.

The new entity, with $74 billion in revenue, is a family of businesses that include Dell, Dell EMC, Pivotal, RSA, SecureWorks, Virtustream and VMware.

Read more about Dell’s plans.

Biggest M&A of Sept.-Oct.: Verizon-Sensity Systems

Verizon signed an agreement to buy Sensity Systems Inc., a private company that is said to help Verizon with its IoT efforts. The carrier did not disclose the terms of the transaction, but it is subject to regulatory approvals and is expected to close before the year is out.

Read Verizon’s full announcement.

Biggest M&A of Sept.-Oct.: Windstream’s Dark Fiber

Another big sale or sales could be on the horizon for Windstream, including dark fiber assets.

The business communications giant sold its hosting unit to TierPoint a year ago, and this summer exchanged its remaining equity stake in Communications Sales & Leasing (CS&L), a real estate investment trust (REIT) and Windstream spinoff, to reduce debt.

And of course, there was the Nov. 7 announcement that is buying EarthLink for $1.1 billion.

For full context, read our report on the potential sale of dark fiber assets here.

Biggest M&A of Sept.-Oct.: Tech Data-Avnet

Tech Data bought a big chunk of competing distributor Avnet – its technology solutions operating group – in a cash and stock deal valued at about $2.6 billion.

Avnet reported $26.2 billion in fiscal year 2016 annual revenue, with electronics marketing comprising $16.6 billion and technology solutions contributing $9.7 billion. The purchase expands Tech Data’s reach across technologies and the world to establish it as “one of the world’s most diverse end-to-end global IT distributors with operations in 35 countries,” the company said.

The deal is expected to close in the first half of 2017, subject to customary closing conditions and regulatory approvals.

Read more details of the purchase.

Biggest M&A of Sept.-Oct.: EarthLink on Verizon-XO

EarthLink came forward in opposition to Verizon’s pending $1.8 billion purchase of XO Communications’ fiber-optic network business.

In a Sept. 12 letter to the Federal Communications Commission, Thomas Jones, EarthLink’s legal counsel, outlines a number of reasons why the deal would “harm competition and consumer welfare in several important respects.”

Read the full recap of the drama here.

Of course, EarthLink was the source of its own M&A drama last week when it announced a merger with Windstream.

Biggest M&A of Sept.-Oct.: AT&T-Time Warner

While channel implications might only be tangential, AT&T said it would buy entertainment conglomerate Time Warner for $84.5 billion.

This one, of course, isn’t without regulatory hurdles. The deal combines Time Warner’s library of content and ability to create new premium content with AT&T’s “extensive customer relationships, world’s largest pay TV subscriber base and leading scale in TV, mobile and broadband distribution,” according to the carrier.

Before the Nov. 8 election, now-President-elect Donald Trump spoke out against the deal.

“As an example of the power structure I am fighting, AT&T is buying Time Warner and thus CNN, a deal we will not approve in my administration because it’s too much concentration of power in the hands of too few,” Mr. Trump said.

This is where to read more about this mega deal.

Biggest M&A of Sept.-Oct.: HP Inc.-Samsung Print

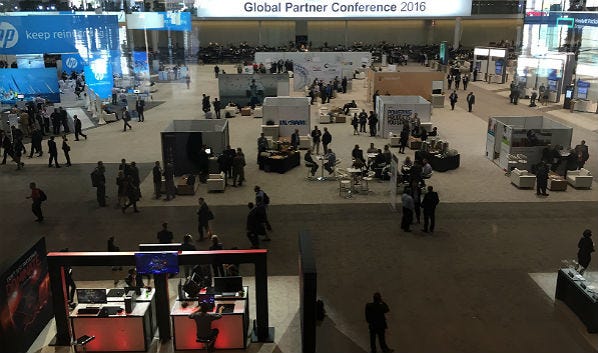

HP Inc. opened its Global Partner Conference in Boston, with the news of a definitive agreement to acquire Samsung Electronics Co.’s printer business.

The purchase gives the freshly separated print and personal-system vendor a stake in the $55 billion copier industry, where today, the company has less than 5 percent market share. Almost simultaneously with the $1.05 billion Samsung deal, HP launched an A3 portfolio containing 16 new next-generation HP PageWide and LaserJet platforms slated to go on sale in mid-2017.

Read more about this acquisition.

Biggest M&A of Sept.-Oct.: Extreme Networks-Zebra’s WLAN

Extreme Networks completed its $55 million acquisition of Zebra Technologies’ wireless LAN business.

Extreme executives have said the purchase helps the company’s goal of expanding its presence across various verticals, including education, health care, government and manufacturing. CEO Ed Meyercord said the acquisition keeps Extreme positioned as the third biggest provider within the enterprise campus market.

The purchase includes Zebra’s WLAN customers, personnel and technology assets, which Extreme says will lead to more than $115 million in annual revenue.

Get the full scoop here.

Biggest M&A of Sept.-Oct.: RCC-VARCentric

Richardson Communications and Consulting (RCC) acquired VARCentric, a telecommunications consulting services provider.

Rachel McNeese, RCC’s president and founder, and a member of the Channel Partners Advisory Board, told us the acquisition is part of her effort to expand and create new business lines.

The financial terms of the acquisition were not disclosed. RCC is located in McKinney, Texas, and VARCentric is based in Dallas.

Read more details on the buy.

The Biggest M&A of Sept.-Oct. 2016

Please click here for more Channel Partners galleries.

Read more about:

AgentsAbout the Author

You May Also Like