The New MSP 501 2020 Methodology ExplainedThe New MSP 501 2020 Methodology Explained

The managed services market looks far different than when the MSP 501 debuted.

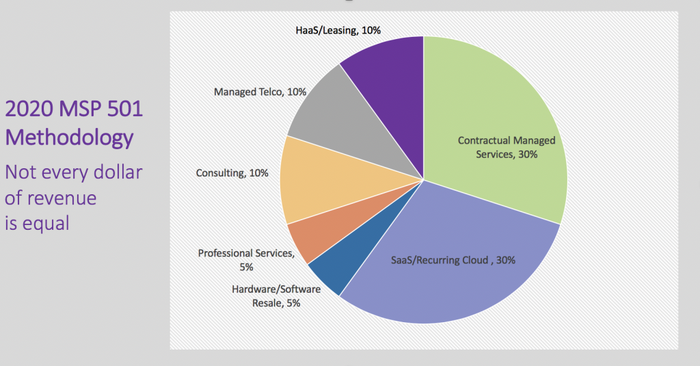

Since the inception of the MSP 501 14 years ago, winners have been ranked on the previous year’s annual revenue. About five years ago, in light of changes in the market driven by cloud and SaaS applications, we revised the methodology to weight different revenue streams differently depending on their long-term strategic health.

But some interesting things happened with the 501 in 2019 as a result of new market forces driving the managed services industry. We had a 35% year-over-year increase in applications between 2018 and 2019 that reflected a new maturity in the MSP market and an explosion of enthusiasm and support from vendor communities.

The nature of the list itself also changed. Two in five companies on the 2019 list weren’t on the 2018 list, which was a surprising and very notable evolution. We had so many entries from nontraditional channels or new MSP applicants that the list looked far different than in previous years.

Many of our 2019 501ers are in the beginning of a strong pivot toward managed services, but one wouldn’t necessarily categorize them as a true MSP. Of the top 10 MSP 501 winners in 2018, seven identified as MSPs, two as VARs and one dubbed itself an IT service provider. Compare this to last year: Four are VARs, only three are pure-play MSPs, one is a telco service provider, one is an IT business consultant — and that same IT service provider.

This diversity of partner types isn’t a fluke. Many of these nontraditional MSPs are sophisticated, large businesses in their own “home” markets that are making a concerted and strategic effort to build out their managed service practices, form relationships in this space, and promote their solutions.

Since these businesses already have a great deal of maturity under their belts, their annual revenue is substantially higher than our average 501er of the past, which also greatly altered the list. Between 2018 and 2019, the average annual revenue for a 501er grew by about one-third, from $28.8 million to $42.3 million. Since the 501 rankings were still solely based on annual revenue, albeit with the weighted methodology, that meant these new, bigger companies pushed a lot of our longtime 501ers off the list.

We knew it was time to re-evaluate our methodology and align it with market trends. In order to do that, we had to answer two questions, and they just happen to be questions investors today are examining to determine if an MSP is a healthy long-term investment.

1. What Defines a Managed Service Provider?

Many of the companies on the 2019 MSP 501 list have robust, growing MSP practices within their businesses that will only get larger as time goes by. But it isn’t enough, just as a hypothetical example, for a VAR that makes 90% of its revenue from resale or project work to say it manages hardware warranties on an ongoing basis and is therefore a true MSP.

To keep the 501 a safe space for traditional MSPs to play, we’ve created a separate list under the MSP 501 umbrella for those companies, both large and small, with new, growing managed services practices seated within a non-MSP tech company like a telco provider, digital agency or VAR.

The NextGen 101 will recognize outstanding partners with recurring revenues that are less than 20% of their total annual revenue. No matter how big or small, we feel a special …

… recognition is deserved by those businesses that recognize the incredible opportunity of managed services and decided to pivot toward it. We’ll be watching the NextGen 101 closely to see which players become powerhouses on the 501s of the future.

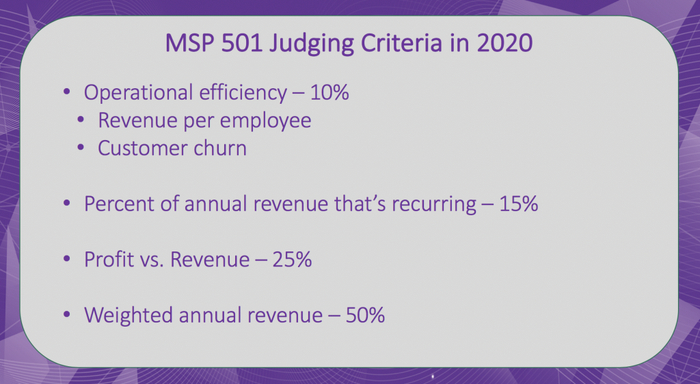

Percentage of recurring revenue will also factor into our overall judgement criteria, coming in as 15% of an applicant’s total score. Again, we’re looking at the factors that the larger financial markets will scrutinize to determine if you have what it takes to grow over the long haul. We all know these Wall Streeters are drooling for recurring revenue. It has to factor into our new methodology.

The key metric healthy managed service providers are measured on is recurring revenue, but today that comes in many different flavors. Office 365, hardware leasing, and telecom management are all recurring revenue streams, but they fall outside the realm of true managed services monthly contractual revenue.

We realized we had to differentiate contractual, true managed services from other streams of recurring revenue such as managed telco or HaaS. These streams will still count, but we’ll be placing a lesser weight on them in 2020. In total, weighted previous year’s annual revenue will count for 50% of an applicant’s final score as opposed to 100%.

2. What Does It Mean to be a ‘Top’ MSP?

Today, partners are expected to have 10-year business plans, succession plans, on-point valuation and the perfect revenue mix. MSPs are being forced into an operational maturity they’ve never had to deal with before. It isn’t enough to be a great tech with great customer relationships and a great book of clients. If you’re going to compete in 2020 and beyond, you’ve got to be savvy when it comes to business, too.

If we wanted the list to truly be a reflection of the top MSPs in the world rather than just those with the largest annual revenue, we needed to incorporate some key metrics used to gauge the health of a business.

For starters, we all know that it isn’t really the revenue you bring in that makes you a healthy business; it’s the profit, customers, and employees you keep. Basing the MSP 501 rankings solely on annual revenue, even when you incorporate the weighting methodology, is a logical fallacy. A company making $10 million in revenue but only $500,000 in profit shouldn’t place over a smaller, but more profitable company, just by default; therefore, in 2020 we will be asking applicants to provide not only annual revenue but annual profit as well.

But maybe you’re in an investment phase where you’re pouring resources into scaling efforts. Profit margin, therefore, will count for a good chunk of the criteria at 25%, but it isn’t high enough to knock out those companies making heavy investments in growth strategies, especially when you consider the other criteria we’re looking at.

Operational efficiency is a critical metric that anyone looking to acquire you, invest in you, or partner with you will be looking at closely to see if you have what it takes to scale.

Operational efficiency means doing more and supporting new and existing clients with the same resources, and in a services company, those resources largely come in …

… the form of people — both employees and customers. So in 2020, we’re measuring revenue per employee and customer churn as part of the judgement criteria. Each of these metrics will comprise 5% of an applicant’s total score, meaning the operational efficiency piece clocks in as 10%.

With the new methodology, our 2020 MSP 501 list will likely look much different than it did in 2019. We’re doing a deeper dive into recurring revenue streams, measuring revenue per employee and customer churn to assess operational efficiency, and looking at profit margins to gauge the health of the balance sheets. To hear a more in-depth explanation, check out our “So You Wanna be a 501er?” webinar.

The MSP 501 has grown from a competitive ranking list into a full-fledged community, complete with targeted market intelligence reports to help you benchmark your company against your competitors; an ongoing MSP Educational Series with industry experts sharing their knowledge; and our annual MSP 501 Awards Gala held every year at Channel Partners Evolution in the fall.

Wonder what it’s like to be a 501er? A lot of fun, for starters. Check out this We Are the 501 video for proof.

Applications for the 2020 MSP 501 will open March 1 and run through May 31. Stay tuned to the MSP 501 page on the Channel Futures site for updates. For questions, email [email protected]

We can’t wait to see your submission come through this year. Best of luck to all of our applicants!

About the Author

You May Also Like