SMBs’ SaaS, Cloud Collaboration Spending to Fall in 2020SMBs’ SaaS, Cloud Collaboration Spending to Fall in 2020

Much of that drop will impact the channel. But research firm Analysys Mason says there is hope.

Channel partners serving SMBs may have a tougher road ahead of them than expected. New findings from research firm Analysys Mason indicate that COVID-19 is putting a big dent in SMBs’ IT spending; in particular, software as a service and cloud collaboration.

The guidance seems to run somewhat contrary to that of other outlets. Data from other entities has tracked and forecast more spending on cloud platforms amid the pandemic.

But this week, Analysys Mason released two reports. They show SMBs funneling less money into SaaS and cloud collaboration tools, all because of the novel coronavirus. There are, however, caveats to the predicted trend.

Starting With SaaS

The good news? SMBs’ reduced spending on SaaS will prove temporary, according to Analysys Mason in its latest SMB Technology Forecaster for SaaS. For managed service providers, VARs, ISVs, system integrators and other channel partners, navigating the intervening weeks or months of decreased demand may be the hardest part.

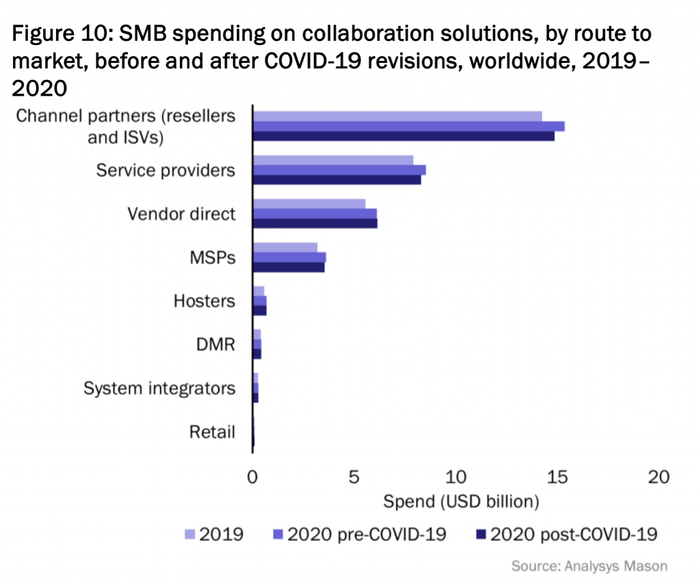

That’s because the channel collectively accounts for 91% of SMB spending on SaaS, Analysys Mason said. Year-on-year revenue growth for this key route-to-market category is expected to fall 3-5 percentage points in 2020; that is compared to the firm’s previous forecast.

That’s because the channel collectively accounts for 91% of SMB spending on SaaS, Analysys Mason said. Year-on-year revenue growth for this key route-to-market category is expected to fall 3-5 percentage points in 2020; that is compared to the firm’s previous forecast.

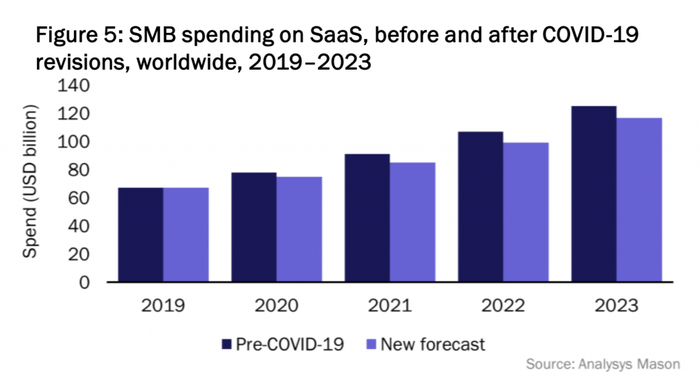

However, even though SMBs will buy less SaaS because of COVID-19, Analysys Mason still expects the sector to grow by 12% this year.

The ups and downs coincide with organizations’ furloughs and permanent layoffs, analysts noted. Yet, as economies reopen, the need for SaaS will bounce back. In addition, the pandemic has altered the nature of work. That means SMBs, along with their larger counterparts, stand to consume more SaaS over the long term, according to Analysys Mason. This applies in verticals across the board, including those that traditionally have had a more hands-on approach to serving customers.

“Small retailers and restaurants will need to rethink how they accept orders and payments, thereby creating a push for e-commerce, touchless payments and SaaS POS solutions,” analysts wrote.

Retailers and restaurants still are struggling as COVID-19 impacts shopping and dining out. Yet channel partners can work with these customers now to help them survive. Taking all verticals into account, Analysys Mason sees hosters and MSPs in the channel growing their revenue the most. The firm says that’s due to SMBs’ increasing needs for support and management.

On another note, partners targeting SMBs in Asia Pacific (APAC) may find more success faster. The SaaS growth rate in that region will be higher in that region than in EMEA and the Americas over the next few years. Analysys Mason attributes that to the COVID-19 outbreak, which has been more severe in the Americas and EMEA. Thus, analysts say the SaaS spending growth rate in these two geographies will reach 12% and 9% this year, respectively. APAC will see growth of 16%.

In all regions, though, Analysys Mason says SaaS will return to pre-pandemic growth levels by 2023.

All in all, Analysys Mason found that SMBs will spend $75 billion on SaaS in 2020, compared to analysts’ previous forecast of $78 billion.

The Forecast for Cloud Collaboration Spending

The situation for cloud collaboration differs somewhat than that for SaaS. In essence, channel partners may see more immediate benefits from focusing on sales of these platforms for a while.

As Analysys Mason points out in its new SMB Technology Forecaster for collaboration, SMBs are relying heavily on cloud-based software for video meetings, chat and file sharing because of the pandemic.

As Analysys Mason points out in its new SMB Technology Forecaster for collaboration, SMBs are relying heavily on cloud-based software for video meetings, chat and file sharing because of the pandemic.

Still, the research firm says overall collaboration spending (not just on cloud platforms) will drop by about $1 billion, to $34 billion. That aligns with analysts’ expectations that SMB spending on IT and communications solutions, in general, “will fall significantly due to the COVID-19 pandemic,” the report reads. Analysts say the largest declines will come in 2020 and recovery will begin late next year and into early 2022.

The general reduction comes in response to less on-premises collaboration and legacy hosted voice usage as businesses cut staff and close offices. At the same time, organizations are looking to cloud alternatives to keep teams connected. Because of that, Analysys Mason forecasts cloud collaboration spending to almost match that of its pre-COVID-19 numbers, or $43 billion in spending, by 2022.

Even so, Analysys Mason says resellers’ and ISVs’ collaboration revenue – including that from cloud solutions – will come in $500 million lower this year. MSPs, meanwhile, will see about 11% year-on-year growth due to organizations’ need for their holistic services.

By region, APAC will experience the most notable spending decline because of COVID-19. But Analysys Mason says it also will have the strongest recovery. The Americas will suffer only slight drops, with 8% year-on-year growth fueled by U.S. SMBs. In EMEA, SMBs in Western Europe will outpace the spending of their counterparts in Africa and Eastern Europe.

About the Author

You May Also Like