Quarterly Survey Analysis: Partners Turn Macroeconomic Lemons Into Financial LemonadeQuarterly Survey Analysis: Partners Turn Macroeconomic Lemons Into Financial Lemonade

Our analyst breaks down key findings from the most recent Channel Futures quarterly market survey.

September 11, 2023

Every quarter, Channel Futures gets the pulse of the channel market via its dynamic Quarterly Market Outlook surveys. These quarterly surveys provide an abundance of relevant channel market data which allow us to constantly assess the current status and future outlook of the market from the perspective of various channel partners.

In our latest 2Q23 Quarterly Market Outlook survey, we got feedback from more than 150 channel partners – MSPs (including MSSPs) and technology advisors/agents (TAs) – who shared their latest thoughts on prominent industry topics such as technology trends, sales/profit results, market challenges, macroeconomic factors, hiring practices, competition and more.

Findings from this quarter’s survey revealed some compelling insights that shed light on the industry’s evolving landscape. Here are the most pivotal:

Key Managed Service Provider (MSP) Survey Analysis Findings

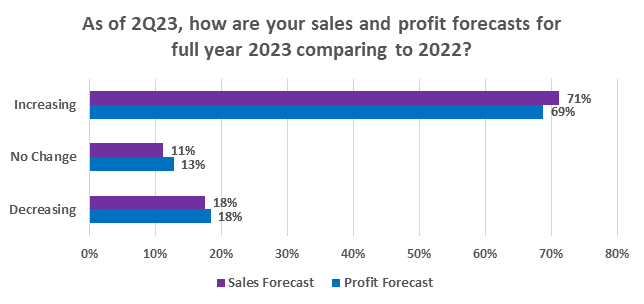

Rising Profits & Sales Forecasts: Despite oscillating macroeconomic conditions, the results indicate a promising uptrend in sales and profit among MSPs as they gear up for growth and position themselves to reap the benefits of increased outsourcing and rising demand for solutions such as cybersecurity, cloud, and AI. Consequently, 71% of MSPs are projecting to increase full-year sales and 69% are projecting to increase full-year profits in 2023, compared to 2022.

The Hunt for Vendors Persists: As the channel progresses and new technologies develop, MSPs are seeking the right vendor and supplier partners that will enable them to capitalize on the latest trends. In 2Q23, 54% of MSPs added vendors. The top service areas for those additions were managed security (34%), cloud storage (28%), and backup and disaster recovery (27%).

Key Technology Agent/ Advisor (TA) Survey Analysis Findings

Investment and Growth Are Sustained: In the midst of rising competition for channel expertise, TAs continue to invest in their businesses, with 33% stating they increased their full-time employee headcount in 2Q23. From a solution perspective, offerings like WAN/connectivity, unified communications (UCaaS) and cybersecurity received top marks for increasing sales in the quarter, compared to the year-ago quarter.

For more in-depth insights and analysis of the Quarterly Market Outlook Survey and to get a unique perspective on the key trends impacting the channel from the lens of prominent MSPs and technology advisors, check out our new Quarterly Market Outlook Survey Insights – 2Q23 report. |

Talent Recruitment & Retention Hurdles: Beyond the lack of skilled professionals, TAs are grappling with retaining their top talent. In an industry where the human touch is crucial, ensuring the continuity and satisfaction of employees becomes paramount. Forty-four percent of TAs stated recruiting and retaining talent was their biggest challenge in 2Q23.

Key MSP and TA Findings

Lead Generation a Top Priority for Go-to-Market (GTM) Success: Of all resources that can propel GTM success, lead generation stands out as the most sought-after among both MSPs (37%) and TAs (44%). Each group listed it as the most important resource they need from vendors to make GTM enhancements. This underlines the importance of quality leads in the sales conversion funnel.

Rise in Generative AI Utilization: In an era of digital transformation, MSPs and TAs are increasingly leveraging generative AI to optimize their processes, make data-driven decisions and tailor their offerings. Such technologies are heralding a new dawn for the sector, emphasizing innovation and efficiency.

Conclusion

The channel continues to evolve thanks to increased demand for critical offerings like cybersecurity, traditional solutions like cloud, and trendy technologies like AI. In spite of macroeconomic deterrents, channel partners remain focused on growth and optimistic about future sales. Our Quarterly Market Outlook survey results offer an invaluable blueprint for stakeholders to successfully navigate the present intricacies of the industry.

About the Author

You May Also Like