Google Cloud Still 3rd, But Will It Stay There?Google Cloud Still 3rd, But Will It Stay There?

Plus, Oracle Cloud expands and Synergy Research Group has hot cloud revenue estimates.

Activity in the cloud computing market is picking up the pace as we head into the second month of the year. Google Cloud, Oracle Cloud and Synergy Research Group all have news of impact to the channel.

Google Cloud Still 3rd in Revenue, But for How Long?

For the first time ever, Alphabet has disclosed Google Cloud’s revenue — and it’s notable, although still lagging behind Amazon Web Services and Microsoft Azure.

On Monday, Google Cloud reported $2.6 billion in revenue, thanks in part to large customers including Lowe’s and Wayfair, compared to $1.7 billion a year earlier. That comes to a 53% growth rate. For all of fiscal year 2019, Google Cloud contributed $8.9 billion, up from $5.8 billion in 2018 and $4 billion in 2017, to Alphabet’s earnings.

Google’s cloud infrastructure, data, analytics, enterprise G Suite and Anthos – the multicloud platform – all were key to the growth.

Still, Google Cloud remains in third place when it comes to the public cloud computing wars. Last week, AWS reported $9.95 billion in fourth-quarter revenue while Microsoft said Azure saw a 62% revenue increase. Redmond doesn’t disclose specific Azure numbers but a number of analysts peg them at around $4 billion per quarter.

But that’s not to say Google Cloud isn’t up and coming — and fast.

“While Google’s cloud results may have disappointed some, they weren’t terrible by any means,” Billy Duberstein, a contributor for The Motley Fool wrote in a column for Nasdaq.com. “The cloud race is shaping up to be a decades-long race between these three large providers, and one quarter’s specific numbers probably won’t matter in the long run.”

A final note: Everyone’s crowing about Google Cloud’s $10 billion run rate. Keep in mind that run rates are imaginary projections. They’re designed to excite investors and get them hyped up about the future. Run rates can provide useful insight about anticipated activity but anything can happen. A run rate does not reflect revenue set in stone.

Oracle Adds Cloud Data Centers in 5 Regions

Oracle has expanded the number of regions where it offers cloud computing as it seeks to compete against AWS, Azure and Google Cloud.

On Monday, the nearly 43-year-old company said it has opened data centers in Amsterdam; Jeddah, Saudi Arabia; Melbourne, Australia; Montreal, Canada; and Osaka, Japan. Enterprises will find those locations in their Oracle Cloud Consoles now.

The five new regions come on top of the 10 Oracle Cloud opened in the last six months.

“We now have Oracle’s Generation 2 Cloud available in 21 fully independent locations,” Andrew Reichman, director of product management for Oracle Cloud, wrote in a blog. “We’re well on our way to having 36 cloud regions available by the end of 2020.

IDC’s Deepak Mohan

Oracle, which has specialized in business software for most of its 40-plus years in business, has struggled with its strategy as “cloud” has become the in-demand technology. However, as the company rents data center space to enterprises, it may be on a more successful track. More countries are imposing strict data security and privacy regulations, which requires information to remain in-region. Providing data centers in these geographies gives enterprises more compliance assurances, helping Oracle Cloud to gain traction. After all, Oracle’s roots lie in the enterprise world – not consumer – adding to executives’ peace of mind about using the vendor.

Deepak Mohan, a research director at IDC, said as much to Reuters on Monday.

“Oracle’s taken a bad rap over the last couple years, but I think some of that has been them taking the …

… time to get the ship righted,” he said, according to Reuters. “There’s a lot they need to do – the leaders are still innovating – but I think they’ve shown that from a first-step perspective, they are definitely on the right path.”

Synergy: Q4 Cloud Infrastructure Services Earnings Biggest Market Has Seen

Now that most of the major cloud players have released their fourth-quarter 2019 earnings results, Synergy Research Group is estimating that the quarter’s cloud infrastructure service revenue exceeded $27 billion.

The firm also said on Tuesday it expects full-year cloud revenue to top $96 billion.

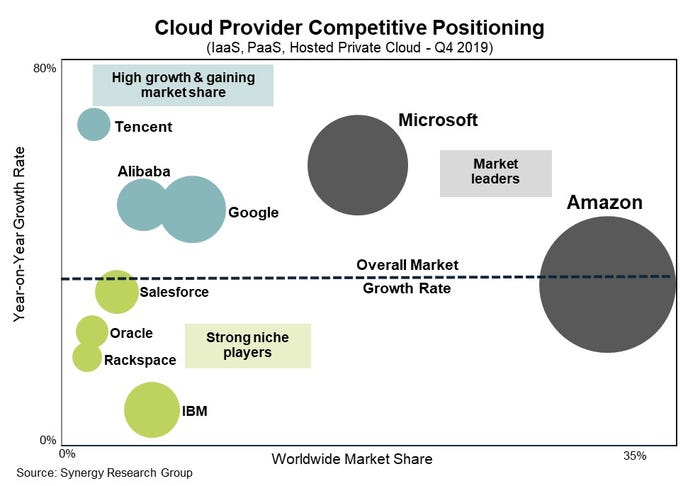

“Public IaaS and PaaS services account for the bulk of the market and those grew by 38% in Q4,” analysts wrote in a Feb. 4 blog. “In public cloud the dominance of the top five providers is even more pronounced, as they control over three-quarters of the market. Geographically, the cloud market continues to grow strongly in all regions of the world.”

The five main vendors are Amazon Web Services, Microsoft Azure, Google Cloud, Alibaba and Tencent, according to Synergy.

Overall, 2019’s fourth quarter posted the biggest cloud infrastructure services increases the market has seen, analysts said.

“The year ended with a bang as Amazon and Microsoft both posted big sequential gains in cloud revenues,” said John Dinsdale, a chief analyst at Synergy Research Group. “Thanks to these two market leaders and strong growth from some other cloud providers, the 2019 market was over twice the size of the 2017 market. Given secular trends in the market we will continue to see strong growth. We will also see a continuing battle for market position between the global giants and smaller cloud providers that have a more focused geographic or service footprint.”

About the Author

You May Also Like