Many AWS Users Also Embrace Microsoft Azure, Google CloudMany AWS Users Also Embrace Microsoft Azure, Google Cloud

A multicloud strategy is red hot these days.

January 29, 2019

Enterprises continue to use more than one of the top three public-cloud providers, with most embracing Amazon Web Services along with either Microsoft Azure or Google Cloud, according to a new survey by Kentik, the network analytics technology provider.

The survey, which collected responses from 310 executives and technical-level professionals at the latest AWS re:Invent user conference, found that the trend toward multicloud initiatives – where more than one public-cloud provider is used – is surpassing that of hybrid clouds, where at least one public cloud provider is used in conjunction with more traditional on-premises environments.

At the same time, the way organizations grow their use of the cloud – in multicloud as well as hybrid cloud approaches – is raising concerns around visibility and cost controls in these increasingly complex environments, the report found.

Courtesy Kentik

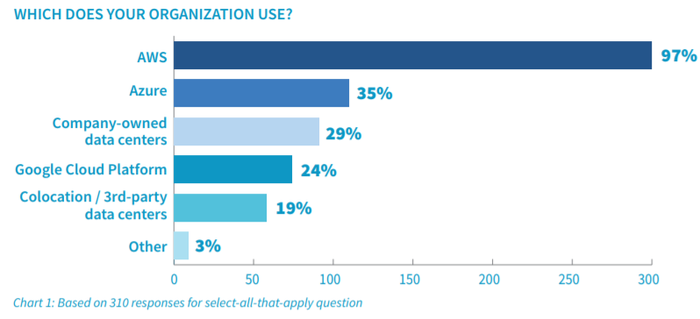

Given the venue in which the survey was taken, it’s not surprising that 97 percent of respondents said their organizations were using AWS; however, more than one in three (35 percent) said they use Azure and 24 percent said they use Google Cloud. Overall, 58 percent said they were using more than one of the big three providers. Forty percent use two cloud service providers, while 18 percent use all three.

“This aligns with the industry consensus that AWS is leading the cloud grab, and Azure is in the No. 2 spot,” the report’s authors wrote. “We think this is real evidence that ‘multicloud’ is not just a buzzword, but beginning to be the fact on the ground as well.”

The 58 percent of multicloud users was more than the 33 percent who said they use a hybrid-cloud model, though the authors wrote that “since organizations that have entirely migrated away from traditional infrastructure are still relatively rare, we believe most of this delta likely represents younger organizations whose infrastructure has been cloud-only since their inception.”

The results from the Kentik survey fall in line with what others in the industry are finding. Analysts at Synergy Research Group have said that AWS continues to dominate the space with 34 percent market share in the third quarter of 2018, followed by Azure, IBM and Google. Cloud management software provider RightScale said in a report last year that “a multicloud strategy remains the preference among enterprises,” with 81 percent of those surveyed using more than one cloud provider.

“Clients are increasingly looking to cloud to drive business value,” said IBM CFO Jim Kavanaugh on a conference call about his company’s latest quarterly financial numbers, according to a transcript on Seeking Alpha. “As they move more mission-critical workloads to the cloud, they need to securely move data and workloads across multiple cloud environments.”

For the year, IBM’s cloud revenues hit $19.2 billion, up 12 percent over 2017, Kavanaugh said.

While the Kentik survey shows the trend toward multicloud strategies, it also points to cost management being among the most significant cloud challenge. Almost 30 percent of respondents cited this as their biggest hurdle, with security – at 22 percent – coming in second. Among the key drivers of the cost concerns has been development teams aggressively pursuing cloud adoption without many times having …

… a full understanding of the costs involved. In addition, management and finance teams within enterprises are developing processes and controls that work with the pay-as-you-go cloud pricing models, and many organizations don’t have the data or visibility they need to allocate costs to individual departments. Without those, it’s difficult to put in cost controls, the authors noted.

There also is an abundance of monitoring tools used to gain greater visibility into cloud applications, with no one tool being a clear leader. Fifty-four percent use a cloud monitoring tool, while other solutions being implemented include log management, application performance management (APM), open-source tools and network-performance management.

Nearly six in 10 (59 percent) respondents said they use at least two of these tools, and 3more than one in three (35 percent) said they use three or more. Seven percent use five or more.

“Overall, we found it surprising that only around half of respondents are using cloud-specific tools to monitor their cloud environments,” the authors wrote. “This may stem from functional gaps that still exist between native monitoring toolsets, such as CloudWatch for AWS or StackDriver for Google Cloud, and commercial solutions from traditional monitoring vendors. It may also represent organizations’ attempts to employ consolidated monitoring strategies that are not cloud-specific.”

Read more about:

Channel ResearchAbout the Author

You May Also Like