Public Cloud Spending to Jump 22% in ’23, Driven by AWS, Azure, GooglePublic Cloud Spending to Jump 22% in ’23, Driven by AWS, Azure, Google

So much for speculation of public cloud spending cooling, just not as hot as it was.

It’s official: Public cloud spending just keeps growing, driven by the usual suspects, Amazon Web Services, Microsoft Azure and Google Cloud.

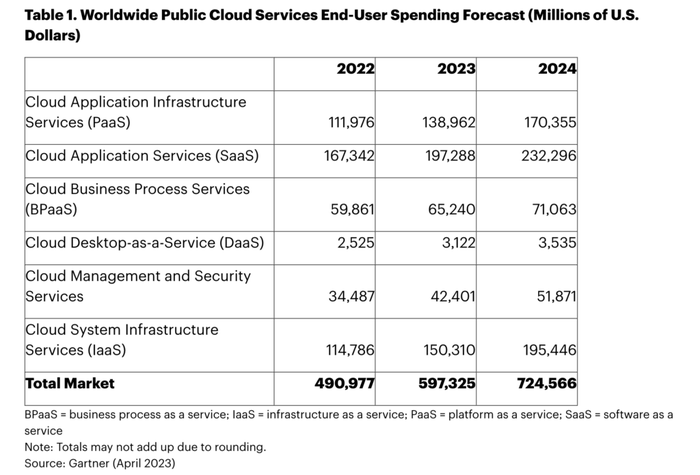

This year alone, end users will shell out more than $597 billion on public cloud, up almost 22% from 2022, according to fresh numbers from Gartner.

And generative AI – the likes of Microsoft’s ChatGPT, Google’s Bard and AWS’ newly launched Bedrock – will underlie much of cloud computing’s consumption from now on. So will Web 3.0 and the so-called metaverse, Gartner found.

Public Cloud Spending Actually Fell Short of Forecasts in 2022

The projections for 2023 track with estimates that have been filtering around since late last year. Of interest, however, is that the rise in public cloud spending appears to be tapering off from its previous meteoric trajectory — think during COVID-19 and all that work-from-home demand. In fact, global public spending last year fell $4 billion short of Gartner’s original projections, reaching $491 billion.

That gap arose as organizations started implementing cloud optimization techniques, rather than continuing to let resources run unchecked. Cloud providers and industry observers have sounded alarms that cloud computing adoption is slowing, but it’s more likely that IT leaders are at last controlling their environments. Of course, that frightens Wall Street and, in response, the hyperscalers have shed thousands of jobs. They overhired during the pandemic and now are encountering slower growth as organizations rein in their public cloud spending.

Digital Transformation Projects Will Fuel Ongoing Public Cloud Spending

Yet, despite enforcing greater control over their cloud estates, organizations still will shell out plenty on public cloud services, applications, infrastructure and more (see Gartner Table 1). Such digital transformation efforts require cloud technology and, as such, adoption will only chug along — just, perhaps, not at the 30% and higher rates investors would prefer. As such, AWS, Azure, Google Cloud, Oracle Cloud and their peers will have to keep distinguishing their unique capabilities and pitching those differentiators to buyers.

Yet, despite enforcing greater control over their cloud estates, organizations still will shell out plenty on public cloud services, applications, infrastructure and more (see Gartner Table 1). Such digital transformation efforts require cloud technology and, as such, adoption will only chug along — just, perhaps, not at the 30% and higher rates investors would prefer. As such, AWS, Azure, Google Cloud, Oracle Cloud and their peers will have to keep distinguishing their unique capabilities and pitching those differentiators to buyers.

“Organizations today view cloud as a highly strategic platform for digital transformation, which is requiring cloud providers to offer more sophisticated capabilities as the competition for digital services heats up,” said Sid Nag, vice president analyst at Gartner.

Generative AI Stands Out as Key Differentiator in Public Cloud Wars

One of the biggest opportunities for cloud providers to stand out comes in the form of generative AI, where competition has turned especially fierce. Ever since Microsoft came to market with ChatGPT, Google Cloud and AWS have rushed to keep pace. Google beat AWS to the punch with Bard, introduced late last month. AWS just last week revealed its generative AI tool, Bedrock. These platforms should prove key to the hyperscalers’ individual business strategies.

Gartner’s Sid Nag

“Generative AI is supported by large language models, which require powerful and highly scalable computing capabilities to process data in real-time,” Nag said. “Cloud offers the perfect solution and platform. It is no coincidence that the key players in the generative AI race are cloud hyperscalers.”

Organizations’ increasing demand for generative AI could explain one aspect of 2023’s public cloud spending forecasts. Gartner says infrastructure as a service will experience the biggest jump in adoption – at early 31% – followed by platform as a service at slightly more than 24%.

“The next phase of IaaS growth will be driven by customer experience, digital and business outcomes and the virtual-first world,” Nag said. “Emerging technologies that help businesses interact more closely and in real time with their customers, such as chatbots and digital twins, are reliant upon cloud infrastructure and platform services to meet growing demands for compute and storage power.”

SaaS Still Hot as Ever

Meanwhile, software as a service remains the largest segment of public cloud spending, Gartner said. That comes as little surprise as more companies, once license- and premises-centric, provision their programs on a subscription basis. The trickle-down effect reaches channel partners building their recurring revenue streams. Reflecting all of those points, SaaS outlay will total $197 billion this year, representing almost 18% growth, Gartner found.

On the whole, expect that by 2026, global organizations’ appetite for modern technologies will translate into 75% adoption of digital transformation models reliant on cloud, according to Gartner.

Want to contact the author directly about this story? Have ideas for a follow-up article? Email Kelly Teal or connect with her on LinkedIn. |

Read more about:

Channel ResearchAbout the Author

You May Also Like