Microsoft Azure Moves Closer to AWS as Alibaba Posts Best Cloud GrowthMicrosoft Azure Moves Closer to AWS as Alibaba Posts Best Cloud Growth

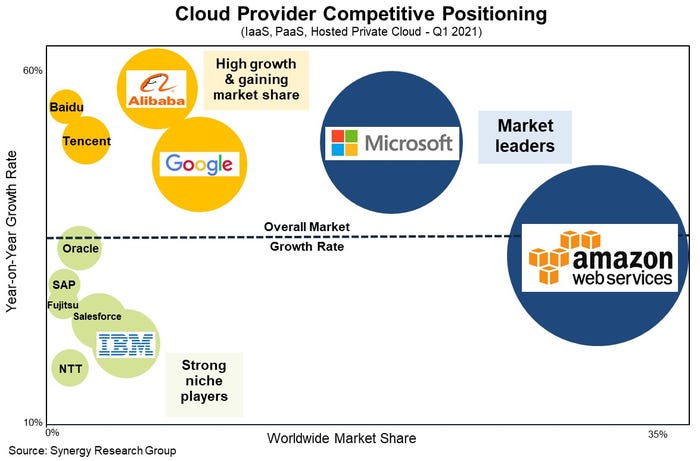

Alibaba and Google are rising in cloud market share, but the two frontrunners are clear.

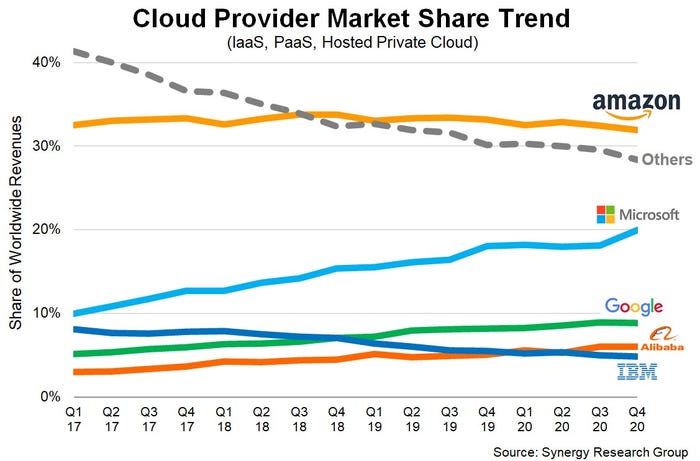

Microsoft continues to inch closer to AWS in the cloud infrastructure services market.

Synergy Research Group released its quarterly tracker of public cloud providers. The firm found that enterprise cloud infrastructure services spending exceeded $39 billion in the first quarter. That increased from $37 billion in the fourth quarter. Moreover, spending in the first quarter increased by 37% over the same quarter in 2020.

Amazon and Microsoft remain the dominant players, jointly earning the majority of worldwide cloud revenue. According to Synergy, Microsoft Azure is slowly gaining on AWS, although AWS continues to hold a clear lead in the cloud market. As of the end of the fourth quarter, Microsoft had just reached 20% market share while Amazon stood steady at about 33%.

Synergy groups infrastructure as a service (IaaS), platform as a service (PaaS) and hosted private cloud services into the market, although public IaaS and PaaS take up more share. The market has grown for the third consecutive year.

Synergy chief analyst John Dinsdale said Amazon and Microsoft have clearly established themselves as frontrunners. Dinsdale pointed to deep investments both companies have made in their global data center footprints and cloud service portfolios.

Synergy Research Group’s John Dinsdale

“These two don’t have to spend too much time looking in their rearview mirrors and worrying about the competition,” Dinsdale said. “However, that is not to say that there aren’t some excellent opportunities for other players. Taking Amazon and Microsoft out of the picture, the remaining market is generating over $18 billion in quarterly revenues and growing at over 30% per year.

Niche Players Welcome

Dinsdale said niche providers that target specific customers, services or regions can tap into plenty of opportunity.

Google trails in third, although Google Cloud Platform made revenue gains in the first quarter. However, Google has sacrificed its bottom line to make steep investments to build out its cloud practice. Alibaba led providers in year-over-year growth rate, tallying close to 60%. Alibaba’s cloud unit recently earned its first positive EBITDA since its 2009 inception.

Synergy’s top 12 list also includes Tencent, Baidu, IBM, Salesforce, Oracle, NTT, SAP and Fujitsu.

Want to contact the author directly about this story? Have ideas for a follow-up article? Email James Anderson or connect with him on LinkedIn. |

Read more about:

Channel ResearchAbout the Author

You May Also Like