$2.1 Billion Flexential Financing Incentivizes Energy-Efficient Data Center Creation$2.1 Billion Flexential Financing Incentivizes Energy-Efficient Data Center Creation

Flexential must must register a power usage effectiveness (PUE) of 1.4 or under for any data centers it builds through the financing.

Flexential claims to have drawn the largest asset-backed securities (ABS) issuance that the data center industry has ever seen.

The Charlotte-based company announced $2.1 billion in inaugural securitization financing. $1.6 billion from that funding is a green bond designed to incentivize sustainable water and energy practices in Flexential’s data centers. Any new data centers Flexential builds through the financing must register power usage effectiveness (PUE) of 1.4 or under.

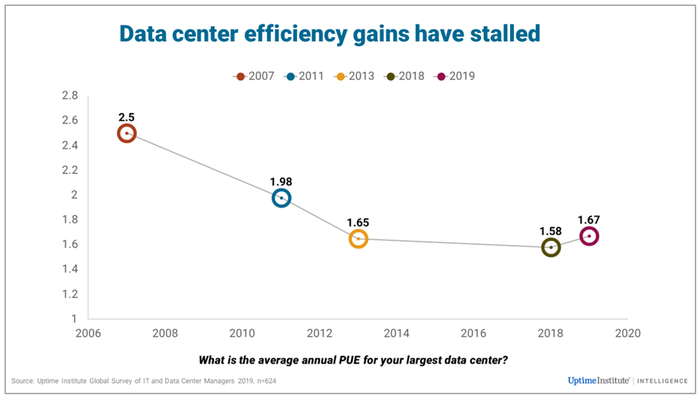

The National Renewable Energy Laboratory estimates that data centers average 1.8. However, energy experts in recent recent years have expressed consternation that average PUE hasn’t dropped much in recent years. Despite the arrival of newer data centers that offer a lower PUE, the larger numbers haven’t really budged in recent years. The Uptime Institute actually saw an increase from 2018 to 2019.

Source: Uptime Institute Global Data Center Survey 2019

Nonetheless, Flexential is touting its “Green Finance Framework” as a key method of ensuring transparency and sustainability.

“Our sustainability strategy focuses on where we can make the most impact by ensuring the entire life cycle of Flexential’s facilities are designed, built and maintained with sustainability in mind,” said Garth Williams, chief financial officer, Flexential. “We will look to achieve this through energy- and water-efficient cooling, cleaner power systems, and renewable energy options.”

Details

The $1.6 billion green bond came from a wholly owned subsidiary of Flexential. Flexential executives said the financing lowers capital costs. It also lets the company “deploy greater data center capacity to meet accelerating demands in new and existing markets.”

The transaction also bolsters Flexential’s investment grade credit. Most of the notes come with a five-year repayment timeline.

“We will leverage the capital generated by this transaction to deliver on our promise to support our customers’ evolving hybrid IT requirements,” said Chris Downie, chief executive officer, Flexential. “This inflection point is a result of considerable effort and tenacity from our employee base, along with the support from our investment partners and the entire Flexential ecosystem.”

To support our rapid growth and development, we have completed a $2.1 billion inaugural securitization financing, the largest single asset-backed securities to date in the data center industry. Learn more in this press release: https://t.co/sS5eVTqpNj #BeyondFourWalls pic.twitter.com/4R9cCNrjuL

— Flexential® (@flexential) December 2, 2021

Investment continues to pour into the data center space. Two weeks ago, American Tower announced the $10.1 billion purchase of CoreSite. Also two investments firms announced the $15 billion acquisition of CyrusOne.

For the nitty-gritty financial details of Flexential’s new notes, check out its press release.

About the Author

You May Also Like