AT&T Falls Down, Verizon Rises in Global Ethernet RankingsAT&T Falls Down, Verizon Rises in Global Ethernet Rankings

SD-WAN continues to propel Ethernet consumption.

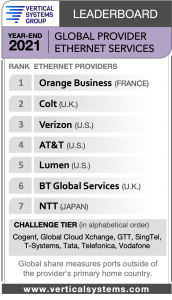

Orange Business returned to top form in the latest rankings for global Ethernet providers.

Paris-based Orange overtook American rival AT&T in the Vertical Systems Group Global Provider Ethernet Services 2021 Leaderboard. Vertical Systems Group measured the companies based on the number of billable retail customer ports the providers have installed outside their home countries.

Orange scored first in the 2017 leaderboard before falling off the podium the next year. It climbed from fifth in 2018 to fourth in 2019 to third in 2020. AT&T, on the other hand, led the leaderboard from 2018-2020.

Colt remained in second, while Verizon leapfrogged Lumen and AT&T into third.

Ethernet-based internet access is enjoying a spike in popularity, according to Vertical’s latest leaderboard. The research firm found that enterprise demand for Ethernet DIA is going up while fewer customers are looking to use Ethernet to access VPNs. Vertical noted that more and more customers are moving on from their MPLS networks.

Vertical Systems Group’s Rick Malone

“Global customer demand for Ethernet networks is slowly recovering; however, we expect continued volatility ahead due to unstable economic and geopolitical conditions worldwide,” said Rick Malone, principal of Vertical Systems Group. “Latest share results are tight across the top providers competing in this highly specialized global segment of the Ethernet services market.”

In the meantime Lumen has been dominating the U.S. Ethernet market.

Rising SD-WAN Demand

Techaisle’s Anurag Agrawal

Anurag Agrawal, who covers SMBs and channel partners for Techaisle, recently released a report that SMB SD-WAN adoption will grow by 145% in the next year. That being said, the SMB market is only 10% penetrated. Another one in four (25%) SMBs plans to adopt SD-WAN, according to Techaisle.

Agrawal said SD-WAN will play a key role in helping businesses adapt to the new normal.

“Networks are a clear pain point for SMBs as they embark on digital transformation to align with the emerging requirements of the post-pandemic world. Networks consume scarce IT resources, and they are the critical link providing the connectivity that unlocks all other digital opportunities and potential,” Agrawal wrote in a blog. “Techaisle’s survey data shows that 47% of SMB IT time is allocated to networking-related issues. Nearly 90% of SMBs believe that proactive, consistent network management to deliver ideal performance is important.”

Want to contact the author directly about this story? Have ideas for a follow-up article? Email James Anderson or connect with him on LinkedIn. |

About the Author

You May Also Like