The Channel Eyes the SMB Segment — and Marketplaces?The Channel Eyes the SMB Segment — and Marketplaces?

A new study suggests that providers should use digital platforms to reach the smallest customer segment. Do partners agree?

Will telecom providers finally tap into the huge SMB market opportunity, and if so, will that come through direct sales, channel partners or marketplaces?

A recent study from Beyond Now prompts that question. Beyond Now’s recent report, “CSPs: it’s time to reacquaint yourselves with today’s SMBs,” makes the argument that smaller businesses are hungrier for technology and more willing to spend on it than previously thought. The survey of 700 decision-makers found that SMBs put 8% of their annual revenues into purchasing technology products and services. Moreover, respondents indicated that they’ll be investing more money in information and communications technology (ICT). Technology spend will increase by an average of 6% in the next year for one-half of the responding SMBs, according to Beyond Now.

But those observations comes with a catch. Beyond Now in its report argues for a marketplace-driven approach to the SMB market.

“It’s fascinating that at a time when the industry is so focused on enabling digital transformation for large enterprises, that many SMBs are already digitally transformed businesses. There is a rich vein of revenue available to CSPs if they can get their SMB value proposition right. That means building solutions around SMB needs, finding repeatable patterns and embracing digital channels that are key for developing viable business models. This involves creating a digital marketplace that can deliver the scale and automation necessary for CSPs to work with partners on delivering technology solutions that meet the diverse requirements of the SMB sector,” Beyond Now CEO Angus Ward said.

BearingPoint’s Angus Ward

It’s not shocking that a digital platform provider like Beyond Now promotes the value of marketplaces, but its claims are worth examining. Are vendors missing out on the SMB market? And if so, are partners, digital channels or both the best avenue to reach those clients?

SMB Demand

Beyond Now cited an Analysys Mason forecast that predicts SMB cloud-based technology spending will grow from $600 billion this year to $1 trillion in 2027. Managed services, infrastructure and cybersecurity highlight the cloud category; Analysys Mason says they account for 45% of SMB IT spending. However, the collaboration and business applications associated with hybrid work are on the rise. The forecast states that SMBs will move from freemium to paid versions of those products.

Beyond Now’s study concluded that SMBs adopt technology in a more sophisticated way than their reputation suggests. The survey found that 70% of SMBs are eyeing technology as a way to grow efficiency and improve their business in categories such as customer experience.

“While large enterprises still struggle with digital transformation, many SMBs are already running as digital businesses. The SMBs of today are sophisticated, technology savvy, and quite independent when it comes to technology consumption,” the report authors wrote.

The Technology Stack

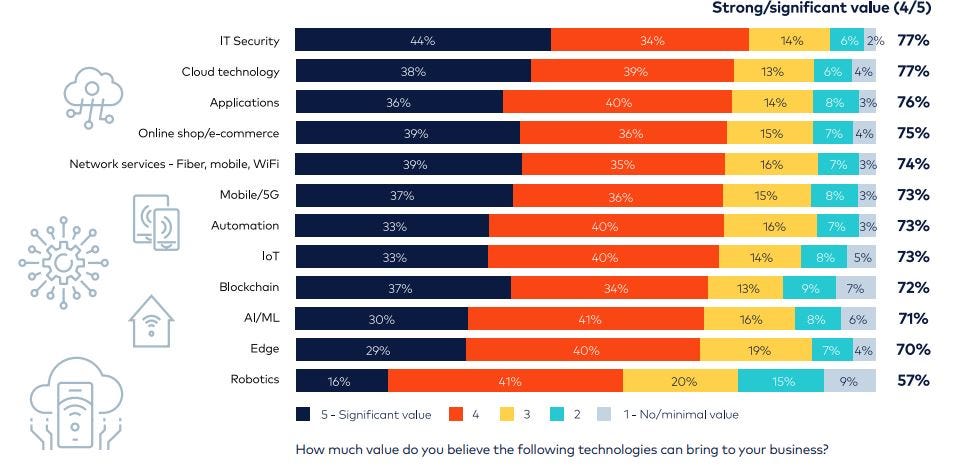

Respondents listed how they value different technologies. Cybersecurity scored the highest, with 44% of SMBs saying it can offer significant value to their business. However, other technologies, including network services, scored similarly. Thirty-nine percent of respondents see network services as offering significant value to their business, and another 35% see strong value.

Source: Beyond Now: “CSPs: it’s time to reacquaint yourselves with today’s SMBs”

Ashley Rowland, partner at technology advisory firm Adaptiv Advisors, sells to the SMB segment. She said she’s seeing tech investment from that market.

Recurring Raise’s Ashley Rowland

“Over 60% of my SMBs customers have added locations, added seats, or increased bandwidth in the last year,” Rowland told Channel Futures. “They are growing and we are here repeatedly to facilitate that.”

She said small businesses show interest in using technology to …

… achieve business outcomes. They also show an openness to hearing about what partners can do for them, she said.

“Since most SMBs are privately owned and operated, every dollar and business process makes a difference to them,” she said. “They also don’t ever ask you for an RFP or make you jump through hoops on fire to consider working with them.”

SMB Challenges

But with that SMB demand for technology comes many caveats, and mainly around the complexity technology management. Nearly two-thirds (65%) of respondents said they want to buy all of their technology from a single source. Moreover, 78% of SMBs said they would happily pay a premium for a single technology source.

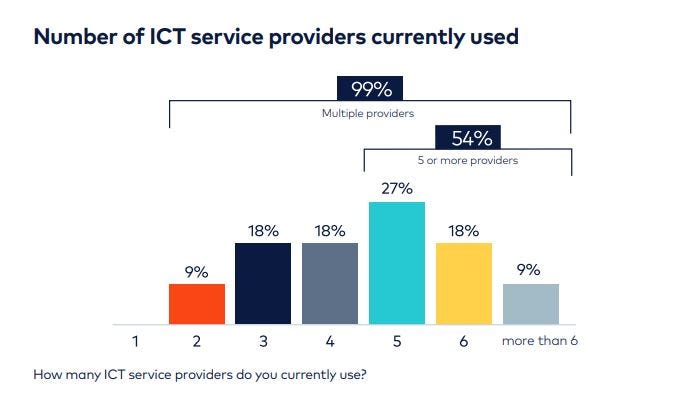

Essentially all of the SMBs (99%) surveyed are using multiple providers. A further 54% are using five or more.

Source: Beyond Now: “CSPs: it’s time to reacquaint yourselves with today’s SMBs”

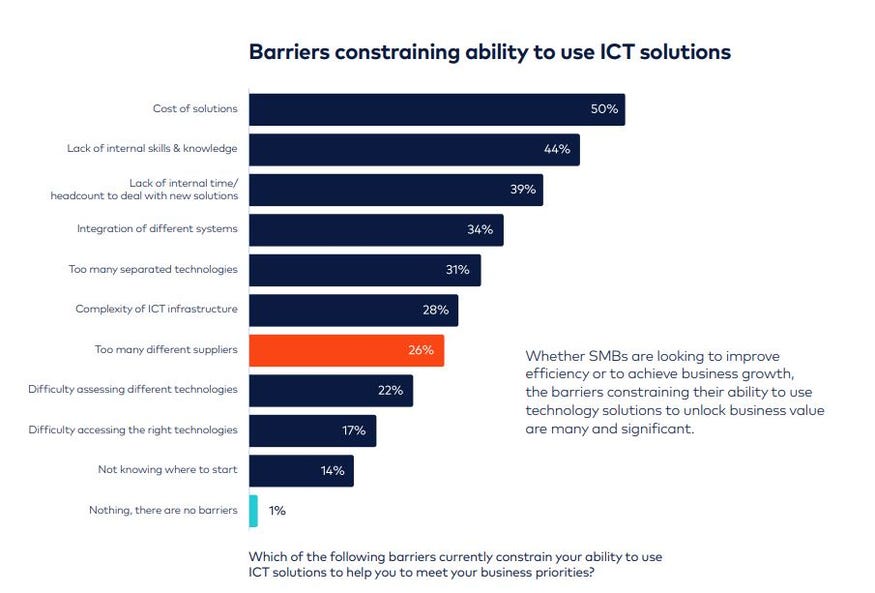

In a not-so-shocking data point, cost emerged as the biggest barrier for customers using technology. Cost scored as the lagest constraining factor (50%), followed by lack of skills and knowledge (44%) and lack of staffing and time (39&).

Source: Beyond Now: “CSPs: it’s time to reacquaint yourselves with today’s SMBs”

The Current Gap

Ray Le Maistre of TelecomTV pointed out how telecom service providers have for decades pursued the SMB segment to no avail. Their go-to-market stragies have largely failed, Le Maistre said. And that largely comes down to the investment telcos need to make.

TelecomTV’s Ray Le Maistre

“Even though the sector includes companies with up to 250 employees, SMEs don’t have significant IT teams, and some don’t have any IT experts at all. Therefore, they need trusted and reliable professional services support from their suppliers, and for telcos to provide customer interaction and supporting services for SMEs, it would require a lot of human resources to support a lot of customers that don’t have massive communications and IT budgets,” Le Maistre wrote.

As a result, smaller businesses have turned to MSPs and systems integrator for that support, Le Maistre said.

“That’s a massive generalisation, but one that appears to be a running theme for at least the past three decades as mobile services and then the cloud changed the comms and IT landscape for all types of enterprise users,” he said.

Digital Platforms

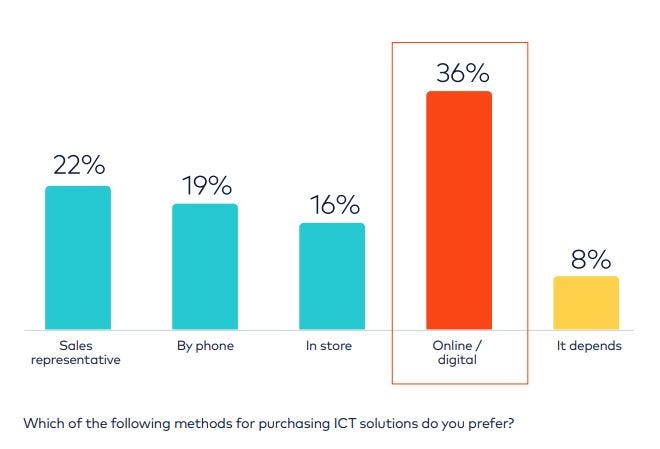

Enter Beyond Now’s thesis: that communications service providers can scale into the SMB using marketplaces and other digital channels. When asked about their preferred purchasing methods, 36% of respondents picked online/digital. Twenty-two percent picked a sales representative. It’s worth noting that this question doesn’t factor in the option of buying from a partner.

Source: Beyond Now: “The playbook for thriving SMB-CSP relationships

What might lead an SMB to purchase technology through an online platform? For 57%, it’s getting access to …

… good pricing and discounts. That was by far the most popular driver. Having a guided journey (43%) and a deep portfolio to explore (40%) took second and third.

Rowland said customer interest in a digital platform reflects two of their key needs: simplicity and speed.

KeyStone Solutions’ Jay Morris

“If you can fulfill their needs via a digital platform or other method like handling it for them and providing receipts, then you’ll keep winning,” Rowland said. “Self-service is chosen over humans sometimes because humans don’t always make it easy. Make it easy, be likeable, be thorough and you won’t be replaced.”

Are Marketplaces the Future?

VARs and agents may have grown tired of reading about marketplaces, but more and more high-profile vendors, such as Cisco, are talking about them. Cisco executives state that participating in cloud marketplaces represents one of many ways of meeting customers’ purchasing preferences.

For Jay Morris, channel chief at SMB-focused MSP KeyStone Solutions, Beyond Now’s study reflects an age-old truth: that aggregation improves life for customers.

On the other hand, everyone in the channel is eager to take one step closer to the end user. And marketplaces are certainly a valid way to take that step. The desire to make oneself a one-stop shop is real for partners, distributors, carriers and connectivity-lookup platforms alike, Morris said.

“Everyone wants their icon on the desktop,” he said.

The Path Forward

Morris pointed to other industries like airlines and hospitality that developed marketplaces over the years. He said he can see the same trend taking place in the telecom industry — starting at the bottom of the market.

“Keep in mind, it’s been around many years for consumers and even small business for cable, telephony, insurance, but that’s much easier. Incumbents in most cases are a single ILEC and or cableco per zip code, so no need for best-of-breed sourcing and procuring, because the choice was limited. Now technology is more broadly available from many providers per market and in some cases, available in any market, not unlike travel, insurance and consumer goods. The difference is the amount of data and the complexity of the data,” Morris told Channel Futures.

But an inevitable shift to digital marketplaces doesn’t equal an immediate shift to digital marketplaces. Morris said such a movement in the telecom channel involves widespread agreements between carriers on rules and process, as well as more accurate data.

“We’ll start to see real gains in five years, large growing concerns in 10, and real transformation in less than 20 [years]. But the easy stuff, single-location broadband and hosted are literally here and now to some degree, but the complex all-encompassing technology in a box is going to take some time, and many failures will happen along the way.”

The Case for Partner SMB Sales

One of the prevailing popular sentiments in the agent channel is that enterprises present the most attractive market opportunity moving forward. Leaders at distributors such as Avant Communications have urged partners to build the skills and relationships necessary to land accounts with larger and larger customers.

And for Rowland, who has developed a presence in the SMB market, her clientele surprises many of her peers.

“When people hear that I mostly work with SMBs they reply, ‘Really?’ as if I’m supposed to be ashamed of this. SMBs aren’t sexy. When you talk to most agents and ask them about their business, most of them tell you about their biggest customer or name drop some huge logos. Not me – I love the SMBs. They are easy to find, easy to work with, and consistent,” Rowland.

And for Rowland, it makes more sense for her to engage in SMB deals with a higher probability of success.

“While big logos are impressive, you better believe they are being targeted by every direct sales rep, tons of agents and consulting firms. If you happen to win one, the margins are usually super skinny since they have huge buying power and get every vendor down on price. You’ll be lucky your vendor doesn’t offer a trade for services just to win the logo, leaving you out of the commission altogether. You might also work for months or years and never get paid if you don’t win the account and don’t have an agreement in place on the front end for your time on the RFP or presale consulting.”

Want to contact the author directly about this story? Have ideas for a follow-up article? Email James Anderson or connect with him on LinkedIn. |

About the Author

You May Also Like