Lumen-Apollo ILEC Sale Update: Will New Company Cater to Agent Partners?Lumen-Apollo ILEC Sale Update: Will New Company Cater to Agent Partners?

"I can't imagine they just want to buy the LEC services of 20 states and be happy with that," a partner said.

Partners are waiting to see if they will earn commissions from the ILEC unit Lumen is selling to Apollo Global Management.

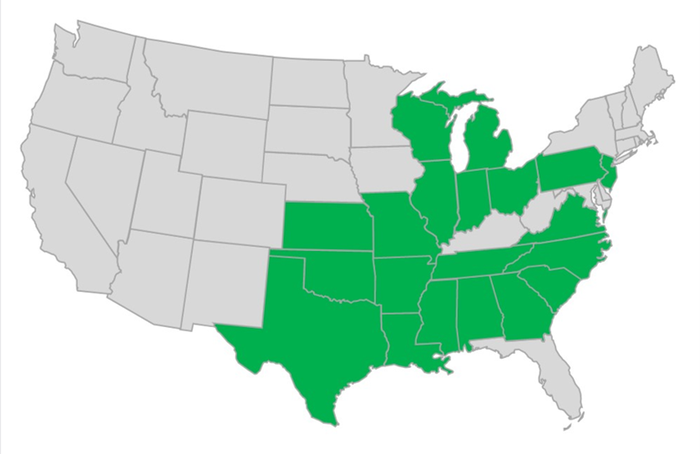

Lumen, the rebranded CenturyLink business, announced in August that it was selling its incumbent local exchange carrier (ILEC) assets in 20 states to Apollo. Currently, Apollo plans to bring the ILEC assets into a entity called “Connect Holding,” although a new name will likely follow.

Dave Young, Lumen’s senior vice president of strategic sales, said the deal will likely close in the second half of 2022.

“Indirect customers served by our incumbent local exchange carrier network will transition to Apollo when the transaction closes,” he told Channel Futures.

He also said Lumen will retain its competitive local exchange carrier (CLEC) practice in the 20 states where it sold its ILEC business. Furthermore, Lumen will retain its ILEC operations in 16 states.

Lumen’s Dave Young

“Lumen will keep our partners informed of any changes that may affect them or their customers,” Young told Channel Futures.

New Company

The $7.5 billion deal gives Apollo access to fiber and copper networks, tower site connectivity and offices. Apollo has also invested $200 million in Utah-based fiber provider FirstDigital Telecom.

Source: Connect Holding

The company says it aims to provide the “highest-speed fiber optic internet experience” in the Midwest and South. Specifically, Connect Holding leaders are targeting rural customers.

“Our vision is to accelerate the upgrade of copper to fiber-optic technologies, bringing faster and more reliable internet service to many rural markets traditionally underserved by broadband providers, while delivering best-in-class customer experience,” the company said in a statement.

Leadership

Former Verizon executives Bob Mudge, Chris Creager and Tom Maguire will lead the company.

Brian Washburn, Omdia‘s research director for service provider enterprise and wholesale, said the leadership team posses strong experience in copper-to-fiber infrastructure upgrades. Mudge, Creager and Maguire worked to roll out Verizon’s Fios service.

Omdia’s Brian Washburn

“Much of the company’s service footprint is in lower population density areas, where the economics of entirely swapping out access infrastructure is more challenging,” Washburn told Channel Futures.

Apollo’s Drivers

Analysts have pointed to the developing Congressional infrastructure bill, which will drive broadband investment, as a reason for the Apollo ILEC purchase.

“Infrastructure isn’t just roads and bridges anymore. Even a slimmed-down version of a federal infrastructure bill would incentivize private investment in companies,” Demitri Diakontonis of Mergers&Acquisition wrote earlier this year.

Shane McNamara, Avant’s executive vice president of engineering and operations, agreed that the infrastructure bill is playing a role. Moreover, he said Apollo is looking to capitalize on an undying demand for high-speed internet.

“While they might be a bit commoditized, there’s not a week that goes by that there isn’t a customer buying POTS lines or moving to locations where they need POTS lines, PRIs, etc.,” McNamara told Channel Futures.

Lumen’s Drivers

Avant’s Shane McNamara

On the other hand, McNamara said Lumen is pivoting toward a different direction to focus on next-generation offerings.

“They’re building out their edge computing, and they’re building out their cloud offering and the security offering (SASE),” he said. “That’s the strategic direction that they want to go.”

McNamara also pointed to the sale of Lumen’s Latin American business as another sign of the times. Namely, the company is narrowing its focus onto the cloud- and edge-focused services that its executives have been talking about. The $10 billion that it is earned from its recent divestitures can go to build those offerings and support the channel, McNamara said.

“In certain areas of the country, specifically the square states, Lumen is remembered as Qwest — Qwest as a rural LEC. Lumen’s trying to shed that perception a bit. They’re trying to change their the whole focus of who they are and reinvent who they are,” he said. “I think some of this is demonstrating that they’re serious being a next-gen service provider and not just some rural LEC that they were back in the day. So to me, that’s really exciting.”

McNamara said he also expects Apollo to acquire more assets.

“I can’t imagine they just want to buy the LEC services of 20 states and be happy with that. And I imagine some of the other big providers may want to divest a bit too. Giving customers more choices I think is a healthy thing. And the partner community can help sift through all the noise to help customers make good decisions for their businesses,” he said.

Channel Impact

The question remains as to how the acquisition will impact broker partners that sold Lumen ILEC services. Specifically, they’re asking questions about commissions.

“Whenever you have any kind of merger or acquisition, the very first thing a partner thinks about is, ‘Oh boy, what’s that going to do for my commissions?'” McNamara said. “Rightfully so. They built a business around a residual business, and they built that annuity, so they want to make sure it stays protected.”

However, McNamara said that most suppliers have managed to keep commissions going even in extreme circumstances such as …… chapter 11 bankruptcy.

“We’re anticipating and expecting that any customers that transition to the Apollo group will continue to pay us commissions. We’ll have probably have to engage in a direct agreement, but there’s assignment language in our contracts that protect that as well,” he said. “So we feel pretty confident that the future is bright for partners as it relates to the commission side. There are no guarantees, obviously, but we feel pretty good.”

Moreover, McNamara said partners are still selling ILEC services. Although legacy carrier services don’t drive the “lion’s share” of business, customers are still requesting them.

“It’s not thriving like unified communications and CCaaS and other cloud services. However, we still get a little bit giddy when we see that 10,000 POTS lines order come in,” he said.

Current Status

For now it’s business usual, with agents working with the Lumen team. Dave Young has noted that much remains to be seen about how Apollo handles partnership when it takes over the ILEC assets. However, Young said Lumen communicated the importance of channel partners to the Apollo team.

“We definitely have discussed it with the buyer, and the buyer has agreed to what the asset looks like,” Young told Channel Futures in August.

Apollo appears to be building out a channel team. Job postings show that Connect Holding is looking for a vice president of sales and channel management. It is also hiring a director of channel operations.

The Value of the Channel

McNamara said Apollo ought to follow in the steps of popular companies like Zoom, RingCentral and 8×8 that have relied heavily on technology brokers and resellers for growth. Even large, established companies like AT&T have turned to indirect sellers.

“[AT&T] built out a residual-based channel program that they’ve never done in their history before. So for every company that’s coming into this business, and any new vendors that are coming into this industry, they know that channel is the way to go,” he said.

Want to contact the author directly about this story? Have ideas for a follow-up article? Email James Anderson or connect with him on LinkedIn. |

Read more about:

AgentsAbout the Author

You May Also Like