Poll: Partners Like HPE's Juniper Acquisition, but Cisco to Stay DominantPoll: Partners Like HPE's Juniper Acquisition, but Cisco to Stay Dominant

Still, 23% said it's "negative" or a "terrible move."

HPE’s $14 billion acquisition of Juniper Networks is getting an overall thumbs-up from channel partners, according to a new poll.

Canalys – which is owned by Channel Futures’ parent company, Informa – conducted a survey of partners on the acquisition. Almost one-quarter (24%) said it was it was an “excellent” move that makes HPE a new leader in AI-led networking. An additional 31% said the purchase was positive and would be beneficial to both companies.

Twenty-two percent of partners questioned were more cautious, noting there were “some benefits, but only in certain areas of the business.”

About one-quarter (23%) either view the acquisition negatively, considering it “not good news for either company or their partners,” or worse, a “terrible move,” where “Juniper’s value will be lost in HPE."

In a separate Canalys poll, 11% of partners said the purchase will have a negative impact on their business. Another 44% said they either don't sell HPE networking or Juniper products or the acquisition won't add anything to their existing HPE business. The remaining 45% said it will impact their business positive or it's "very positive."

Why Is HPE Acquiring Juniper Networks?

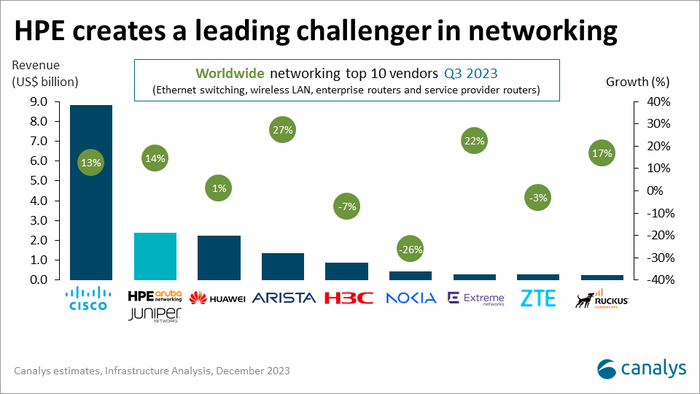

HPE’s acquisition of Juniper will establish a major challenger in all segments of the $72 billion networking market – but Cisco will remain dominant by market share, noted Canalys.

“The combined company will be in a stronger position to capitalize on the growing demand for AI for networking and networking for AI in the coming years. The announcement will also be a catalyst for other divestments, mergers and acquisitions in the networking sector,” said the analyst.

After the deal closes, networking will represent more than 30% of HPE’s business, it said. Servers will still generate the largest proportion of its revenue at just under 40%.

Juniper also gives HPE a significant telecom and cloud service provider networking business. This isn’t just from a portfolio perspective, but also commercial relationships with many of the tier 1 telecom accounts and leading cloud service providers.

“These are customers HPE has either failed to gain traction with or exited from,” said Canalys.

Growth of Juniper Channel Enterprise Business

Meanwhile, Juniper has also been building an enterprise business, with the acquisition of Mist in 2019 a key catalyst. In the quarter ending September 2023, Juniper’s enterprise segment accounted for more than 50% of its total revenue for the first time, said Canalys.

A change to only offering rebates for registered deals has been a key contributor to enterprise growth through the channel. This has doubled the proportion of partner-registered deals to 40% within three years. Juniper also recently enabled partners to deliver a first-line level of support for Mist, giving them full ownership of their customer relationships and build additional services revenue.

Juniper has roughly 500 partners in its program, which typically focus on complex high-performance networks for larger customers. This compares to just under 30,000 partners listed on HPE Aruba Networking’s partner locator.

About the Author

You May Also Like