SMBs Weigh 5G Impact as Verizon, AWS Launch New Use CasesSMBs Weigh 5G Impact as Verizon, AWS Launch New Use Cases

An analyst said 5G business opportunities will start with the enterprise and trickle down to smaller companies.

Verizon expanded its relationship with AWS to provide more enterprise use cases for 5G.

Verizon announced the availability of private multi-access edge compute (MEC) for U.S. enterprise customers. The managed service brings together private Verizon 5G networks, Verizon’s private edge platform and a service called AWS Outposts. AWS Outposts gives customers local access to their AWS-managed infrastructure, thus allowing them to enjoy AWS compute and storage features at their own site. As a result, enterprises can use dedicated, on-premises edge compute infrastructure that works with “ultra-low latency.”

Verizon’s Tami Erwin

“Verizon’s 5G is the platform for 21st century innovation and customers are looking to rapidly innovate, improve performance and create new revenue streams,” said Tami Erwin, CEO of Verizon Business. “Developers are already creating new latency-dependent solutions that run on the Verizon/AWS public MEC service launched last year. Our private MEC offering will unlock that same potential for enterprise customers who need to maintain a secure, closed environment in factories, warehouses and other facilities.”

The companies expanded an existing relationship. Verizon announced in December that it had brought together Verizon’s 5G network with the AWS Wavelength service. As a result, select customers could deploy low-latency applications on 5G-enabled devices. AWS and Verizon had brought the service to 10 cities as of December.

“Now, Private 5G MEC from AWS and Verizon brings ultra-low latency to dedicated, closed, on-premises environments for use cases such as autonomous mobile robots, quality assurance and hazard alerting,” said Dave Brown, AWS’ vice president of Elastic Compute Cloud (EC2).

Use Cases

Corning Inc. will use the private MEC first. The New York-based manufacturing giant will harness the service to process information from autonomous mobile robots.

Srinivasa Kalapala, Verizon’s vice president of technology and supplier strategy, said multi-access edge computing allows businesses to process data in real-time. High speeds matter very much when we consider the proliferation of connected devices that is creating ever more complex data.

Verizon’s Srinivasa Kalapala

“It’s the idea of bringing the cloud closer to the edge of the network to deliver new experiences for both businesses and consumers,” Kalapala said. “It’s based on the premise that as the tech evolves, we expect more devices to connect to the network.”

Public MEC and private MEC differ significantly, according to Kalapala. While public MEC allows mobile customers to access cloud computing at the edge of the cellular network, private MEC deploys the cloud at the customer location. Thus, private MEC customers don’t need to move their data off premises.

Kalapala pointed out two main use cases for private MEC.

In one case, a customer wants improved latency that will help them process video in real-time. For example, doctors don’t want to just record video from a colonoscopy. They want to examine the colon as they film it, using machine-learning inference.

In other cases, private MEC helps customers be more efficient with their data. Consider a security camera, which records around the clock. Kalapala said private MEC allows customers to bring the video into the AWS cloud to sort out the 99% of the data that is useless to them.

However, Kalapala said many more use cases will result from these services. He said Verizon is working to establish the “basic ingredients” for a low-latency network.

“Our belief is that these are the fundamental building blocks. It’s the broader customers base out there – the cloud developers – they are ones that are going to innovate,” he said.

State of 5G

Daryl Schoolar leads Omdia‘s fixed and mobile infrastructure practice. We asked him to weigh in on the state of the 5G market.

Omdia’s Daryl Schoolar

Schoolar noted that the three big wireless carriers differ significantly in their …… approach to 5G, particularly with concern to spectrum. T-Mobile, for example, uses low-band spectrum, which does not reach the speeds of AT&T and Verizon’s mmWave (high band) spectrum. However, T-Mobile’s low band ensures a wider reaching network that penetrates buildings better than mmWave. AT&T also offers a low-band 5G network.

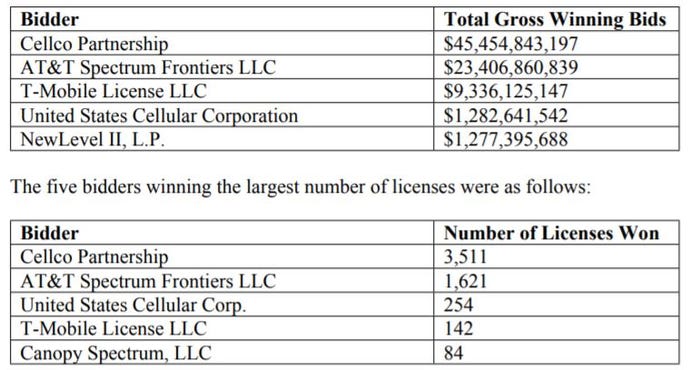

It remains to be seen how carriers will incorporate midband spectrum into their 5G networks. T-Mobile appears to have an upper hand due to its purchase of Sprint, which owned the most midband spectrum. The FCC recently announced the results of an auction, which dished out highly coveted mid-band spectrum. Verizon (going under the name “Cellco Partnership”) took home more of the 5,684 licenses than any other company.

Verizon Wireless (Cellco Partnership) garnered the most spectrum licenses in the FCC’s latest auction. (Source: FCC)

Schoolar said each carrier still needs to fill out gaps in their network to fully realize the benefits of 5G.

“You’re still a few years away from getting a really well built-out 5G network that can differentiate from 4G LTE,” Schoolar said.

Customer Impact

However, Schoolar noted that many 5G use cases already exists. He pointed to large manufacturing firms like Corning that have benefited, as well as maritime ports, large mining areas and hospitals. He agreed with vendors like AT&T, which have argued that 5G differs from 4G LTE in how it impacts business customers more than consumers.

Moreover, Schoolar said enterprise are feeling most of the early impact.

“A lot of what you’re seeing is geared toward not the small and midsize businesses but the enterprise ones, because a lot of these early services that I see are very bespoke, customized solutions,” Schoolar said. “That means the customer has to be spending a lot of money to justify it. It’s not really aimed at the insurance office in the strip mall or the dentist office or things of that nature.”

Consider the mobile operators that use mmWave spectrum. Schoolar said these 5G providers are unlikely to cover an entire city with a mmWave network. However, they may deploy multiple radios to cover a region of the city that contains multiple large customers. The carriers will prioritize their 5G investment around areas where customers have use cases that will justify the expenditures.

Nevertheless, the technology make work itself down-market to the smaller companies as ecosystems mature, Schoolar said. The carriers have recently rolled out business-focused 5G offerings. For example, T-Mobile last month announced multiple work-from-anywhere offerings that use 5G connections. In addition, AT&T announced new 5G-enabled fixed wireless routers that partners can sell.

Read more about:

AgentsAbout the Author

You May Also Like