Study: Average Enterprise Connectivity Budget to IncreaseStudy: Average Enterprise Connectivity Budget to Increase

But there's a caveat, especially if you sell public broadband.

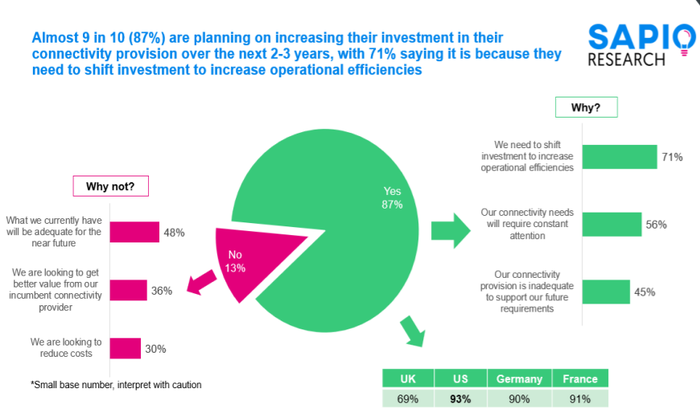

The lion’s share (87%) of enterprises are planning to increase their connectivity budget over the next two to three years.

That’s according to a recent Quortus study, which points to growing opportunities for VARs and other partners that can deliver private networks.

The private mobile networking provider commissioned a Sapio Research survey of 260 enterprises about their sentiments and plans regarding private networks. It found that customers are looking to spend more on their networks. Quortus estimates that the average enterprise already spends $400,000 per year on connectivity. The study showed that many enterprises are considering spending more. The biggest drivers revolve around business outcomes: a desire to increase operational efficiencies and support business requirements.

Source: Quortus, “Build, Don’t Buy: The Road to Private Networks”

Neil Dunham, Quortus’ vice president of sales, said the study highlighted the growing demands modern enterprise infrastructure must meet.

Quortus’ Neil Dunham

“Enterprises are looking at how they can continue to build those into their business,” Dunham told Channel Futures. “The network connectivity is the bottleneck in their business that inhibits them from building the operational benefits that digital transformation brings to them.”

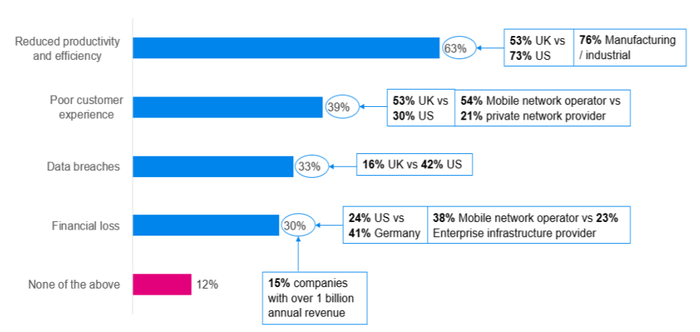

The study tapped into concerns enterprise users feel about macro public networks. For example, 63% of enterprises reported reduced productivity and efficiency. They also cited poor customer experiences and security concerns.

Source: Quortus, “Build, Don’t Buy: The Road to Private Networks”

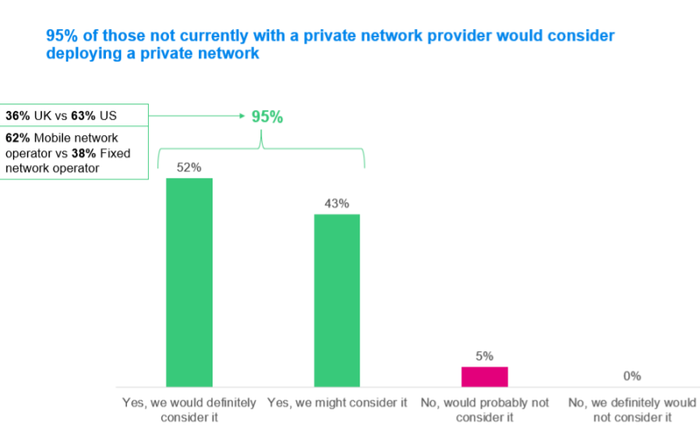

According to Dunham, public networks are holding back digital transformation. He said the study indicates an increasing level of willingness to deploy a private network. For example, 95% of respondents who were not working with a private network provider said they would consider it.

Source: Quortus, “Build, Don’t Buy: The Road to Private Networks”

The VAR Opportunity

One in three (33%) respondents would rather create their own network using a partner than to buy from a public operator. Dunham said the likely subjects would probably be VARs who specialize in networking, but he said other resellers who have earned the trust of their customers could also see opportunity.

Dunham said private networks represent a big opportunity for VARs. They are both a new revenue stream and a new way to engage with the C-suite.

“The people adopting private networks – looking to exploit these opportunities that private networks give – are looking to both grow that budget and move that budget from its more traditional spend into partners that can build this capability within their portfolio,” Dunham said.

While the findings spell opportunities for VARs, it’s difficult to say how the sales agents that represent the major service providers will feel.

“All of that connectivity and the budget that’s available for that connectivity is absolutely going to start moving away from the big network provider,” Dunham said.

Want to contact the author directly about this story? Have ideas for a follow-up article? Email James Anderson or connect with him on LinkedIn. |

About the Author

You May Also Like