AT&T, Comcast, Verizon Keep Lead in U.S. Carrier Managed SD-WANAT&T, Comcast, Verizon Keep Lead in U.S. Carrier Managed SD-WAN

An easing supply chain backlog propelled the U.S. carrier managed SD-WAN market in the first half of 2023.

Diminishing supply chain backlog helped propel the managed SD-WAN market in the first half of 2023.

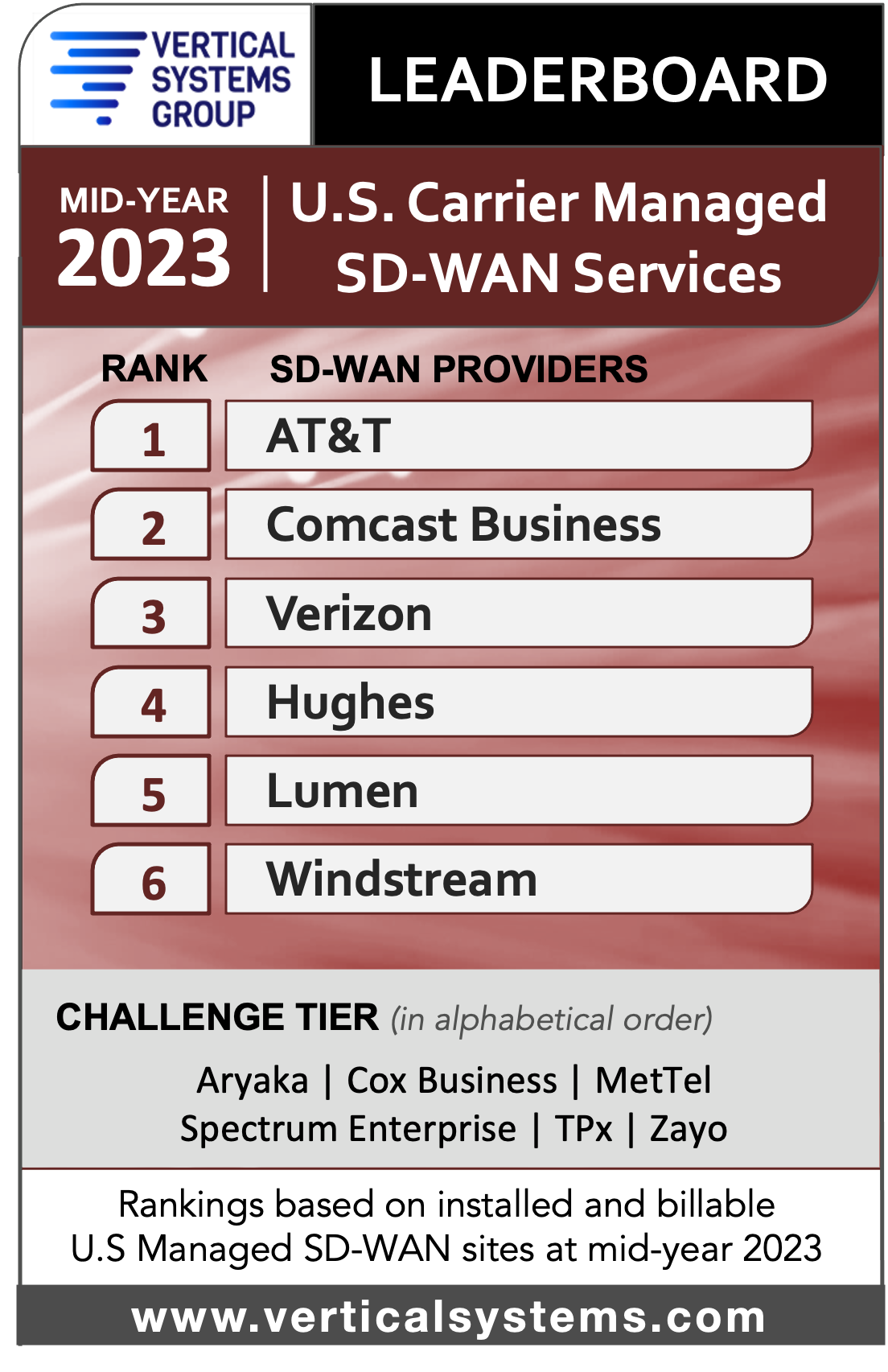

Vertical Systems Group just published its midyear leaderboard for U.S. carrier managed SD-WAN services, revealing no changes from the 2022 year-end leaderboard. AT&T leads the way in the top spot, as it has for more than five years. Comcast trails it, followed by Verizon, Hughes, Lumen and Windstream.

But the big change is that the leaderboard has moved from nine players down to six. VSG has shifted its ranking criteria, now requiring members of the leaderboard to hold at least 4% of installed U.S. sites. That bumps TPx, Zayo and Aryaka down to the challenge tier. Spectrum Enterprise, Cox Business and MetTel join them in the challenge tier.

Furthermore, Fusion Connect and Cogent dropped out of the challenge tier. T-Mobile, which sold the Sprint wireline business (and Sprint’s SD-WAN business) to Cogent for $1 in 2022, drops out by extension.

We recently compiled a list of 20 top SD-WAN providers offering products and services via channel partners. |

The full list of companies in VSG’s “market players” tier can be found on the research firm’s website. It includes Granite, Meriplex, Frontier and Momentum Telecom.

Managed SD-WAN Portfolios

Many of these carriers are offering a multivendor portfolio for SD-WAN. BCN, for example, recently added its fourth technology partner for SD-WAN. The flavors of these offerings and vendors vary, with some combining SD-WAN with advanced cybersecurity features (SSE) on a single platform to create SASE, and others leaving those two streams distinct.

“This broad range of options is making solution integration more complex, the sales process more demanding, and customer purchase decisions more protracted,” Vertical Systems Group wrote in its announcement.

In the meantime, visible improvements in the technology supply chain are bringing new vigor to SD-WAN market growth. While many of the carriers on this list aren’t actually manufacturing the equipment they use to manage the SD-WAN, they still must leverage hardware from somewhere.

Vertical Systems Group’s Rick Malone

“During the first half of 2023, supply chain improvements led to the fulfilling of a large backlog of SD-WAN orders,” Vertical Systems Group principal Rick Malone said. “As the number and size of customer networks grow, service providers are experiencing unanticipated challenges such as network complexity, vendor interoperability and customer education.”

Channel Futures covered VSG’s global carrier-managed SD-WAN rankings three months ago. AT&T came out on top, overtaking Orange Business.

Want to contact the author directly about this story? Have ideas for a follow-up article? Email James Anderson or connect with him on LinkedIn. |

About the Author

You May Also Like