AT&T, Spectrum, Verizon Chase CenturyLink on Ethernet LeaderboardAT&T, Spectrum, Verizon Chase CenturyLink on Ethernet Leaderboard

CenturyLink still reigns after an acquisition back in 2017.

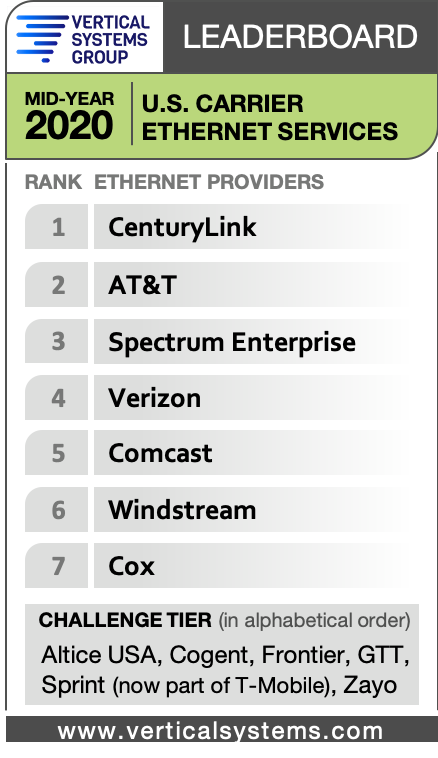

CenturyLink and AT&T retained the top two spots on Vertical Systems Group’s (VSG) mid-year 2020 U.S. Carrier Ethernet Services Leaderboard.

The rankings remain unchanged from the year-end 2019 leaderboard. Spectrum Enterprise is ranked third, followed by Verizon, Comcast, Windstream and Cox.

CenturyLink powered its way to the top spot in the year-end 2017 leaderboard after its acquisition of Level 3 Communications — and hasn’t looked back.

CenturyLink powered its way to the top spot in the year-end 2017 leaderboard after its acquisition of Level 3 Communications — and hasn’t looked back.

VSG calls this an industry benchmark for measuring Ethernet market presence. Network providers must have 4% or more of the U.S. Ethernet services market to crack the leaderboard.

COVID-19 Halts Growth

“Port growth for the U.S. Ethernet market came to a halt in the first half of 2020 as COVID-19 abruptly altered customer networking requirements and impeded new installations,” said Rick Malone, VSG’s principal. “Continued demand for Ethernet dedicated internet access (DIA) services supporting VPN, cloud and SD-WAN connectivity was substantively offset by declines for local Ethernet private line and metro LAN services.”

VSG expects a slow rebound through the end of the year and into 2021.

Cable MSOs saw the most port growth in the first half of 2020. That’s based on demand for high-speed Ethernet DIA services. Companies in this segment on the leaderboard are Spectrum Enterprise, Comcast and Cox.

Total bandwidth for all U.S. Ethernet services should increase by more than 20% in 2020. The most common speed is 100 Mbps based on customer installations. 10+ Gbps and 1 Gbps are the fastest growing.

CenturyLink is the only company on the leaderboard that has attained MEF 3.0 CE (carrier Ethernet) certification. And Spectrum Enterprise employs the highest number of MEF carrier Ethernet certified professionals across all leaderboard companies.

Challengers

Altice USA, Cogent, Frontier Communications, GTT, Sprint (now part of T-Mobile) and Zayo ranked in the Challenge tier, which includes providers with between 1% and 4% share of the U.S. retail Ethernet market.

The Market Player tier includes all providers with port share below 1%. It features channel players like AireSpring, Crown Castle, Fusion Connect, Masergy, MetTel, Momentum Telecom, NTT and others.

Ethernet is the WAN underlay of choice for carrier-managed SD-WAN solutions requiring secure, dedicated high-speed connectivity. Active fiber buildouts across the United States are enabling Ethernet expansions to serve a broader base of midmarket customers.

Read more about:

AgentsAbout the Author

You May Also Like