Cato WAN Study: Telcos Failing to Meet Customers' Agility, Service, Pricing NeedsCato WAN Study: Telcos Failing to Meet Customers' Agility, Service, Pricing Needs

The study gives an edge to cloud service providers, of which Cato is one.

Customers aren’t happy with their telcos’ wide area networking (WAN) services, but the new wave of SD-WAN companies has room to grow as well, according to the latest study.

SD-WAN provider Cato Networks‘ “Telcos and the Future of the WAN in 2019,” is chock full of results that don’t look good for the big telecommunications providers. We learned in last year’s study that the legacy telecommunications providers own a significant portion of the market, but enterprises rely on them only “grudgingly,” according to Cato.

More than 1,600 respondents fielded survey questions in December and January. Cato focused on 432 IT professionals who buy services from telcos and work with some degree of MPLS in their networks. One of their chief gripes was a lack of customer service.

“They are big and are everywhere, but have the attitude that goes with it,” said an unnamed IT professional working for a health care and pharmaceutical company with more than 250 locations. “They think that they are big and nobody has a choice, so they do business as they please.”

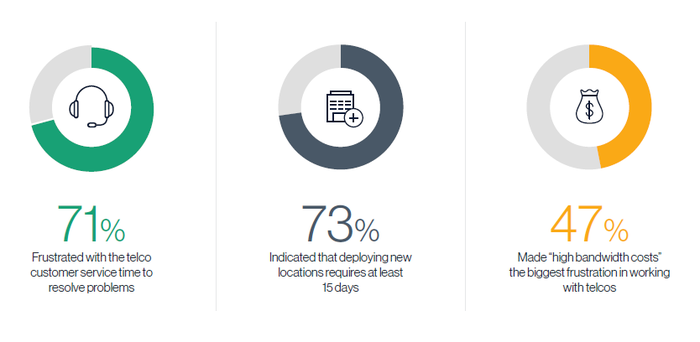

Time to deployment is a problem, as 73% of respondents reported a 15-day or longer waiting period for new locations (a problem AT&T is working to address with its SD-WAN Now service). Another 47% lambasted telcos for high bandwidth costs. The IT professionals collectively graded their telcos at 54 of 100 for fairness of network service pricing.

Courtesy: Cato Networks “Telcos and the Future of the WAN in 2019”

Forty-four percent of respondents either deployed SD-WAN in the previous year or considered it. A 2017 Cato survey found that only one in 10 had already deployed an SD-WAN.

Cato’s Dave Greenfield

But there’s a problem — 85% of respondents said SD-WAN will poorly address or ignore business use cases in 2019.

“When SD-WAN first came out, we were told that it was going to be really easy,” said Dave Greenfield, Cato secure networking evangelist. “That was kind of the selling point of SD-WAN. You have zero-touch configuring; the WAN configures itself and voila, it’s done. As the industry’s matured, one of the things we’ve realized is, an SD-WAN deployment requires a number of moving parts. It’s not just the SD-WAN.”

What impact will #DigitalTransformation have on your network? Read the results of our survey of 1600+ IT professionals ?https://t.co/CBgI6ienvF pic.twitter.com/FmqS653JLd

— Cato Networks (@CatoNetworks) May 28, 2019

Greenfield told Channel Partners that new obstacles SD-WAN must hurdle include incorporating the cloud, covering an increasingly mobile workforce and securing branch internet access. Agility is an overarching need.

“Those contributors have been with us for many years, but as companies start look at going toward a digital transformation initiative and they need to support their initiatives, they need to be more agile,” Greenfield said. “As businesses become more agile, the network needs to become more agile. All these problems that we’ve had … now come to the fore.”

The majority of companies – 56% – said they prefer a co-managed solution. That’s a 7-point increase from last year’s survey, in which 49% wanted co-managed. While 33% of companies preferred a self-managed WAN last year, only 19% said …

… the same in 2019.

Courtesy: Cato Networks “Telcos and the Future of the WAN in 2019”

“I think enterprises are looking for a solution that is easy to deliver, agile and cost-effective — all of those things that we want in a service but haven’t been able to get from a telco,” Greenfield said.

Cato’s study puts forward cloud service providers as the logical alternative to telcos. Cloud application providers and cloud data center providers earned overall customer scores of 3.71 and 3.70, respectively, from respondents. Global telcos scored 3.24.

It’s worth noting that Cato describes itself as a cloud-native, managed SD-WAN provider.

Greenfield said cloud providers provide the aforementioned agility that’s lacking. The reliance on cloud data software as opposed to appliances allows for a quicker introduction of new features and more flexible network growth.

Cato found that, for 70% of respondents, ransomware/malware is a chief concern. The next two problems are enforcing mobile security policies (49%) and the cost of buying new security tools (45%).

Read more about:

AgentsAbout the Author

You May Also Like