Masergy SD-WAN Study: Rapid Adoption a 'Double-Edged Sword'Masergy SD-WAN Study: Rapid Adoption a 'Double-Edged Sword'

The branch has fundamentally changed, and that could be a problem.

Cybersecurity shapes software-defined wide area networking (SD-WAN) adoption more than any other factor, according to a new study.

Masergy and IDG released their joint 2019 SD-WAN Market Trends Report on Tuesday, which shows customer opinions shifting from a similar study from 2017. While 35% of respondents said then that they had adopted SD-WAN, 54% said yes in 2019.

Courtesy Masergy and IDG

Ray Watson, Masergy’s vice president of innovation, said customers are migrating to SD-WAN at about twice the speed at which they moved to MPLS. But the rapid rate of change comes with its unique challenges. It’s a “double-edged sword,” according to Watson. Customers are confused by the the sheer number of vendors that call themselves SD-WAN providers.

Masergy’s Ray Watson

“In many cases that is one of the things that we have to be able to talk though: understanding the benefits of the technology versus one particular vendor’s implementation of it,” Watson said. “We didn’t really have that with MPLS; with MPLS you could choose any vendor anywhere, and it would work.”

Customers are seeing different SD-WAN benefits than they were seeing two years ago. Forty-five percent of respondents called security a potential business benefit in 2017; the number ticked up to 60% in 2019.

But security is a need just as much as it’s a benefit. The biggest WAN challenge is securing the branch office, according to one-half of respondents. Cloud migration is SD-WAN’s biggest driver, according to Watson, but it’s also opening up a Pandora’s box of security issues.

“There are great security concerns around the migration of data to the cloud, because we’ve definitely seen more than one instance where somebody left an S3 bucket open or was leaking PII without intending to. So the biggest concerns that we hear about from security ultimately revolve around ransomware-type attacks and around the migration of their data to the cloud,” Watson said.

Courtesy Masergy and IDG

We’ve been writing more about the branch than ever before. Fortinet and CloudGenix recently launched new products that will bring more flexibility and security to remote offices.

Watson told Channel Partners that although the typical corporate headquarters requires more resiliency and redundancy than other offices, “it’s not the hub to a network by any stretch of the imagination.”

“If you think in terms of what a traditional WAN looked like five years ago, all of the critical apps were sitting in the customer’s data center, which might be a colo, but it might also be a freestanding data center that sits on the campus of their corporate headquarters,” he said. “But now all of that has been moved to Salesforce and Concur and Amazon, and you name it on the public side. The branches want direct connectivity to those services without going to the corporate firewall that’s all the way back to the headquarters, right? So we are seeing networks where the corporate headquarters has now become a branch itself. It’s a super-branch.”

Analysts have time and time again dispelled the assumption that SD-WAN will decrease overall costs, but the new study indicates that customers still see an opportunity to reduce spending. In fact, the number jumped from 36% in 2017 to 50% in 2019.

Watson said businesses – especially small ones – migrating away from MPLS often hope to …

… recoup money by moving to the internet. But the larger companies are seeing the true benefit, according to Watson. These companies are looking for higher resiliency, uptime and “active-active” connections.

“Rather than using one as active and one as passive or one of those as failover … using the bandwidth that you have on both types of connections, whether that’s MPLS, 5G, fixed wireless or whatever it is, plus a dedicated internet access connection, is extremely vital,” Watson said. “In the real world we don’t see customers – or even projects – that are necessarily trying to drive costs out of the WAN equation by using this technology as a cost-savings measure, as much as it is about being able to bring in more bandwidth, more diversity, more flexibility and more direct connectivity to the cloud providers.”

Courtesy Masergy and IDG

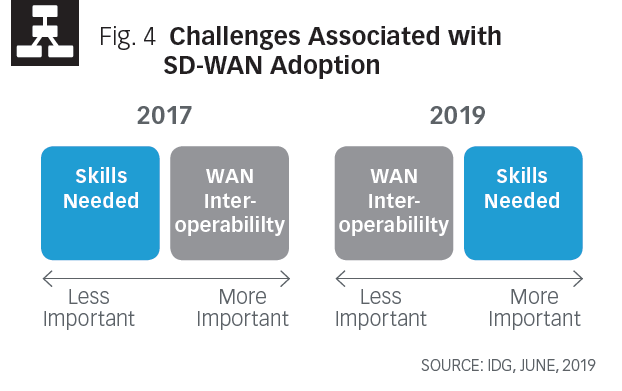

Watson said he’s happy to see that respondents feel less concerned about WAN interoperability than they did in 2017; however, the same people are more concerned than ever about the skills they have in place to implement and manage SD-WAN.

Cato Networks concluded in its May “Telcos and the Future of the WAN in 2019” study that SD-WAN will fail to solve 85% of customer use cases — particularly those who purchase from large telcos. Cato’s secure networking evangelist told us businesses need more agility in their SD-WAN platforms to support their initiatives.

Masergy and Cato both offer an SD-WAN solution.

Read more about:

AgentsAbout the Author

You May Also Like