SD-WAN Roundup: VMware, Silver Peak Lead Latest Gartner Rankings as CloudGenix, Fortinet RiseSD-WAN Roundup: VMware, Silver Peak Lead Latest Gartner Rankings as CloudGenix, Fortinet Rise

North American companies prefer do-it-yourself SD-WAN, according to Gartner, but that trend is shifting.

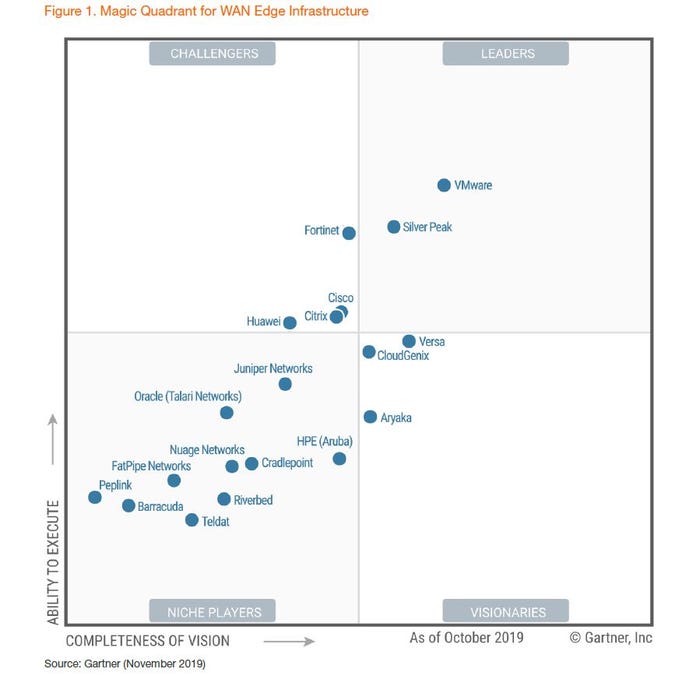

Gartner honored VMware and 18 other vendors in its latest WAN Edge Infrastructure Magic Quadrant.

The research firm lists VMware and Silver Peak as the two companies in its “Leaders” category. VMware leads the pack, as it has in several other studies that cover the software-defined wide area networking (SD-WAN) market.

VeloCloud’s Sanjay Uppal

“VMware SD-WAN by VeloCloud was one of the first products to enter this industry, and now we believe we are leading the industry into the multicloud phase by enabling the network of cloud services, with our advanced SASE [Secure Access Services Edge] solution and hyperscale SD-WAN architecture,” said Sanjay Uppal, vice president and general manager, VeloCloud Business Unit, VMware.

Shining bright! @Gartner_inc names @VMware a Leader in its 2019 Magic Quadrant for WAN Edge Infrastructure. Read the report today to discover why @VMware is placed furthest in “Completeness of Vision” and “Ability to Execute.” https://t.co/nuh0TQHWkn #GartnerMQ #SDWAN pic.twitter.com/81SIVkjKD1

— VeloCloud, now part of VMware (@VeloCloud) December 5, 2019

Silver Peak, which claims 1,500 enterprise SD-WAN customers, stands alone with VMware in the Leaders quadrant. Silver Peak CEO David Hughes said the market has evolved beyond the cost-saving conversation that previously held sway over customers.

Silver Peak’s David Hughes

“Customers are more educated. A growing number of enterprises have completed pilots or trials and have become more discerning about how they move forward,” Hughes said. “There is broad recognition that SD-WAN, while foundational, is only a piece of what is required to build a modern WAN. Enterprises are realizing that the differences across various vendors’ approaches are much greater than what they initially thought.”

Source: Gartner WAN Edge Infrastructure Magic Quadrant

A noticeable change from last year’s Magic Quadrant is Cisco, which slid from the Leaders category to the Challengers category. Gartner reported “stability and scaling issues” from Cisco customers and channel partners. Cisco nevertheless remains in striking distance and has led in other market share studies thanks to its wide range of capabilities.

Fortinet continued its rise up the charts to lead the Challenger category. Gartner recently listed Fortinet as a top three vendor for SD-WAN equipment revenue market share.

New to the list this year is HPE-owned Aruba, which rolled out SD-WAN capabilities last year.

The 40-page Gartner report revealed interesting data for the SD-WAN market. Adoption is on the rise, as Gartner anticipates 60% of enterprises to deploy SD-WAN, compared to 20% today. The study also projects internet WAN connectivity to jump from 10% of enterprise locations to 30% in 2023.

Gartner also touched on the fact that companies are weighing the option of SD-WAN as a managed service. The report said the North American market is more than 60% comprised of do-it-yourself (DIY) deployments. But that approach contrasts with that of other countries.

“In general, we see a trend toward more managed services, even though SD-WAN makes managing the WAN easier. At the

same time, this introduces new challenges, with the greater use of internet transport,” report authors Jonathan Forest, Mike Toussaint and Neil Rickard wrote. “Large global organizations usually prefer a DIY approach, whereas midsize organizations are more likely to favor a managed services approach.”

Aryaka, which landed in the “Visionary” quadrant, said it is the only managed services vendor …

… listed on the leaderboard.

“It’s exciting to see that Gartner agrees with our cloud-first as-a-service approach to networking and it is also a testament to our customers who embarked on this journey with us some 10 years ago. Allowing our customers to focus on business intent rather than on painstakingly planning, operating and constantly troubleshooting their do-it-yourself infrastructures has been our vision since the company’s inception.”

Read our 2018 recap of Gartner’s first WAN Edge Magic Quadrant.

CloudGenix

The San Jose, California-based vendor rose in the Visionary Quadrant this year. CEO Kumar Ramachandran pointed to a few reasons why the company has met the “meaty” requirements that Fortune 1000 enterprises bring to the table.

CloudGenix’s Kumar Ramachandran

Ramachandran said the company has developed its architecture to provide a “true, autonomous networking” experience. A recent innovation is its CloudBlades platform, which allows customers to use the cloud clean up hardware sprawl at their branch locations and remain flexible with vendor selection.

“[Previously] if you wanted best-of-breed, it was a nightmare,” Ramachandran said.

He said CloudGenix has benefited from its channel relationships, which include VARs, system integrators and several master agents. One factor for channel success, he said, is the ability to offer carrier-neutral managed service options.

Quick Hits:

Juniper Networks this week expanded its SD-WAN solution to include SD-LAN. Read our story at Channel Futures.

Multiple vendors, including Silver Peak and Citrix now offer support for the AWS Transit Gateway network manager. SDxCentral has the story.

If you’re looking for a headline, check out SDxCentral’s recap of Aviatrix CEO Steve Mullaney’s comments. Mullaney projected the SD-WAN to lose traction as AWS announces more offerings like its Transit Gateway that make branch connectivity easier: “That [SD-WAN] market is on the decline because more and more the center of gravity goes into the cloud.”

Read more about:

AgentsAbout the Author

You May Also Like