SD-WAN, UCaaS Lead the Way in Latest Avant Partner, IT StudiesSD-WAN, UCaaS Lead the Way in Latest Avant Partner, IT Studies

Reports of MPLS' death may be greatly exaggerated.

CHANNEL PARTNERS CONFERENCE & EXPO — Avant Communications (a Premier Sponsor) is shedding some light on industry trends with a pair of new surveys.

The Chicago-based master agent on Tuesday unveiled results from its inaugural State of Disruption survey – which polled 300 U.S.-based enterprise decision makers – and annual Cloud Channel survey, which queried almost 200 “channel sellers.”

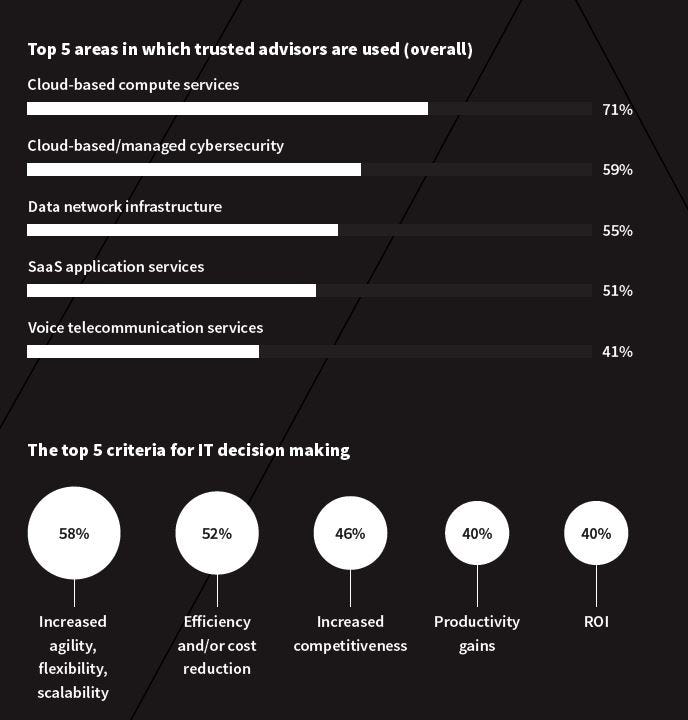

In the first of the two surveys, 82% of respondents said they work with a “trusted adviser” — a phrase Avant has popularized to describe companies that sell to, but more importantly, guide customers through business problems that technology can solve. But these third-party experts play different roles depending on the industry.

“Manufacturers, financial services providers and retailers, for instance, are more likely to use trusted advisers for managed security services, whereas healthcare/medical organizations prioritize trusted advisers for data network infrastructure and SaaS application services,” Avant wrote in its report.

The study indicates that companies are embracing new technology with the intention of altering the very structure of the business. At least that is to say that cost savings were not the biggest driver. Respondents most frequently cited having agility, scalability and flexibility as their motivations.

Caption: Avant State of Disruption Survey

“We see the pace of change in IT accelerating with enterprises literally struggling to evolve or die. Trusted advisers are uniquely equipped to help them navigate the rapid rate of technological change,” said Drew Lydecker, president and co-founder, Avant. “We’re pleased to release the State of Disruption report as a pulse for forward-thinking IT teams and the experts who enable their decision-making. From networking infrastructure to cybersecurity to breakthrough technologies likes SD-WAN, we are seeing disruption across the board as organizations in all industries are advancing digital transformation.”

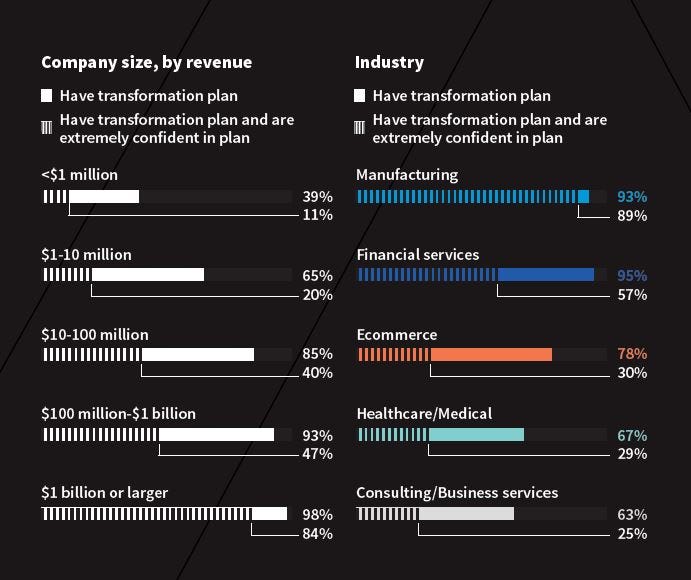

There remains a strong opportunity with small businesses. Only 39 percent of businesses making $1 million or less in revenue had a transformation plan, and 11 percent felt extremely confident about their transformation plan. Companies of $1 to 10 million also present an opportunity with only 20 percent feeling confident, but the survey indicates a clear jump in preparedness in larger companies. Manufacturing appears to be a highly penetrated market in terms making sweeping technological changes, trailed closely by financial services.

Source: Avant State of Disruption Survey

Health care scored significantly lower. Experts have noted that although the industry presents a juicy opportunity, plenty of regulations make its decision-makers afraid of working with a third-party technology provider. That being said, NetServe Systems’ Abdi Ahmed did tell us in 2017 that medical professionals’ attitudes toward tech had shifted dramatically to positive.

“Four years ago, if I had suggested to a doctor that he or she needs to put [his or her] data in the cloud, they would look at me as if I’m from another planet,” said Ahmed, who is Netserve’s president/CTO of NetServe Systems. “Today, if I don’t talk to them about the cloud, they think something is wrong with me and my presentation. The rate at which cloud services are being adopted in the health-care industry is just amazing.

Also from the State of Disruption survey, Avant noted that although some analysts have described MPLS as on track to fade away, reports of its death are greatly exaggerated. The survey found that 83% of companies …

…that are familiar with MPLS plan to increase its infrastructure in 2019. E-commerce and financial services indicated the biggest interest in expanding MPLS at 52% and 51%, respectively. But only 6% of health care IT professionals felt the same.

“While most technology leaders are planning to use SD-WAN in their corporate networks by the end of 2019, the use of MPLS is far from over, with the vast majority of current MPLS users planning to increase their MPLS infrastructure this year,” the report authors wrote.

Meantime, public internet broadband connections supported 63% of SD-WAN networks last year.

The second survey, the annual Cloud Channel survey, found that partners are diversifying their portfolios. The average service offering will expand from four to six in 2020, according to the study.

It found that UCaaS (67%), SD-WAN (61%), security as a service (45%) and data networks (39%) are the most common services it anticipates channel partners will sell over the next two years. Data networks accounted for the most sales transactions over the last year, matching a similar trend from last year’s study.

Read more about:

AgentsAbout the Author

You May Also Like