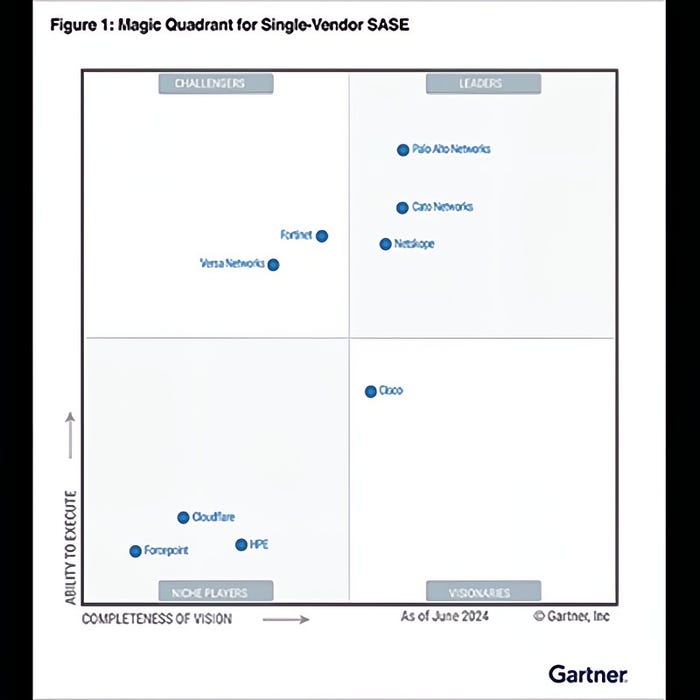

Palo Alto Networks, Cato Networks, Netskope Lead Gartner SASE Magic QuadrantPalo Alto Networks, Cato Networks, Netskope Lead Gartner SASE Magic Quadrant

Gartner expects more vendors to enter the market in the next year.

Palo Alto Networks, Cato Networks and Netskope are leaders in Gartner’s "Magic Quadrant" for single-vendor secure access service edge (SASE).

For its Magic Quadrant, Gartner defines single-vendor SASE offerings as those that deliver multiple converged-network and security-as-a-service capabilities, such as SD-WAN, secure web gateway (SWG), cloud access security broker (CASB), network firewalling and zero trust network access (ZTNA). These offerings use a cloud-centric architecture and are delivered by one vendor.

SASE supports branch office, remote worker and on-premises general internet security, private application access and cloud service consumption use cases.

“The market for well-architected single-vendor SASE offerings is dynamic and maturing, and SASE interest among our clients has been growing rapidly,” Gartner said. “Client interest in single-vendor SASE has more than doubled year over year. We estimate there are over 10,000 organizations using a vendor’s primary single-vendor SASE offering."

2024 Gartner Single-Vendor SASE Magic Quadrant

The report says, however, that many customers aren't yet using all of the core features that vendors support in their SASE offers.

"For example," Gartner researchers said, "it is common to see enterprises using SD-WAN, firewall and SWG from a SASE vendor, but not CASB or ZTNA. Multiple vendors now have a single-vendor SASE offering (nine qualify for this research), but few offer the required breadth and depth of functionality with integration across all components, a single management plane, and unified data model and data lake.”

Magic Quadrant Leaders

Among Palo Alto Networks’ strengths, Gartner said the vendor has a “proven track record” in this market, and a large number of customers. In addition, its finances are strong and customers nkow the Palo Alto brand, which should help it grow in the market.

However, Gartner said Palo Alto Networks’ offering is expensive compared to that of most of the other vendors in its research. In addition, it has limited support for non-English user interfaces, documentation and technical support.

Among Cato Networks’ strengths, Gartner said the vendor was an early pioneer that helped drive the market, and its upcoming innovations are likely to continue to shape the market. In addition, Cato delivers an above-average customer experience compared to other vendors in the Magic Quadrant.

In terms of negatives, Gartner clients report “frustration” with Cato Networks' pricing model, as sales proposals can be high and/or difficult to understand. Costs are related to site bandwidth, which can lead to large increases when customers need bandwidth upgrades. In addition, its geographic strategy lags competitors, due to limited localization of documentation and technical support.

“Cato’s true SASE platform is the antidote to IT complexity that persists in the face of ongoing so-called ‘platformization’ efforts,” said Shlomo Kramer, Cato Networks’ CEO and co-founder. “Cato pioneered the SASE market and is shaping its future with best-in-class customer experience and a train of innovations that deliver on SASE’s promise.”

Cato Networks' Shlomo Kramer

Among Netskope’s strengths, Gartner said the vendor has a strong geographic strategy compared to other vendors based on its coverage, localization and regional certifications. In addition, it has strong “feature breadth and depth” for both networking and security.

But Netskope, Gartner points out, was late to enter the market with a generally available (GA) product, and thus lacks experience compared to some other vendors assessed. In addition, there is limited financial information available about the vendor, which creates uncertainty over its long-term viability.

"Netskope was built on the idea that a converged approach to security and networking is necessary to address rapid shifts in how teams work, where data resides, and how businesses keep technology secure and optimized," said Sanjay Beri, Netskope’s CEO and co-founder. "Today, Netskope delivers a complete range of SASE capabilities tailored for various customer sizes and technology environments, ranging from midmarket businesses to large enterprises requiring the advanced SASE capabilities other single-vendor SASE vendors simply can't provide."

Netskope's Sanjay Beri

Challengers, Niche Players

Gartner listed Fortinet and Versa Networks as "challengers" in the Magic Quadrant, while Cisco is a "visionary." In addition, Gartner considers Cloudflare, Forcepoint and HPE to be niche players.

In the next six to 18 months, Gartner expects the following changes in the single-vendor SASE market:

More vendors will enter the market over the next 12 months.

Generative AI assistants that are integrated natively into a SASE management console will become a mandatory requirement from buyers.

Clients will see notably higher pricing of 25-250% more from vendors that rely exclusively on hyperscaler infrastructure to deliver services, and in different regions.

SASE vendors will expand to adjacent markets.

Sensitive data discovery and control will become as important as threat intelligence as buyers evaluate offerings.

Rather than a one-size-fits-all approach, support for unmanaged devices will expand into a spectrum of options including reverse proxies, dissolvable agents, browser plug-ins, remote browser isolation and local browser isolation (either through separate secure enterprise browser or tighter integration with browser security capabilities exposed by Google and Microsoft).

About the Author

You May Also Like