Image Gallery: Intel Security Americas Partner SummitImage Gallery: Intel Security Americas Partner Summit

Intel Security this week held its Americas Partner Summit at the Boca Raton Resort & Club. The theme: Ascend 2016.

May 12, 2016

Already have an account?

Image Gallery: Intel Security Americas Partner Summit

Intel Security this week held its Americas Partner Summit at the Boca Raton (Florida) Resort & Club. The theme: Ascend 2016.

The partner summit comes seven months after Intel Security revamped its corporate strategy around an open-platform approach with a focus on endpoints and cloud and a philosophy of “protect, detect, correct.” The company’s global partner program is open to resellers and managed service providers as well as technology partners.

The strategic revamp involved discontinuing some products, including McAfee endpoint and email security and archiving solutions. However, executives told the close to 200 invited partners in attendance that savings have been reinvested in R&D and internal improvements to better support their efforts.

Strategically, Intel Security is focused on forging partnerships, not buying companies and then integrating acquired products. The cornerstone of the technology partner strategy is the Intel Security Innovation Alliance, or SIA, program, which has been signing up supplier partners at a good pace. Earlier this month, Israeli cybersecurity automation vendor Ayehu Software Technologies joined Brocade, MobileIron, Aruba, CounterTack and many others. Integration of disparate solutions is via the McAfee Data Exchange Layer, or DXL, which connects security technologies from multiple vendors through an open platform. CTO Steve Grobman told attendees that this approach offers the flexibility of a best-of-breed collection of security products with deep integration for bidirectional threat information sharing.

The sweet spot for Intel Security is the Global 2000, scaling up to some Fortune 50 wins and down to midsize companies that recognize the need for a unified security strategy.

“We’re not going after five guys in a deli,” said Grobman. What it does want are MSSPs that will base their services on the platform. Intel Security also isn’t advocating rip and replace, though execs say customers are paying for lots of products that aren’t working well, and that there is room to grow: The company now serves 62 percent of that Global 2000, averaging 18 percent share of wallet for existing customers.

Click through our image gallery for highlights from the event, including a channel-program update, awards news and some security stats to rally around.

Follow editor in chief Lorna Garey on Twitter.

Intel Security Americas Partner Summit: Opening Reception

The historic Boca Raton property, now a Waldorf Astoria, is celebrating its 90th anniversary, and the 200 invited partners in attendance kicked off the summit at the garden pool while admiring a vintage Olds on display.

Intel Security Americas Partner Summit: Ken McCray

Kenneth McCray, recently promoted head of Intel Security’s Americas channel sales & operations, asked attendees, “Who is your challenger customer — the person who can stop the transaction?” McCray’s reference was to the research-based book, “The Challenger Customer: Selling to the Hidden Influencer Who Can Multiply Your Results,” which says there are now more than five decision-makers involved in a major technology purchase — 5.4 to be precise.

Helping top channel partners anticipate and counter customer questions around the company’s platform and SIA approach was a running theme, and a big part of the reason Intel Security recently separated the partner summit from its larger FOCUS event. McCray explained the move as offering an opportunity for partners to engage one-on-one with executives and sales and marketing reps.

Intel Security Americas Partner Summit: Bill McAlister

Bill McAlister, VP, Americas sales, focused on the state of the Americas business, and the news was positive. Intel Security announced an all-time record quarter in Q1 2016 across all regions and units; Web, server and data-protection sales were up around 30 percent each, while sales of advanced threat-detection technology jumped more than 200 percent.

Few partners enjoy explaining why products are sunsetted, and McAlister acknowledged the pain of Intel Security’s recent portfolio rationalization while stressing that the freed-up capital is going toward innovation as well as investments in go-to-market strategies for financial services and health-care verticals. The company recently appointed CTOs dedicated to both markets, which are seeing double-digit growth.

McAlister discussed a new value-management office to build ROI and TCO calculators, with outside consultants validating the models for customers.

“I saw a $20,000 deal turn into $7 million,” he said, based on showing customers hard numbers.

Intel Security is also investing in a facelift of its Santa Clara executive briefing center and a series of innovation road shows to help partners close deals.

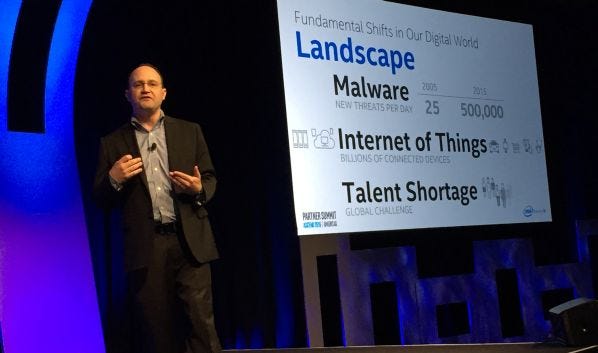

Intel Security Americas Partner Summit: Steve Grobman

Intel fellow and CTO Steve Grobman opened with some sobering statistics: 500,000 new malware samples are detected every day, up from just 25 daily in 2005.

Advanced attacks are getting more devious. Grobman cited integrity exploits, where an attacker gets in and changes systems to, for example, redirect payments to a fraudulent account. The IoT means devices never intended to be connected to the Internet are now vulnerable. One Fortune 50 manufacturing customer said a breach holding a major factory for ransom could be a “company ender.”

That level of responsibility is incredible for partners, and we can’t throw bodies at the problem. “They don’t exist,” said Grobman, citing 200,000 unfilled cybersecurity jobs and no silver-bullet technology solution.

The answer, he told partners, is a platform that can deal with massive amounts of data using automation and pull in new security technologies quickly and efficiently to maximize the window between introduction and compromise. While acknowledging the complexity of the platform architecture, Grobman insists that there is no way that any collection of point technologies can protect customers. And he says the numbers – Q1 revenue of $537 million, up 12 percent year-over-year, and operating income of $85 million, up 467 percent in the same span – say partners should bet on Intel’s integrated approach.

”Hope is not a plan,” he said.

Intel Security Americas Partner Summit: Raja Patel

VP/GM corporate products Raja Patel took the stage to talk road map. One area of focus is user experience — given the lack of in-house expertise, ease of use is critical. Patel says tasks can be accomplished with 70 percent fewer clicks in the updated, integrated management platform.

“Customers want to automate their response to commodity attacks,” said Patel. “A lot of spend is coming back into data protection.”

On that road map:

Endpoint 10.2: Dynamic application containment to limit the actions and monitor the behavior of apps.

DLP 10.0 Web SaaS: Unification of policies is the current focus, but full cloud delivery is on the horizon. Intel Security will launch a SaaS solution at full scale this year.

MOVE 4.0: Better auto discovery and end-to-end visibility and faster resolution.

MAR 2.0: Automated trace analysis and custom response.

Intel Security Americas Partner Summit: Allison Cerra

Telecom veteran and award-winning VP of marketing Allison Cerra closed the Day 1 keynotes by warning partners that there’s always someone behind you who “wants to change the view.”

Selling is getting tougher, too: Fifty-seven percent of customers have already decided on a strategy, 67 percent of the buying journey is done digitally before the trusted adviser even walks in the door, 5.4 people are involved in a B2B buying decision and we face an estimated global shortage of 1.5 million cybersecurity experts in the next five years, so partners can’t depend on a CISO champion.

“We are a DIY culture, where customers frame their own decisions,” said Cerra. Enter the buyer’s journey two-thirds down the road, and partners are competing on price.

To combat that, teach customers something they don’t already know. Take advantage of research (the company’s insights on the state of cloud security spending are here). And don’t be afraid to challenge customers on pre-formed ideas.

Cerra says Intel Security is working with more than 100 vendors across the integrated ecosystem, a huge selling point for best-of-breed fans. It’s prepping ready-to-launch campaigns and has pre-vetted agencies that partners can use their MDF with.

“We have to be playing the long game,” she said of marketing teams. “We have to be thinking of who is trying to change your view.”

Intel Security Americas Partner Summit: Awards

Bahamas Junkanoo Revue kicked off the Intel Security Ascend 2016 partner awards banquet in style. See a complete list of winners here.

Intel Security Americas Partner Summit: Richard Steranka

Richard Steranka, head of Intel Security’s global channel operations, provided the audience with a frank look at the state of the company’s channel program. The good news: Q1 16 bookings have grown 14 percent, led by the enterprise, with 90-plus percent of business through the channel.

“Enterprise is absolutely on fire,” said Steranka, while reiterating the company’s commitment to commercial land verticals.

Still, while an 80 percent renewal rate is respectable, Steranka says partners left business on the table last year: Seventy percent of customers have only one Intel Security product in production, and just 4 percent of partners’ business is coming from new customers.

In a one-on-one interview (watch for the full discussion soon), Steranka told Channel Partners that he’s made progress simplifying Intel Security’s partner program by, for example, offering free training and certification testing online. Partners can get employees up to speed on their own schedule and avoid duplication of training.

“There’s an honor system in place here,” he says. In a survey, partners gave the program high marks for sales and tech certs and ease of doing business.

“Simplicity is money,” said Steranka.

The company fared less well, however, on profitability and CAM support; he promised to address both, acknowledging “we’ve caused pain” and pledging new clarity and transparency. He encouraged partners to escalate problems. “Don’t be afraid of repercussions,” he said.

As to profitability, Steranka cited accelerated deal registration and clarity on rebates, which are available only to platinum partners, and a commitment to protecting margins even when competing on price. He also thanked distributors (Ingram Micro and Tech Data were event sponsors) and hinted at some creative disti programs to come.

Steranka’s 2016 channel priorities: strategic engagement, including rules around sales and partner alignment; mutual growth and profitability through more solution selling; and enabling better customer outcomes.

“If we don’t do this last one, the other two are moot,” he said.

As to the solutions angle, that ties in to a focus on helping reseller partners move to a managed-services specialization, which is most the profitable model. Over 700 partners are acting as Intel Security MSSPs today and earning significant MRR. Three keys to success there: Scale cost effectively, respond faster and more accurately to customer problems, and develop cutting-edge services and then align sales in the field.

“The changes we make in our channel programs have only one objective: Address the challenges our customers are facing,” said Steranka.

Intel Security Americas Partner Summit: Panel

A panel of global partners joined Steranka and McCray on stage. From left to right: Steranka; Steve Struthers, Dyntek VP of security, West & federal; Kevin Dawson, president of Canadian partner ISA; Miguel Perez, founder and CEO of Chilean provider NovaRed; and McCray.

Struthers says security is approaching 50 percent of Dyntek’s business, with program and compromise assessments, health checks and remediation most in demand. More challenging? Renewals.

“Customers were taking a long time to mature products they had purchased,” Struthers said. “Come renewal time, many hadn’t even enabled all the features they were paying for. The MSSP model lessens that issue.”

Securing cloud is another hot area: “Email moved out much faster than we thought,” he said, mainly to Office 365.

Dawson and Perez agreed that trying to spin extra professional-services capacity into an MSSP practice is challenging at best. “It’s different DNA,” said Perez.

“They are absolutely different teams,” said Dawson, who is selling a lot of security awareness training to help combat ransomware.

The panelists also cite tension between buying the next hot security tech versus using what customers have in a mature way. Heads nod throughout the audience – seems some things are universal.

Other areas of agreement: The skills shortage is real and needs to be addressed with education and cross-training, and the approach of a security platform supplemented with select point products is the future – one that Intel Security is not alone in pursuing.

Intel Security Americas Partner Summit: Security Services Stats

The security services business is growing fast.

Intel Security Americas Partner Summit: Brett Kelsey

Brett Kelsey, VP and CTO, Americas, got a chuckle when he discussed defense in depth as a security model: “I like to call it ‘defense in debt’ because it’s really expensive,” said Kelsey.

Intel Security Americas Partner Summit: McAfee — No, Not That McAfee

The closing keynote came from Andrew McAfee, co-director of the MIT initiative on the digital economy, an author of Business in the Second Machine Age — and no relation to John McAfee, whose name is gradually being scrubbed from the Intel Security line.

Image Gallery: Intel Security Americas Partner Summit

Please click here for more Channel Partners galleries.

Read more about:

AgentsAbout the Author

You May Also Like