Canalys: Channel Partner-Delivered IT Will Dominate AgainCanalys: Channel Partner-Delivered IT Will Dominate Again

Channel partners remain the backbone of the tech industry, and will deliver 73% of the worldwide IT market in 2024, says Canalys.

Channel partners remain “the backbone of the tech industry,” accounting for 73.2% of the total IT market in 2024.

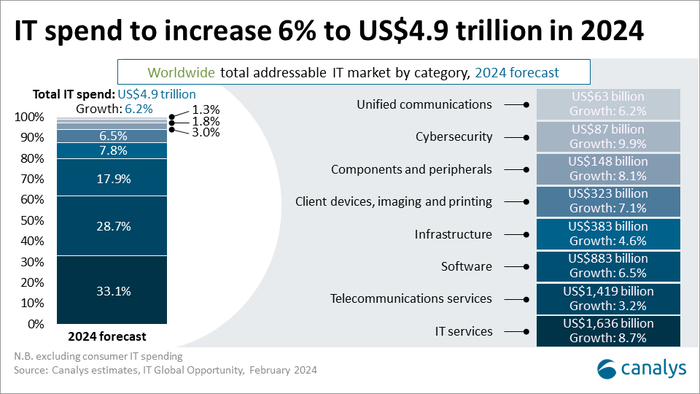

On Monday research firm Canalys released its February IT Opportunity update (Informa Tech owns both Canalys and Channel Futures.). It predicts a 6.2% growth in worldwide IT spending this year, reaching $4.94 trillion, despite heightened risk of disruption from different directions.

“Economic headwinds like inflation and potential recession are real, especially in the first quarter of 2024. But organizations continue to recognize the critical role of technology and IT services in transforming and expanding operations, building resilience, and driving employee productivity,” Canalys’ Matthew Ball noted in the update.

Across hardware, software and services, Canalys expects channel partners to continue to play a crucial role in scaling vendors’ reach and delivering complex technology solutions to customers. They will do this by providing advisory, designing, building, procurement, adoption and management capabilities.

Canalys' Matthew Ball

“Planning for uncertainty and disruption in 2024 will be paramount for partners, but recognizing how much opportunity there is will be just as important,” said Ball.

North America Channel Partners Lead, Asia Pacific Bounces Back, EMEA Subdued

Canalys expects North America to lead the pack in market growth. The region is forecast to grow by 6.6%, to account for 38.8% of worldwide IT spending. Ball cited its “high concentration of tech titans and startups, government spending initiatives and a workforce skewed toward large enterprises.”

Growth in Asia Pacific (+7.4%) will rebound, driven by Mainland China and India’s continued expansion. EMEA's (+4.2%) growth will be more subdued due to weak economic trends in key markets. This includes Germany, which is being impacted by weak exports, skilled labor shortages, high interest rates and uncertainty around energy security.

AI to Take Center Stage

The update also noted that generative AI (gen AI) will be the catalyst for a multiyear investment cycle across all IT segments. While 2024 is the starting point, AI will reshape the entire tech landscape in the coming years. AI for infrastructure (AIOps) and infrastructure for AI, AI embedded in software, applications, plug-ins and devices, and services that help companies plan, adopt, implement, use, and optimize AI will present new growth opportunities.

Canalys forecasts gen AI will be a $159 billion opportunity for the channel by 2028. Formulating a clear strategy, building in-house expertise and developing strategic partnerships must be priorities for channel partners this year to capitalize on future AI growth opportunities, said Ball.

Market Trends To Watch

Canalys also released a list of market trends for partners to watch in 2024.

The PC market will return to growth. Canalys forecasts a revival in PC sales, with AI-capable models adding a boost to the ongoing refresh cycle.

Servers will offset a decline in networking in the infrastructure segment. Investment in higher-priced and more powerful AI-capable servers will offset a decline in networking hardware spending.

Cybersecurity will remain an investment priority. Due to evolving threats, cybersecurity spending will remain robust, with XDR, SASE and CNAPP platform investment gaining traction.

Demand for managed IT services will thrive. As complexity rises and organizations seek expertise, managed IT services growth will outpace total IT spending, with cybersecurity, application and cloud infrastructure management being of priority.

Commitments to cloud infrastructure services will rise. Cloud infrastructure services growth will reaccelerate, fueled by larger spending commitments as customers plan for the next wave of cloud migration and AI adoption.

AI will become a feature, not a fee. While software with integrated AI will boost near-term spending, expect it to become a standard feature in the long run.

About the Author

You May Also Like