Bluewave Adds Life Cycle, 'TDaaS' Chops in RCG AcquisitionBluewave Adds Life Cycle, 'TDaaS' Chops in RCG Acquisition

Learn about the model RCG built and how that might fit with Bluewave.

National technology advisory firm Bluewave Technology Group is buying Resource Communications Group (RCG), the company known for providing telecom department as a service (TDaaS) to businesses.

RCG agreed to a financially undisclosed transaction with Bluewave, which has purchased multiple companies in the technology advisor (agent) space with the help of Columbia Capital. The agreement puts together two groups that brand themselves as an evolution beyond the traditional technology broker model into life cycle services.

Tennessee-based RCG has claimed to be the only provider of telecom department as a service in the world. While part of its revenue comes from residual commissions it makes from referring vendor solutions, RCG also earns a significant portion through a monthly service fee it bills to its clients.

For RCG partners and owners Kara Rickvalsky, Rich Brown and John Anderson, Bluewave's resources and funding can help provide better services to their customers.

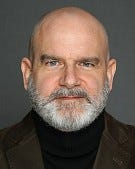

RCG's Kara Rickvalsky

“Now, being part of Bluewave is a significant step in our commitment to enhancing client-centric technology advisory services," Rickvalsky said. "John, Rich and I are passionate about extending specialized support to IT teams. Bluewave shares our belief that clients benefit from collaborative partnerships in developing and managing solutions to achieve defined outcomes. We are excited to unite with Bluewave, offering our clients and team members enhanced opportunities within a nationwide, growing organization.”

Bluewave CEO and founder Seth Penland over the last two years has emphasized the opportunity for Bluewave to add life cycle management services to the agent model, which historically does not heavily engage with clients post-sale. Acquisitions of companies like Compass Solutions – and now RCG – have reinforced the thesis.

Bluewave's Seth Penland

“This strategic integration reinforces our position as a leading technology advisory and sourcing company and enhances our ability to provide clients with top-tier technology lifecycle management services," Penland said. "We look forward to combining our expertise and resources to provide excellent service to our clients and help them achieve their technology goals and measurable business outcomes.”

The deal represents a deeper foray into the Southeast for New Jersey-based Bluewave. The company has notably acquired three businesses in Kentucky, most recently JIL Communications. Bluewave has acquired five agencies in 2023.

Bluewave measures its customer base at more than 6,000.

What is TDaaS?

Melinda Curran founded RCG in 2004 and later sold it to Anderson, Brown and Rickvalsky. Those three had all spent time at XO, Level 3 and CloudSmartz before joining RCG a little less than 10 years ago.

After joining the company, they kicked the tires on concept they originally called "telecom process outsourcing," Anderson said. The service, which carried a flat, monthly fee, brought in RCG to handle all things telecommunication on behalf of the client. RCG previously had functioned as more of a traditional agency, with a focus on the carrier services it sourced for its customers.

Although the branding of telecom process outsourcing would eventually need to rebrand into telecom department as a service, Anderson said the new emphasis on the life cycle immediately showed promise.

RCG's John Anderson

“We knew we were on to something, because it was focused on the life cycle. It was focused on people, process and systems. It was focused on what we saw as a pretty recurrent gap in IT departments, almost universally, from the network admin all the way to the CIO. None of them had expertise in telecom, so they couldn't build what we built (TDaaS),” Anderson told Channel Futures.

Part of the initial conversation with customers entailed defining what telecom meant to them. For some customers, that extended all the way into contact center. For others, it stopped at unified communications, or even broadband. Anderson noted that RCG made a strategic decision to not include cybersecurity as part of the possible telecom umbrella..

Anderson said he and his partners initially hoped their revenue would divide evenly between billed TDaaS services and residual carrier commissions. However, he said TDaaS actually functioned as an "accelerant" for the actual agency sales.

“We found that when we bolted on TDaaS, we became more than a trusted advisor," Anderson said. "We became their entire procurement process. We eliminated competition, and we kind of eliminated the sales process too. It was all enterprise-level procurement at that point, which is a different skill... We would go in as their telecom department, and they would just say, 'Here. Go fix all this.' It's a higher level of empowerment with our clients than we've ever seen."

Integration

Anderson said RCG is seeing a 100% staff retention rate for RCG employees moving into Bluewave. He said he's also interested to see how RCG's TDaaS play fits into the larger strategy.

“The tip of the spear for Bluewave is the technology advisory, but with lifecycle services from RCG and other acquisitions… I think RCG can be an interesting offering and a big differentiator for them, that's solving a really unique problem. I think there's room for the TDaaS model in the larger Bluewave strategy," Anderson said.

Read more about:

AgentsAbout the Author

You May Also Like