AWS IaaS Lead Shrinks as Microsoft, Google, Huawei Post Staggering Revenue GrowthAWS IaaS Lead Shrinks as Microsoft, Google, Huawei Post Staggering Revenue Growth

The infrastructure-as-a-service market grew 41% last year. So what's in it for partners?

Amazon retains its lead in Gartner‘s latest IaaS market share report, but rival hyperscalers are making up ground.

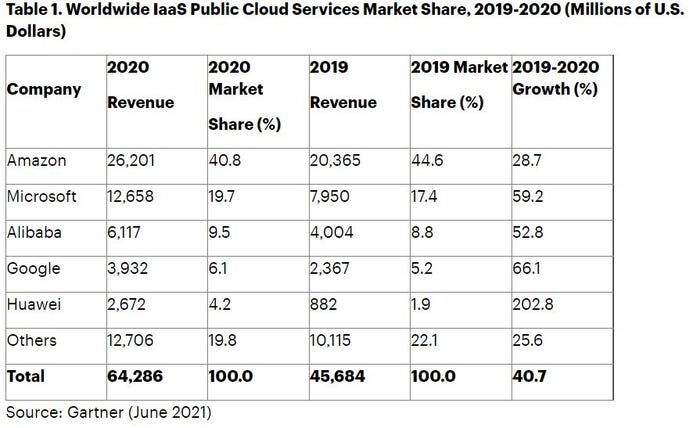

The report shows an industry that’s growing on all fronts. The infrastructure-as-a-service (IaaS) market totaled $64.3 billion in 2020, up from $45.7 billion in 2019. That equates to growth of nearly 41%.

Gartner’s Sid Nag

“The era of CIOs investing in cloud IaaS and platform as a service (PaaS) discretely is long over,” Gartner research vice president Sid Nag said.

AWS raked in $26 billion in 2020 – an almost 29% increase from $20 billion in 2019. The public cloud giant holds a whopping 40.8% of the market, according to Gartner.

Market share reports have indicated, however, that the lead is slowly shrinking. Amazon’s market share dropped to 40.8% from almost 45% in 2019. The other hyperscalers are registering faster growth rates. For example, Google’s IaaS revenue ticked up about 66%, and top challenger Microsoft grew more than 59%. AWS still holds a clear market share advantage over Azure – 40.8% to 19.7% – but the differential has decreased significantly by six percentage points.

In addition, Huawei grew significantly. It went from less than 2% market share to 4.2%, now accounting for $2.7 billion in annual revenue. And it’s in line with Huawei’s investments, according to Nag.

“After 2019, Huawei made a hard pivot away from selling equipment to investing heavily in their cloud services business, which is starting to yield results,” said Nag.

Alibaba, another Chinese hyperscaler, held 9.5% of global market share, going from $4 billion to $6 billion. According to Gartner, 105% growth in the education vertical propelled the company.

Opportunities

Sid Nag pointed to distributed cloud and edge solutions that are helping the public cloud reach deeper into private, on-premises environments. They’re helping customers find “data sovereignty, workload portability and network latency.”

Nag also said most organizations relied on the public cloud during the pandemic. Ken Presti, Avant’s vice president of research and analytics, agreed and predicted that the trend will continue beyond COVID-19.

Avant Analytics’ Ken Presti

“The impressive surge in IaaS is driven partly by the growing momentum of the as-a-service phenomenon, and partly by last year’s global pandemic, during which companies were open to all kinds of ideas that would help support a work-from-home model,” Presti said. “This will largely continue for the foreseeable future, given that a lot of companies are embracing a hybrid model that blends working from home with working from the office.”

Nag argued that said “cloud-adjacent” technologies like edge computing, 5G and AI will offer the most significant growth opportunity for solution providers. And Pesti said IaaS growth is leading to a positive trickle-down effect for partners.

“The partner community is always happy to see measurable growth that can be parlayed into new engagements,” Presti said.

Microsoft last week announced its plans to buy the platform and staff of AT&T’s Network Cloud, meaning that AT&T’s 5G wireless network will run on Microsoft Azure.

Read more about:

Channel ResearchAbout the Author

You May Also Like