SD-WAN Roundup: Silver Peak Harnesses the Channel, VMware Leads RankingsSD-WAN Roundup: Silver Peak Harnesses the Channel, VMware Leads Rankings

Take a look at who's on top and who's surging.

Silver Peak is leaning heavily on channel partners to sell its Unity EdgeConnect SD-WAN solution.

I haven’t given you an SD-WAN roundup in months, so we sure have some catching up to do. Don’t let the lack of columns fool you: 2019 has already been packed with SD-WAN news.

The big-name vendors have plastered themselves over the news with funding announcements, forward-thinking technology partnerships and big personnel changes. All the while, Oracle’s acquisition of Talari Networks and the latest IHS Markit revenue rankings loom large.

We’ll start with Silver Peak, which is expanding its distribution partnership with Synnex in order to build its North American indirect sales presence. The companies had already been working together by virtue of Synnex owning Westcon-Comstor, but the earlier partnership covered Europe, the Middle East, Africa (EMEA) and Asia Pacific.

Synnex will offer Silver Peak channel partners dedicated staff, sales support, and education and marketing resources. Michael O’Brien, Silver Peak’s vice president of worldwide channel sales, said Synnex is the vendor’s preferred distributor.

Silver Peak’s Michael O’Brien

“Synnex is the obvious choice for Silver Peak given its extensive experience and wealth of global resources — all directed at helping us to expand and enable our growing channel base to accelerate customer acquisition in North America and around the world,” O’Brien said.

Silver Peak offers an SD-WAN edge platform that one Synnex executive said is on its way to becoming the first “self-driving” WAN.

“We’re delighted to team with Silver Peak and look forward to collaborating in new ways to help the company equip partners with a comprehensive range of distribution, logistics and enablement programs and services,” said Reyna Thompson, Synnex senior vice president of North American product management.

O’Brien described the self-driving WAN as a solution that saves time for network managers and administrators by automating tasks such as deploying new sites and adding new applications or cloud platforms.

“Our ultimate vision is to deliver a self-driving wide area network that gets smarter every day and adapts to changes in the network in real time,” O’Brien told Channel Partners. “We’ve been focused on delivering features and functionality that allow customers to do that.”

O’Brien said partners can pitch the self-driving WAN to customers as a “business accelerant.” Businesses will more readily buy in if they see how a centralized, simplified network management process allows them to focus on their actual business goals.

“They can build a profitable business practice when they engage with us, not just selling hardware or software but actually …

… helping customers to re-architect their wide area network and move their customers’ business forward,” he said.

@SilverPeak announces expansion of North American distribution agreement with @SYNNEX to develop Silver Peak #channel & enable #VAR & #Resellers to build successful & profitable #SDWAN business practices. https://t.co/NEZblSgjd4

— HG Insights (@HGInsights_) March 20, 2019

The company scaled its partner program significantly in 2018. O’Brien joined the company as channel chief last June after leading channels at Aerohive Networks. The company at around the same time was accepting $90 million in funding from TCV with a goal to “expedite execution of its go to market expansion plans.” The Santa Clara, California-based vendor four months later announced several changes to its Partner Edge program, including financial incentives of up to 12 percent margin, “programmatic” deal registration and a demo platform.

“[We] made sure we have the right incentive and margin-rich opportunities for partners to sell Silver Peak and that we have the right training and development programs to make sure partners are successful in engaging customers and selling SD-WAN,” O’Brien said.

The company also created sales teams for EMEA and the service provider market and launched a program for partners deploying the Silver Peak platform. Silver Peak in January added Google Cloud to its stable of public cloud providers, alongside Oracle, AWS and Azure.

More than 1,000 customers had deployed the EdgeConnect platform as of last August.

Latest Rankings

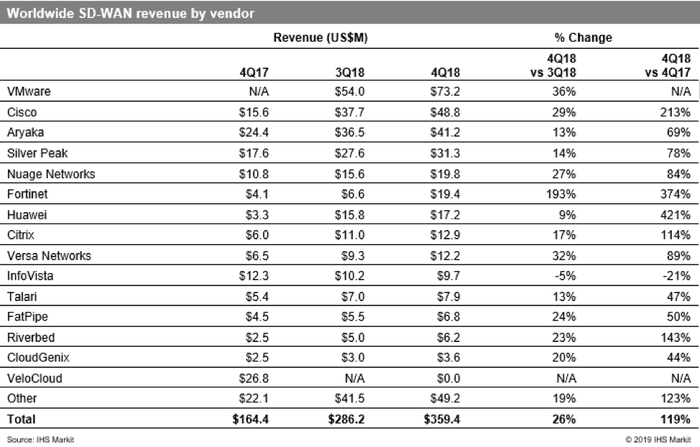

Silver Peak sits fourth in IHS Markit’s latest revenue ranking. The leaderboard is one of many industry recognitions, but we in the networking media love seeing its quarter-to-quarter changes.

The results vary little in terms of position. VMware’s VeloCloud continues to dominate, with Cisco a distant second, followed closely by Aryaka and Silver Peak. Cisco dipped behind Aryaka and Silver Peak at different points last year but appears to have regained ground. We’re waiting to see where Oracle will land in the rankings after its acquisition of Talari.

Source: IHS Markit Q4 SD-WAN Revenue

Fortinet is the biggest riser in the leaderboard. Its nearly 200 percent quarter-over-quarter revenue increase puts it on top of the recent dogpile of security vendors getting into SD-WAN.

Nokia’s Nuage Networks remains a dark horse in this race. The vendor is powering Spectrum Enterprise’s recently announced SD-WAN solution and enhanced its own platform back in September. Founder and CEO Sunil Khandekar touted the virtualized network services (VNS) platform’s ability to deliver IT orchestration.

“Unlike other vendors that either have basic connectivity solutions, use proprietary hardware or need to cobble together multiple platforms to address enterprise IT needs, we purposefully developed our VNS offer on a single platform to give our customers a powerful, seamless and consistent set of capabilities across the entire network,” Khandekar said.

Only Infovista dropped in revenue, according to the study. The Virginia-based company saw a slight 5 percent decrease quarter over quarter, but its recently appointed CEO is priming the company for the 5G opportunity.

“It’s a great time to be joining Infovista,” the new executive said. “The opportunity that lies ahead to capitalize on the fast-growing demand for SD-WAN and 5G solutions and further grow in key sectors worldwide is immense. The ability to lead this next phase of growth is both exhilarating and humbling.”

Josh Bancroft, a senior research analyst who contributed to the IHS Markit study, noted that telecommunications providers want to combine 5G’s “network-slicing” with SD-WAN’s ability to seer application traffic to maximize industrial IoT and edge applications.

“The telcos view SD-WAN as a key way to ensure various traffic types are automatically steered to the appropriate links. It can also guarantee IoT traffic is prioritized over 5G, and other applications are automatically routed over broadband,” Bancroft said. “If they haven’t done so already, SD-WAN vendors should consider adding …

… IoT-specific features to their offering, such as application identification, prioritization and protocol translation functionality on SD-WAN appliances.”

Ben Niernberg, MNJ Technologies’ senior vice president, told Channel Partners earlier this year that the rise of 5G has raised SD-WAN’s profile for UCaaS companies. Niernberg said we can expect to see more voice companies putting SD-WAN boxes at customer location to mitigate quality-of-service (QoS) problems, packet-loss and latency. RingCentral, for example, recently added Cato Networks as one of its compatible SD-WAN vendors.

“With 5G coming on board, the SD-WAN box becomes even more paramount in how it connects directly to the UCaaS provider,” Niernberg said.

The study also gave a nod to the channel and services. More and more vendors are partnering with MSPs, systems integrators and other telecommunications providers. A recent IHS Markit survey found that although some customers prefer a self-managed platform, more companies will be asking for managed services with network function virtualization (NFV) services.

A MarketsandMarkets study echoed the same sentiment earlier this week.

“These services help end users in reducing costs, lowering operational costs and improving business performance. With the help of these services, organizations can track, evaluate and analyze the requirements of their business to make informed decisions,” the study authors wrote.

A Partner Perspective

We wrote in February about how MNJ Technologies implemented a Silver Peak solution for a large electrical contractor.

The partner supplanted the carrier that had been hitting the customer with a large MPLS bill. The new arrangement saved money, quickened support time and made security provisioning easier.

“No one gets fired for the decision to go with AT&T or Verizon,” Ben Niernberg said. “It’s the easy one to do, but no one’s happy about it. Their response times … the effort it takes.”

The customer still uses the carrier’s fiber but determined that MNJ, as a CLEC, could manage the platform and provide connectivity in a more cost-effective, vendor-agnostic fashion. Financial incentives also differ from one another.

“My concern with carriers is, with the MPLS erosion going on, oftentimes they aren’t looking at what’s best for the customer. They’re trying to maintain the MPLS circuit to maintain the revenue and the profitability. [Whereas] we look at it objectively and say, ‘What’s the best thing for the customer?'”

Quick Hits

TELoiP re-branded to Adaptiv Networks. The change reflects migration away from “ill-suited” MPLS and legacy networks. Read the company’s announcement.

We interviewed Aryaka Networks’ new channel about his plans for the vendor’s program. The new hire previously led partner programs at EarthLink and Windstream. He praised Aryaka for its unique approach to SD-WAN. Read the Q&A.

Unified cloud services provider PanTERRA partnered with Bigleaf Networks to include it in its service offering. Find the press release here.

Read more about:

AgentsAbout the Author

You May Also Like