Tech Advisors Saw Staff Growth, Channel Conflict in Q1Tech Advisors Saw Staff Growth, Channel Conflict in Q1

Forty-four percent of agents grew their headcounts in Q1, but talent recruiting and retention poses a top challenge.

Although tech advisors face increasing sales conflict from vendors and pressures to grow their teams, partners continue to see sales growth in network, UCaaS, cybersecurity and many other technologies.

That assertion comes from Channel Futures’ Q1 Agent Sentiment survey. A field of 36 partners, each of which belongs to the technology advisor/agent model, answered questions about how their businesses are growing and how they feel about the channel. According to the survey, tech advisors see plenty of opportunity in front of them. Fifty-eight percent of agents reported a “good” level of confidence in the health of the industry. Another 11% called their confidence “excellent.”

What is your company’s level of confidence in the health of the industry?

Q2 22 | Q3 22 | Q4 22 | Q1 23 | |

Excellent | 9% | 18% | 14% | 11% |

Good | 33% | 57% | 49% | 58% |

Average | 41% | 18% | 31% | 22% |

Poor | 13% | 7% | 3% | 3% |

Terrible | 4% | – | 3% | 6% |

For a second straight quarter, tech advisors were split on whether they see customer spending going up or down. More than one-third (36%) of partners said customers were more willing to buy technology than in the quarter a year ago. But 39% said appetite had stayed the same, and 25% said it decreased.

From your perspective, how did customers’ willingness to spend money on technology in the first quarter of 2023 compare to the first quarter of 2022?

Increased | 36% |

Stayed the same | 39% |

Decreased | 25% |

Tech advisors, more colloquially known by their vendor partners as agents, typically rely on vendors for end-user billing and managed services, while collecting residual commissions from the vendors they source.

Growth

The Q1 survey of tech advisors showed that partner are getting larger. Forty-four percent of technology advisors grew their headcounts in the first quarter, while none decreased their headcounts.

That statistic rang true for Charlotte, North Carolina-based Opkalla, which grew its team by approximately 20% in the first quarter. But managing partner Jim Campbell said he sees some of his peers are challenged to keep staff.

Opkalla’s Jim Campbell

“Industry-wide I have started to see more talent looking to transition, which is surprising considering what’s going on with the economy. I would have expected more people to stay conservative and not look elsewhere,” Campbell told Channel Futures.

Respondents most commonly selected “recruiting and retaining talent” as the biggest challenge they face, alongside “industry consolidation.”

“For Opkalla, our biggest challenge or opportunity is responsibly growing the company,” Campbell told Channel Futures. “Investing in the right people and the right go-to-market strategy. It’s easy to get distracted with how fast the industry is moving, so the balance between the 12-18 month vision versus what we need to do well today is top of mind.”

Technology Portfolio

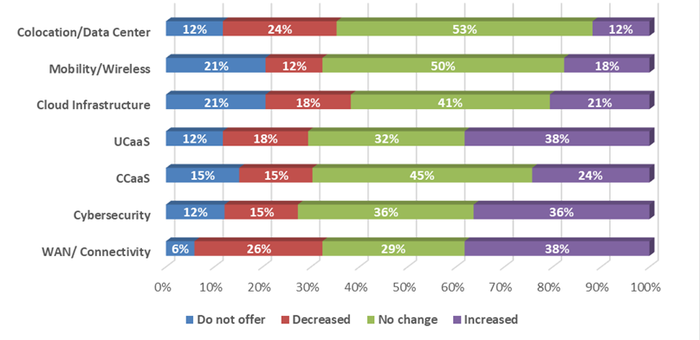

The latest survey shows sales growth across multiple technology segments for tech advisors.

The image below shows the breakdown of how tech sales changed year-over-year, merging together slight and significant increases/decreases.

Source: Q1 Channel Futures Agent Sentiment Survey

WAN and connectivity showed both growth and regression. A total of 27% of tech advisors said WAN/connectivity sales decreased year-over-year, with only …

… 6% reporting a significant decrease. That’s the lowest year-over-year decrease for any technology category. On the other hand, 39% of respondents said they saw more WAN/connectivity sales in Q1 2023 than the quarter a year ago, with 18% reporting a significant increase. That’s the highest total increase for any technology category. Twenty-nine percent of respondents said WAN/connectivity saw no change, and that’s a lower result than for any other category. However you view it, the wireline business isn’t sitting still.

UCaaS saw the second-largest overall increase at 38%, with 12% of tech advisors reporting a significant increase in sales. At the same time, 12% of partners said UCaaS sales decreased significantly. Those conflicting numbers match well with what partner panelists recently told Channel Futures about UCaaS. Some partners see opportunity to take advantage of legacy Avaya customers finally moving to the cloud. And vendor compensation has made UCaaS a lucrative business for its sellers.

We recently compiled a list of 20 top UCaaS providers offering products and services via channel partners. |

North Atlantic Consultants Michael Agri

“The huge SPIFFs and generous residual commissions have made wireline services an afterthought. It’s also a huge problem for many businesses that are struggling to manage their old PBX, or they can’t find anyone to manage or train them on their old first-generation VoIP system. There is a lot of confusion out there right now, which creates a lot of opportunity for agents,” North Atlantic Consultants president Michael Agri told Channel Futures last week.

Other partners warn that the UCaaS space is seeing more channel conflict than ever, with vendors cutting down on those sky-high SPIFFs and moving more compensation inward.

Mejeticks’ Robert DeVita

“… We are seeing fewer resources dedicated to the channel and a shift from channel to direct,” Mejeticks CEO Rob DeVita said earlier this month.

Campbell said many unified communications customers have reached the end of their initial 36-month contracts that they signed at the beginning of the pandemic.

“It was a mad dash when COVID came, but our clients have come back looking at new providers versus remaining with their incumbent,” Campbell told Channel Futures. “Also, as we all know, consolidation in that space is ongoing, which creates fear for clients who aren’t using one of the big four or five players.

Colocation and data center sales didn’t see much uptick in the first quarter, based on the survey. No tech advisors reported a significant increase, and 21% of partners reported a slight decrease.

Cybersecurity saw a strong year-over-year increase in sales, according to the survey. Fifteen percent of partners reported a significant increase, and 21% reported a slight increase. Campbell noted that security represented Opkalla’s highest growth, followed by collaboration and connectivity.

For partners who sold cybersecurity, identity access management comprised the most common offering. Three other categories followed in a three-way tie for second: network security, threat detection and management and penetration testing.

If you sold cybersecurity in Q1, which subcategories did that include? | |

|---|---|

Identity Access Management | 17% |

Network Security (including Secure Access Service Edge (SASE) and Security Service Edge (SSE)) | 13% |

Threat Detection/Management Services (Including MDR and SIEM) | 13% |

Penetration Testing | 13% |

Cyber insurance policy review | 8% |

Email Security | 8% |

Disaster Recovery as a Service (DRaaS) and/or Backup as a Service | 4% |

DDoS Mitigation | 4% |

Other | 21% |

TSD Market Race Reflects Consolidation

Each quarter Channel Futures asks partners to identify the tech service distributors (TSDs) with which they increased or decreased their business from a year prior.

Telarus (36%) and Avant (34%) saw the biggest year-over-year increases in business from partners. However, it’s worth noting that both firms have acquired companies in the last year. Avant acquired PlanetOne, and Telarus bought TCG and TelAdvocate. TBI joined AppDirect near the end of the first quarter.

How did the amount of business you conducted with the following companies in the first quarter of 2023 compare to the first quarter of 2022?

Decreased | Increased | Remained the Same | Was not using and still am not | |

Intelisys | 15% | 18% | 30% | 36% |

Avant | 13% | 34% | 16% | 38% |

Telarus | 12% | 36% | 12% | 39% |

Sandler Partners | 9% | 19% | 19% | 53% |

ScanSource | 13% | 9% | 25% | 53% |

AppDirect | 9% | 16% | 16% | 59% |

TBI | 9% | 21% | 9% | 61% |

Other | 0% | 16% | 16% | 68% |

Pax8 | 6% | 16% | 9% | 69% |

TD Synnex | 6% | 15% | 6% | 73% |

Ingram Micro | 9% | 9% | 9% | 73% |

Jenne | 9% | 9% | 6% | 75% |

Campbell said Opkalla splits its business between Avant and Telarus. The tech advisor’s partnership with Telarus stemmed from Opkalla working with TCG prior to the acquisition.

“The move for Telarus to purchase TCG was beneficial for us as it brought more …

… engineering resources and tools for our people to use,” Campbell said.

While the quarterly survey didn’t show any notable uptick in agents signing direct contracts with suppliers, Campbell noted that Opkalla sees its direct relationships with vendors growing faster than its indirect relationships. Opkalla currently operates more than 50 direct agreements, largely in cybersecurity, with a few in infrastructure.

“We believe that will continue, but we also understand the benefits of the TSD model. Ultimately whether it’s on our paper or the provider’s, recurring revenue is the ultimate focus and where all industry solutions are moving. Our goal is to be flexible enough for the customer to purchase however is best for them,” Campbell said.

Thirty-one percent of respondents said their reliance on TSDs increased in Q1, while 19% said it decreased and 50% said it did not change.

Channel Conflict Looms Large

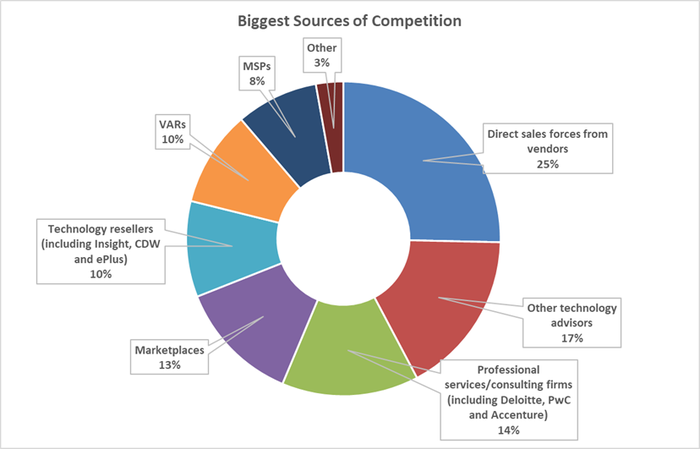

Channel Futures asked partners to list their three biggest sources of competition.

Direct sales forces represented the biggest source of competition to partners, with one-half of partners listing vendors as a top-three competitor. The idea that agents face sales competition from their own suppliers is a tale as old as time in the channel. However, partners increasingly tell Channel Futures that the recession has put pressure on vendors to take resources away from the channel and convert them to direct sales. That includes attempting to convert partner-led deals into direct deals.

Next came other technology advisors at 33%, followed by professional services and consulting firms at 28%.

It’s very much worth noting that marketplaces came in fourth on this list at 25%. Only 4% of agents selected marketplaces as a key competitor in Q3 2022, and that number was 3% in Q4 2022. Many industry pundits say an increasing number of telcos are turning to digital platforms as a way to reach customers, particularly SMBs.

The graphic below summarizes tech advisors’ top challengers on a 100-point scale.

Source: Channel Futures Q1 Agent Sentiment Survey

Devan Adams, newly appointed principal analyst for Informa Tech Channels, contributed to the data insights and created the two infographics. He will play a key role in Channel Futures’ new Research and Consulting practice.

Want to contact the author directly about this story? Have ideas for a follow-up article? Email James Anderson or connect with him on LinkedIn. |

About the Author

You May Also Like